NYC RPIE Instruction 2020 free printable template

Show details

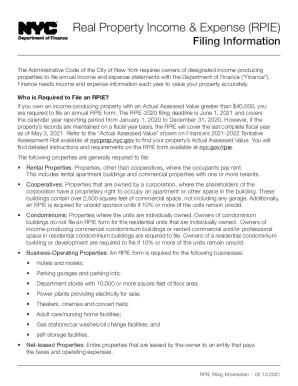

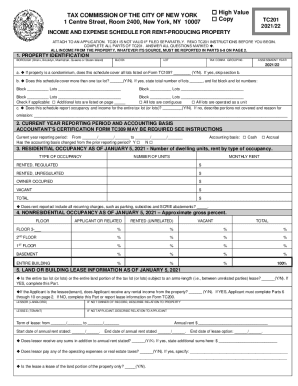

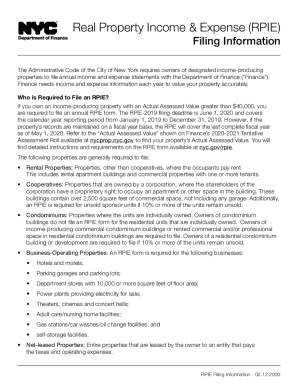

RPIE - 2017 WORKSHEET Real Property Income and Expense Worksheet and Instructions This is NOT the RPIE form. This document is designed to assist you in completing all RPIE forms on our website. PART IV RPIE CERTIFICATION To successfully submit your RPIE filing you must certify the information by clicking Sign and Submit. SECtIoN D - RPIE EXCLUsIoNs If you are identified as a required RPIE-2017 filer you will need to complete an income and expense form or complete a claim of exclusion in...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NYC RPIE Instruction

Edit your NYC RPIE Instruction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NYC RPIE Instruction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NYC RPIE Instruction online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NYC RPIE Instruction. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NYC RPIE Instruction Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NYC RPIE Instruction

How to fill out NYC RPIE Instruction

01

Obtain the NYC RPIE Instruction form from the NYC Department of Finance website.

02

Read the instructions thoroughly to understand the requirements for filing.

03

Gather all necessary property information, including the property owner's name, property address, and tax identification number.

04

Complete each section of the form, ensuring that all required fields are filled out accurately.

05

If applicable, include any supporting documents required for your specific situation.

06

Review the completed form for any errors or omissions.

07

Submit the form by the specified deadline either electronically through the NYC online portal or by mailing it to the appropriate address.

Who needs NYC RPIE Instruction?

01

Property owners who own and operate real estate in New York City.

02

Individuals or entities that are required to report their property income and expenses to the NYC Department of Finance.

03

Landlords and real estate investors who need to comply with NYC rental property income regulations.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file Rpie in NYC?

Who Is Required to File an RPIE? If you own an income-producing property with an actual assessed value greater than $40,000 on the Department of Finance's tentative assessment roll, you are required to file an annual RPIE statement.

What is the non filing fee for RPIE?

$100. Owners who fail to file a claim of exclusion in two consecutive years will be fined $500. Owners who fail to file a claim of exclusion in three or more consecutive years will be fined $1,000.

What is the deadline for RPIE?

Learn more about filing the REUC RPIE. The deadline for filing the REUC forms for RPIE-2021 was June 5, 2022.

How do I file a NYC RPIE?

Filing Instructions: Utility Properties Visit the REUC-RPIE filing portal. Create a password for each property that you must file. Enter the requested information on each screen. You will be instructed to submit the application electronically.

Who needs to file an RPIE?

Who Is Required to File an RPIE? If you own an income-producing property with an actual assessed value greater than $40,000 on the Department of Finance's tentative assessment roll, you are required to file an annual RPIE statement.

What is the deadline for RPIE?

Learn more about filing the REUC RPIE. The deadline for filing the REUC forms for RPIE-2021 was June 5, 2022.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out NYC RPIE Instruction using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign NYC RPIE Instruction and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete NYC RPIE Instruction on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your NYC RPIE Instruction. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I edit NYC RPIE Instruction on an Android device?

The pdfFiller app for Android allows you to edit PDF files like NYC RPIE Instruction. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is NYC RPIE Instruction?

NYC RPIE Instruction refers to the Real Property Income and Expense Instruction set by the New York City Department of Finance, which outlines how property owners should report their income and expenses related to real estate properties.

Who is required to file NYC RPIE Instruction?

All owners of rental properties in New York City that have 2 or more units are required to file the NYC RPIE Instruction, including both residential and commercial real estate properties.

How to fill out NYC RPIE Instruction?

To fill out the NYC RPIE Instruction, property owners must gather their income and expense documents for the previous calendar year, complete the RPIE form with the required data, and submit it to the NYC Department of Finance by the designated deadline.

What is the purpose of NYC RPIE Instruction?

The purpose of the NYC RPIE Instruction is to collect accurate financial data on rental properties to assess property values for tax purposes and ensure compliance with local property tax laws.

What information must be reported on NYC RPIE Instruction?

Property owners must report various information on the NYC RPIE Instruction, including total income from rent, operating expenses, vacancies, and other relevant financial data pertaining to the property.

Fill out your NYC RPIE Instruction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NYC RPIE Instruction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.