NYC TC201 2021 free printable template

Show details

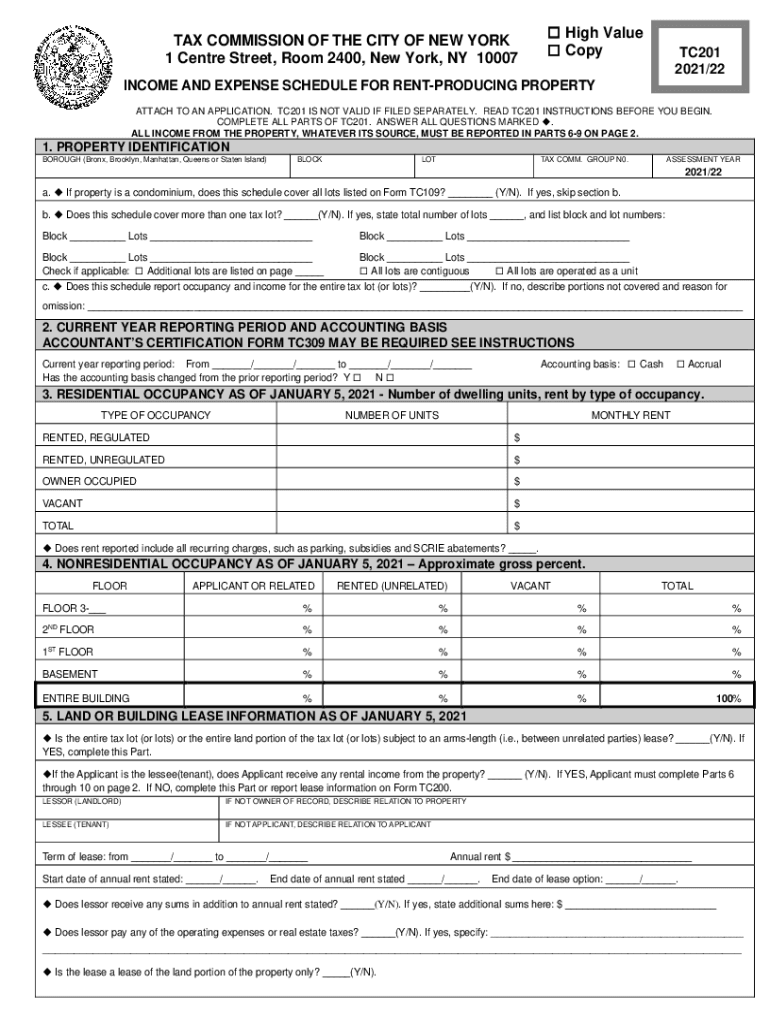

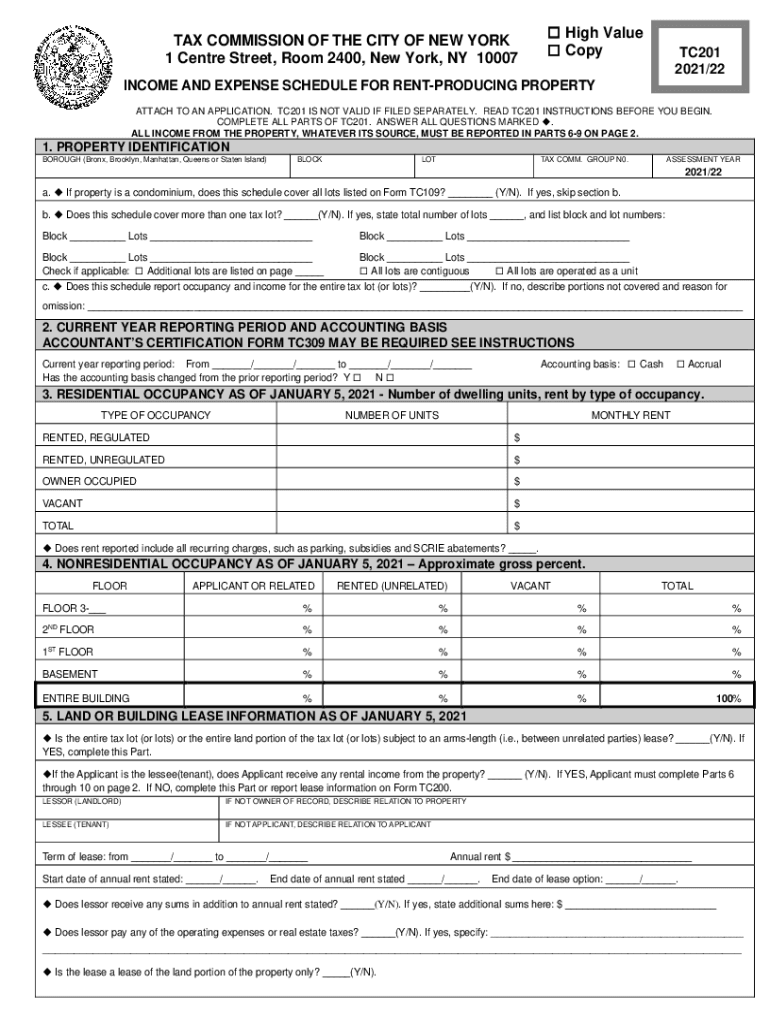

TAX COMMISSION OF THE CITY OF NEW YORK

1 Center Street, Room 2400, New York, NY 10007

INCOME AND EXPENSE SCHEDULE

FOR RENT PRODUCING PROPERTIESTC201INS

2021/22FORM TC201 INSTRUCTIONS FOR 2021/22

Attachment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC TC201

Edit your NYC TC201 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC TC201 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NYC TC201 online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NYC TC201. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC TC201 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC TC201

How to fill out NYC TC201

01

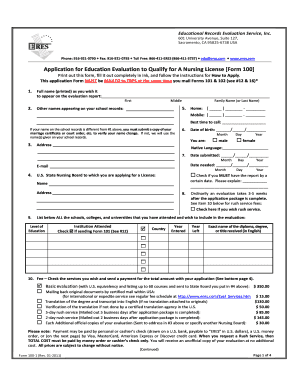

Download the NYC TC201 form from the NYC Department of Finance website.

02

Fill in your personal information such as name, address, and contact details.

03

Provide the details of the tax year for which you are claiming the credit.

04

Complete the income information section, including any relevant income sources.

05

Review and attach any required documents or proof of income.

06

Sign and date the form at the designated area.

07

Submit the completed form by mail or online through the NYC Department of Finance portal before the deadline.

Who needs NYC TC201?

01

Residents of New York City who are applying for a property tax rebate.

02

Taxpayers who qualify for the NYC Earned Income Tax Credit.

03

Individuals filing for certain exemptions and credits related to city taxes.

Fill

form

: Try Risk Free

People Also Ask about

How do I dispute real estate taxes in NYC?

516-571-2391. File the grievance form with the assessor or the board of assessment review (BAR) in your city or town. If your property is located in a village that assesses property, you will have two assessments, one for the village and one for the town.

What is TC 201 audit?

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the Form TC201. The procedures selected depend on the auditor's judgment, including the assessment of the risks of material misstatement of the Form TC201, whether due to fraud or error.

How do I appeal my taxes in NYC?

You may contact the Appeals Division or the Administrative Law Judge Division of the Tribunal through the “EMAIL THE TRIBUNAL” option in the Contact section of this website or by calling 212 669-2070.

Who is the commissioner of taxation and Finance in NYC?

Preston Niblack - Commissioner Preston Niblack was appointed commissioner of the Department of Finance by Mayor Eric Adams in December 2021.

What is the tax commission of the city of New York?

The Tax Commission is the City of New York's forum for independent administrative review of real property tax assessments set by the Department of Finance.

How do I appeal the tax commission in NYC?

You can contact the Tax Commission if you have questions about the appeal process or need help filling out an appeal form. Call 311 or 212-NEW-YORK (212-639-9675) for assistance.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NYC TC201 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your NYC TC201 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I sign the NYC TC201 electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your NYC TC201 and you'll be done in minutes.

Can I create an electronic signature for signing my NYC TC201 in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your NYC TC201 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is NYC TC201?

NYC TC201 is the New York City Transfer Tax Return, a form used for reporting the transfer of real property to the NYC Department of Finance.

Who is required to file NYC TC201?

Any individual or entity that transfers real property within New York City is required to file NYC TC201.

How to fill out NYC TC201?

To fill out NYC TC201, you need to provide information about the property, the parties involved in the transaction, and the details of the sale including the purchase price, and it must be submitted to the NYC Department of Finance.

What is the purpose of NYC TC201?

The purpose of NYC TC201 is to assess and collect the appropriate transfer tax on real estate transactions in New York City.

What information must be reported on NYC TC201?

NYC TC201 requires reporting the property's address, purchase price, the names and signatures of the transferors and transferees, and other relevant transaction details.

Fill out your NYC TC201 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC tc201 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.