TX Comptroller 12-302 2014 free printable template

Show details

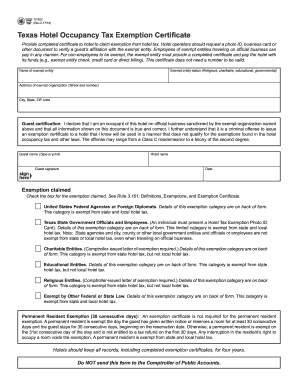

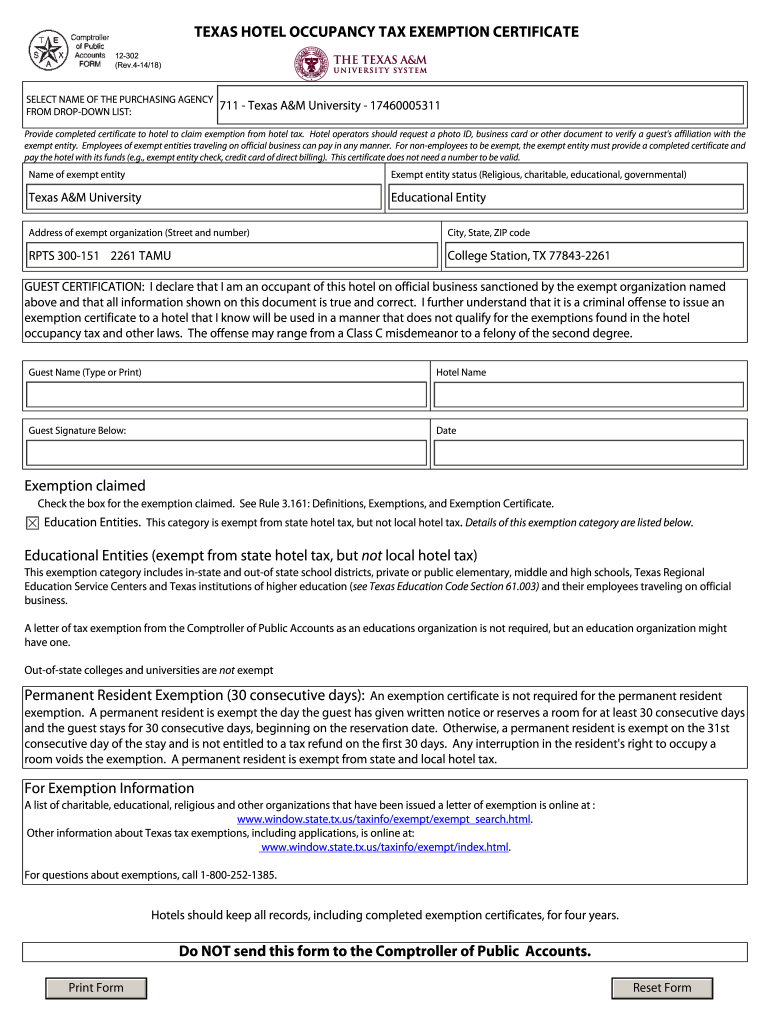

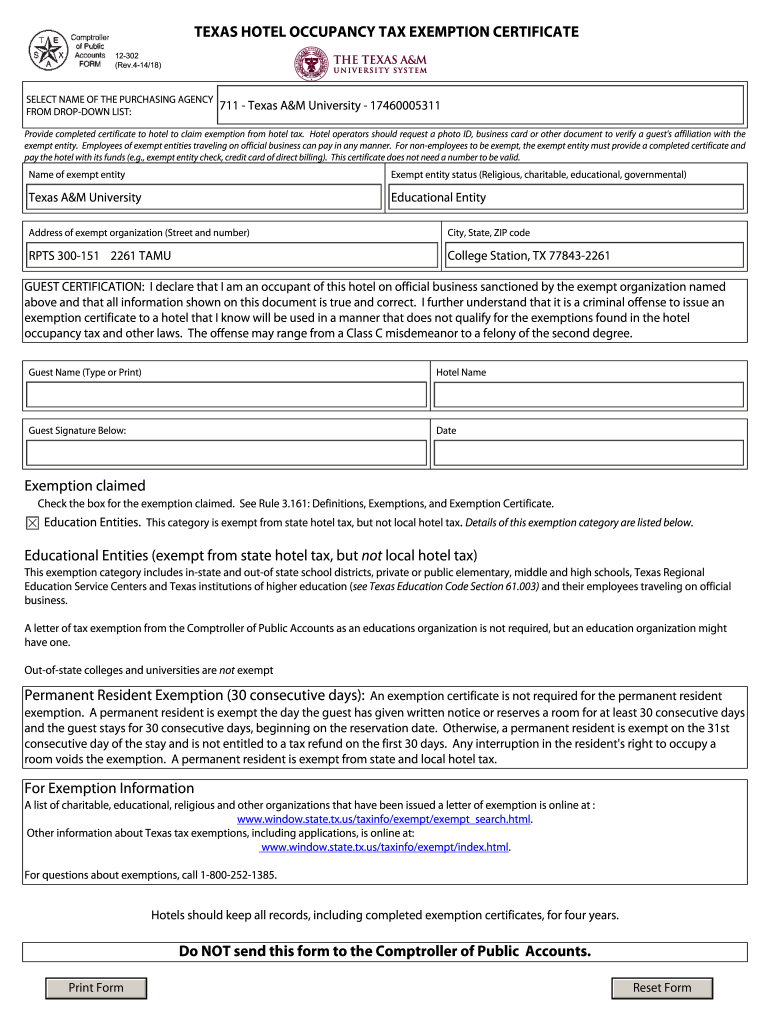

TEXAS HOTEL OCCUPANCY TAX EXEMPTION CERTIFICATE 12-302 (Rev.4-14/18) SELECT NAME OF THE PURCHASING AGENCY FROM DROP-DOWN LIST: 711 Texas A&M University — 17460005311 Provide completed certificates

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign texas hotel tax exempt

Edit your texas hotel tax exempt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas hotel tax exempt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit texas hotel tax exempt online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas hotel tax exempt. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 12-302 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas hotel tax exempt

How to fill out TX Comptroller 12-302

01

Obtain the TX Comptroller Form 12-302 from the official website or your local comptroller's office.

02

Enter your legal business name exactly as it appears in your formation documents.

03

Provide your Physical Address, including City, State, and Zip Code.

04

Fill in your mailing address if it differs from your physical address.

05

Include your Texas Sales and Use Tax Permit Number if applicable.

06

Fill out the responsible party information, including name, title, and contact details.

07

Specify the date you started doing business in Texas.

08

Complete any additional fields or sections as required by the form.

09

Review all the information for accuracy and completeness.

10

Sign and date the form before submission.

Who needs TX Comptroller 12-302?

01

Any business that is making a claim for a refund of Texas sales and use taxes paid.

02

Businesses involved in sales tax exemption transactions.

03

Companies that need to modify their tax reporting due to changes in business structure.

Instructions and Help about texas hotel tax exempt

Hi farmer ranch customers we're here today to let you know about some new changes that are coming through the state of Texas any purchases made after January first 2012 will require a new agricultural permit or sales tax will be charged to find out more information about this you can visit word Texas org and find out more you

Fill

form

: Try Risk Free

People Also Ask about

How do I become exempt from hotel tax in Texas?

Permanent Residents (30-Day Rule) Guests who occupy a hotel room for 30 or more consecutive days with no payment interruption are considered permanent residents and are exempt from hotel tax.

Does a hotel occupancy tax exist in Texas?

Is there hotel tax on meeting or banquet rooms? The 6 percent state hotel tax applies to any room or space in a hotel, including meeting and banquet rooms. Local hotel taxes, however, are due only on those rooms ordinarily used for sleeping.

Does Texas have hotel occupancy tax?

Is there hotel tax on meeting or banquet rooms? The 6 percent state hotel tax applies to any room or space in a hotel, including meeting and banquet rooms. Local hotel taxes, however, are due only on those rooms ordinarily used for sleeping.

How to fill out Texas tax exempt certificate?

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

What is the hotel occupancy tax number in Texas?

For information on the State Hotel Occupancy Tax, please visit their website or call 1-800-252-1385.

What is the Texas tax exempt form?

Description: This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my texas hotel tax exempt in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your texas hotel tax exempt and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I complete texas hotel tax exempt online?

With pdfFiller, you may easily complete and sign texas hotel tax exempt online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I sign the texas hotel tax exempt electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your texas hotel tax exempt and you'll be done in minutes.

What is TX Comptroller 12-302?

TX Comptroller 12-302 is a tax form used in Texas for reporting and paying the state's franchise tax.

Who is required to file TX Comptroller 12-302?

Businesses that are subject to the Texas franchise tax must file this form, including corporations and limited liability companies (LLCs).

How to fill out TX Comptroller 12-302?

To fill out TX Comptroller 12-302, businesses need to enter their revenue, deductions, and calculate the tax owed according to the instructions provided on the form.

What is the purpose of TX Comptroller 12-302?

The purpose of TX Comptroller 12-302 is to collect franchise tax from businesses operating in Texas, ensuring compliance with state tax laws.

What information must be reported on TX Comptroller 12-302?

The form requires reporting of total revenue, allowable deductions, the calculation of tax owed, and information about the business such as name and address.

Fill out your texas hotel tax exempt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Hotel Tax Exempt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.