NY CT-3-A 2020 free printable template

Show details

CT3ADepartment of Taxation and FinanceGeneral Business Corporation Combined Franchise Tax Return Tax Law Article 9ACaution: This form must be used only for periods beginning on or after January 1,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY CT-3-A

Edit your NY CT-3-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY CT-3-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY CT-3-A online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY CT-3-A. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CT-3-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY CT-3-A

How to fill out NY CT-3-A

01

Obtain Form CT-3-A from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill out the header section of the form with your business name, address, and identification number.

03

Complete Part 1: Income and Deductions. Report your total income and any deductions that apply to your business.

04

Complete Part 2: Computation of Tax. Calculate the amount of tax based on your income using the provided tax tables.

05

If applicable, complete any additional schedules or sections required for your business type.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form at the bottom before submitting.

08

Submit the form by the due date as indicated in the instructions, either electronically or by mail.

Who needs NY CT-3-A?

01

Businesses that operate as corporations in New York State and are required to file an income tax return.

02

Corporations that have gross income exceeding the thresholds set by the state.

03

Corporations seeking to claim certain business tax credits or deductions.

Fill

form

: Try Risk Free

People Also Ask about

How is tax base income tax calculated?

Understanding the Tax Base A tax base is defined as the total value of assets, properties, or income in a certain area or jurisdiction. To calculate the total tax liability, you must multiply the tax base by the tax rate: Tax Liability = Tax Base x Tax Rate.

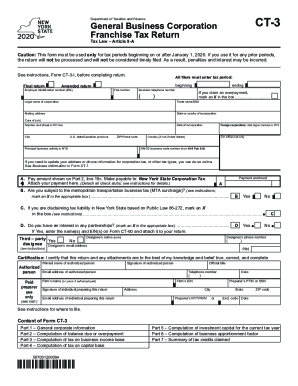

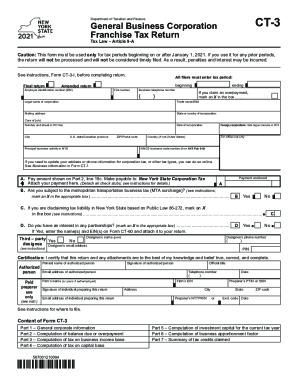

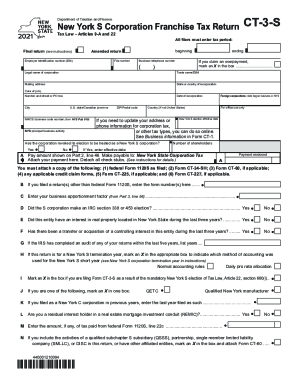

Who needs to file CT-3?

All business corporations subject to tax under Article 9-A, other than New York S corporations, must file franchise tax returns using Form CT-3, unless such corporations are required or permitted to file as members of a combined group (see Form CT-3-A).

How is NYS capital base tax calculated?

The tax rate on the capital base is . 1875% for tax years beginning on or after January 1, 2021 and before January 1, 2024, and 0% for tax years beginning on or after January 1, 2024.

How is NY franchise tax calculated?

Corporations. New York Corporations or, more specifically, C-corps, are subject to a corporation franchise tax that is calculated to be the higher of the New York Corporation's Entire Net Income (ENI), Maximum Taxable Income (MTI), Fixed Dollar Minimum (FDM), or Business and Investment Capital.

How does NYS tax capital gains?

New York taxes capital gains as income and the rate reaches 8.82%. Oregon taxes capital gains as income and the rate reaches 9.9%. Vermont taxes short-term capital gains as income, as well as long-term capital gains that a taxpayer holds for up to three years.

Who must file NY CT-3?

Taxable DISCs must file Form CT-3 on or before the 15th day of the ninth month after the end of the tax year. Such a DISC is subject to the tax on apportioned capital or the fixed dollar minimum, whichever is larger. Write DISC after the legal name of the corporation in the address section of the return.

Who must file NY partnership return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

What is a CT-3?

Department of Taxation and Finance. General Business Corporation. Franchise Tax Return.

Who has to file CT 300?

You must electronically file Form CT-300 if you: do not use a tax professional to file; use a computer to prepare, document, or calculate your tax forms; and.

Who is subject to the NY MTA?

The MTA has the responsibility for developing and implementing a unified mass transportation policy for the New York metropolitan area, including all five boroughs of New York City and the suburban counties of Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk and Westchester.

What is a capital base tax?

(a) Generally, the capital base is the measure of the tax if such calculation results in a greater amount of tax than that computed on the entire net income base, the minimum taxable income base or the fixed dollar minimum.

What is form CT-3 New York?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

What is a form CT-3?

Form CT-3-A/BC provides individual group member detail concerning each member's: general information, fixed dollar minimum tax, prepayments, capital base, investment capital, and apportionment.

What is MTA surcharge tax?

The New York Department of Taxation and Finance announced that the rate of New York's metropolitan transportation business tax surcharge will increase to 30%, effective for tax years beginning on or after January 1, 2021. Our insights. Your choices.

Who must file CT-3 m?

Most corporations are required to electronically file this form either using tax software or online, after setting up an online services account, through the department's website. For more information, see Form CT-400-I, Instructions for Form CT-400.

Who is subject to New York MTA surcharge?

MTA Surcharge Filing If a taxpayer has $1 million or more of MTA receipts, it is subject to the MTA surcharge. … The computation of the MTA Surcharge increases to 25.6% of New York tax from 17%, and is now computed before credits; however, it now uses the actual tax rather than a recomputed New York tax. …

Who files MTA surcharge?

Estimated MTA surcharge Most corporations are required to electronically file this form either using tax software or online, after setting up an online services account, through the department's website. For more information, see Form CT-400-I, Instructions for Form CT-400.

Who must file form CT-3?

Who must file CT-3? All business corporations subject to tax under Article 9-A, other than New York S corporations, must file franchise tax returns using Form CT-3, unless such corporations are required or permitted to file as members of a combined group (see Form CT-3-A).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY CT-3-A for eSignature?

Once you are ready to share your NY CT-3-A, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit NY CT-3-A in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing NY CT-3-A and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete NY CT-3-A on an Android device?

Use the pdfFiller mobile app to complete your NY CT-3-A on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NY CT-3-A?

NY CT-3-A is a New York State corporate franchise tax return form that is specifically used by corporations operating in New York State.

Who is required to file NY CT-3-A?

Corporations that are doing business, engaging in activities, or having a presence in New York State are required to file NY CT-3-A.

How to fill out NY CT-3-A?

To fill out NY CT-3-A, corporations must provide information regarding their income, deductions, and taxes, following the instructions outlined in the form itself, including listing all necessary financial details.

What is the purpose of NY CT-3-A?

The purpose of NY CT-3-A is to calculate the corporate franchise tax for corporations and ensure compliance with New York State tax laws.

What information must be reported on NY CT-3-A?

NY CT-3-A requires corporations to report their business income, deductions, credits, and any allocated income for the tax year.

Fill out your NY CT-3-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY CT-3-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.