NY CT-3-A 2021 free printable template

Show details

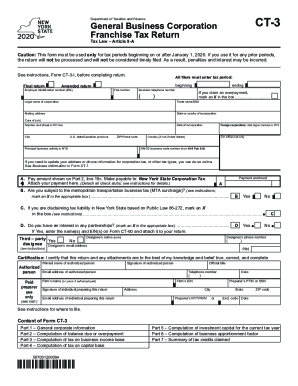

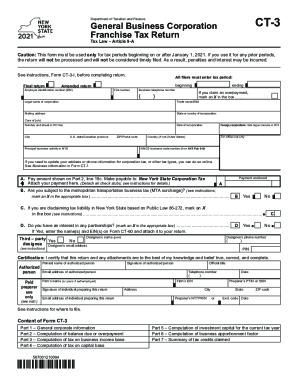

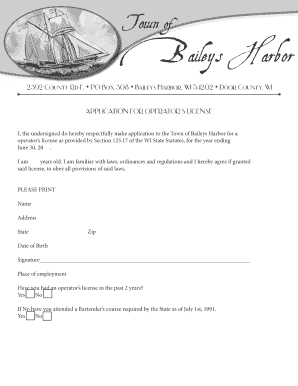

CT3ADepartment of Taxation and FinanceGeneral Business Corporation Combined Franchise Tax Return Tax Law Article 9ACaution: This form must be used only for periods beginning on or after January 1,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY CT-3-A

Edit your NY CT-3-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY CT-3-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY CT-3-A online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY CT-3-A. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CT-3-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY CT-3-A

How to fill out NY CT-3-A

01

Begin with the identification section, including your business name and address.

02

Check the box to indicate if you are a member of a combined group.

03

Fill in your taxpayer identification number (TIN).

04

Complete the income sections, including gross income and deductions.

05

Calculate your taxable income by subtracting deductions from gross income.

06

Fill in any applicable credits.

07

Review the balance due or refund section.

08

Sign and date the form.

Who needs NY CT-3-A?

01

Businesses that have made an election to be taxed as an S Corporation in New York.

02

Corporations that are required to file a corporate tax return in New York.

Fill

form

: Try Risk Free

People Also Ask about

How is tax base income tax calculated?

Understanding the Tax Base A tax base is defined as the total value of assets, properties, or income in a certain area or jurisdiction. To calculate the total tax liability, you must multiply the tax base by the tax rate: Tax Liability = Tax Base x Tax Rate.

Who needs to file CT-3?

All business corporations subject to tax under Article 9-A, other than New York S corporations, must file franchise tax returns using Form CT-3, unless such corporations are required or permitted to file as members of a combined group (see Form CT-3-A).

How is NYS capital base tax calculated?

The tax rate on the capital base is . 1875% for tax years beginning on or after January 1, 2021 and before January 1, 2024, and 0% for tax years beginning on or after January 1, 2024.

How is NY franchise tax calculated?

Corporations. New York Corporations or, more specifically, C-corps, are subject to a corporation franchise tax that is calculated to be the higher of the New York Corporation's Entire Net Income (ENI), Maximum Taxable Income (MTI), Fixed Dollar Minimum (FDM), or Business and Investment Capital.

How does NYS tax capital gains?

New York taxes capital gains as income and the rate reaches 8.82%. Oregon taxes capital gains as income and the rate reaches 9.9%. Vermont taxes short-term capital gains as income, as well as long-term capital gains that a taxpayer holds for up to three years.

Who must file NY CT-3?

Taxable DISCs must file Form CT-3 on or before the 15th day of the ninth month after the end of the tax year. Such a DISC is subject to the tax on apportioned capital or the fixed dollar minimum, whichever is larger. Write DISC after the legal name of the corporation in the address section of the return.

Who must file NY partnership return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

What is a CT-3?

Department of Taxation and Finance. General Business Corporation. Franchise Tax Return.

Who has to file CT 300?

You must electronically file Form CT-300 if you: do not use a tax professional to file; use a computer to prepare, document, or calculate your tax forms; and.

Who is subject to the NY MTA?

The MTA has the responsibility for developing and implementing a unified mass transportation policy for the New York metropolitan area, including all five boroughs of New York City and the suburban counties of Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk and Westchester.

What is a capital base tax?

(a) Generally, the capital base is the measure of the tax if such calculation results in a greater amount of tax than that computed on the entire net income base, the minimum taxable income base or the fixed dollar minimum.

What is form CT-3 New York?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

What is a form CT-3?

Form CT-3-A/BC provides individual group member detail concerning each member's: general information, fixed dollar minimum tax, prepayments, capital base, investment capital, and apportionment.

What is MTA surcharge tax?

The New York Department of Taxation and Finance announced that the rate of New York's metropolitan transportation business tax surcharge will increase to 30%, effective for tax years beginning on or after January 1, 2021. Our insights. Your choices.

Who must file CT-3 m?

Most corporations are required to electronically file this form either using tax software or online, after setting up an online services account, through the department's website. For more information, see Form CT-400-I, Instructions for Form CT-400.

Who is subject to New York MTA surcharge?

MTA Surcharge Filing If a taxpayer has $1 million or more of MTA receipts, it is subject to the MTA surcharge. … The computation of the MTA Surcharge increases to 25.6% of New York tax from 17%, and is now computed before credits; however, it now uses the actual tax rather than a recomputed New York tax. …

Who files MTA surcharge?

Estimated MTA surcharge Most corporations are required to electronically file this form either using tax software or online, after setting up an online services account, through the department's website. For more information, see Form CT-400-I, Instructions for Form CT-400.

Who must file form CT-3?

Who must file CT-3? All business corporations subject to tax under Article 9-A, other than New York S corporations, must file franchise tax returns using Form CT-3, unless such corporations are required or permitted to file as members of a combined group (see Form CT-3-A).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NY CT-3-A online?

pdfFiller has made it easy to fill out and sign NY CT-3-A. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out NY CT-3-A using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign NY CT-3-A and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How can I fill out NY CT-3-A on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your NY CT-3-A. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is NY CT-3-A?

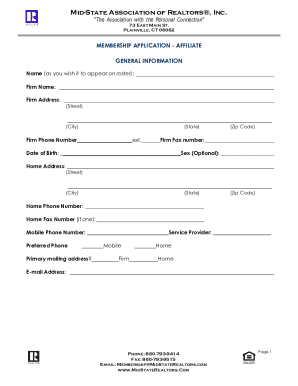

NY CT-3-A is a tax form used in New York State by corporations to report their franchise tax and apportion income.

Who is required to file NY CT-3-A?

Corporations doing business in New York State and are subject to the franchise tax are required to file NY CT-3-A.

How to fill out NY CT-3-A?

To fill out NY CT-3-A, you must provide information such as the corporation's name, address, federal employer identification number, and details regarding income, deductions, and credits.

What is the purpose of NY CT-3-A?

The purpose of NY CT-3-A is to calculate and report the franchise tax liability of a corporation in New York State.

What information must be reported on NY CT-3-A?

Information that must be reported includes the corporation's gross receipts, total income, and any applicable deductions or credits.

Fill out your NY CT-3-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY CT-3-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.