IRS 8829 Instructions 2020 free printable template

Show details

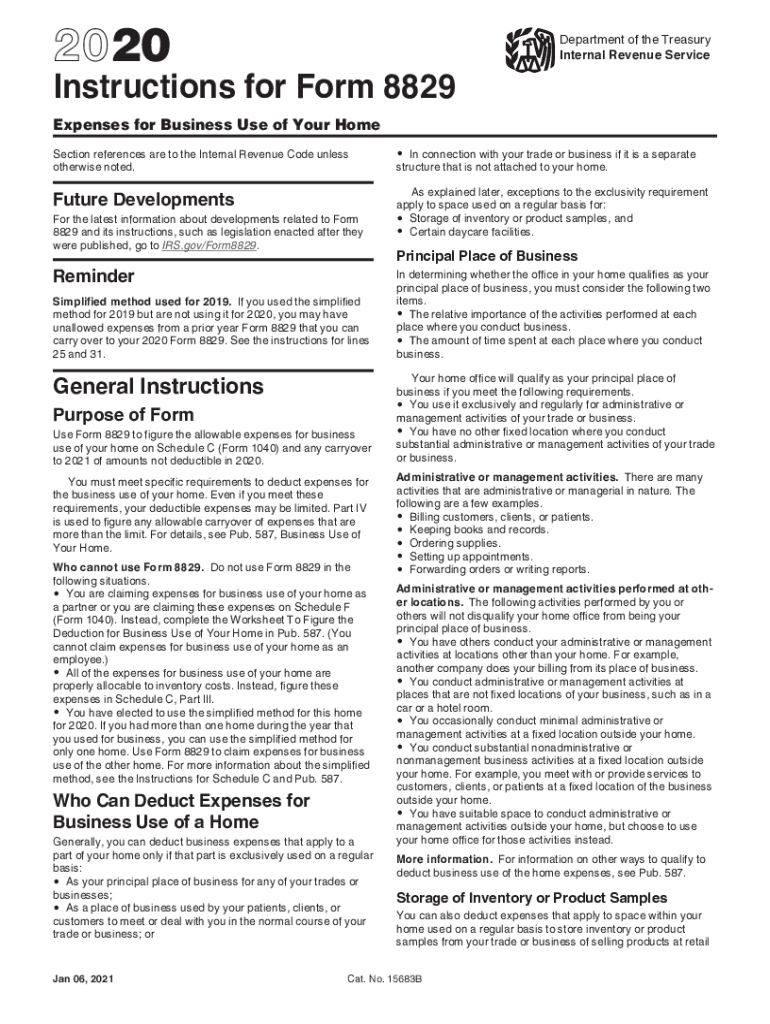

Reminder Simplified method used for 2017. If you used the simplified method for 2017 but are not using it for 2018 you may have unallowed expenses from a prior year Form 8829 that you can carry over to your 2018 Form 8829. See the instructions for lines 25 and 31. General Instructions Purpose of Form Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to 2019 of amounts not deductible in 2018. 107 Enter any amount from your...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8829 Instructions

Edit your IRS 8829 Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8829 Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8829 Instructions online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 8829 Instructions. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8829 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8829 Instructions

How to fill out IRS 8829 Instructions

01

Gather necessary information about your home and business use.

02

Complete Part I to calculate the total area of your home.

03

Calculate the area used for business by filling out Part II.

04

In Part III, list the expenses incurred for the business use of your home.

05

Transfer the calculated deductions to your Schedule C or other appropriate tax form.

Who needs IRS 8829 Instructions?

01

Self-employed individuals who use a part of their home for business purposes.

02

Qualifying homeowners who want to deduct home office expenses on their tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for home office deduction?

To claim the home office deduction on their 2021 tax return, taxpayers generally must exclusively and regularly use part of their home or a separate structure on their property as their primary place of business.

What information is needed for home office deduction?

The home office deduction, calculated on Form 8829, is available to both homeowners and renters. There are certain expenses taxpayers can deduct. These may include mortgage interest, insurance, utilities, repairs, maintenance, depreciation and rent.

How do I set up a home office for tax deductions?

Step 1: Pick a space. Your home office must be the primary area where your business activities take place. Step 2: Measure your home office. Step 3: Choose a method. Step 4: Start deducting. Step 5: Keep good records.

What is the simplified method for home office deduction?

How to calculate the home office deduction (simplified method) To calculate the deduction with the simplified method, you will multiply your client's total home office space by the rate per square foot for the current tax year.

How to fill out form 8829?

How to fill out Form 8829: Step-by-step instructions Calculate the business area of your home. You might need a tape measure for this one. Calculate the allowable deduction. Part II is asking you to list all the deductible expenses associated with your entire home. Calculate home depreciation. Carryover unallowed expenses.

What is the simplified method on form 8829?

About the simplified method The simplified method allows a standard deduction of $5 per square foot of home used for business, with a maximum of 300 square feet. Allowable home-related itemized deductions, such as mortgage interest and real estate taxes, are claimed in full on Schedule A.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8829 Instructions to be eSigned by others?

Once your IRS 8829 Instructions is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an eSignature for the IRS 8829 Instructions in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your IRS 8829 Instructions and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out IRS 8829 Instructions using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign IRS 8829 Instructions and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is IRS 8829 Instructions?

IRS 8829 Instructions provide guidelines for taxpayers to report expenses related to the use of a home for business purposes, specifically when claiming a home office deduction.

Who is required to file IRS 8829 Instructions?

Taxpayers who use part of their home exclusively and regularly for business activities and seek to claim a home office deduction must file IRS Form 8829.

How to fill out IRS 8829 Instructions?

To fill out IRS 8829, taxpayers must gather their home-related expenses, calculate the portion related to business use and complete the form section by section, including identifying the area used for business and detailing expenses.

What is the purpose of IRS 8829 Instructions?

The purpose of IRS 8829 Instructions is to assist taxpayers in accurately reporting and calculating home office deductions on their tax returns according to IRS regulations.

What information must be reported on IRS 8829 Instructions?

Taxpayers must report information such as the total area of the home, the area used for business, direct and indirect expenses (like utilities, rent, and repairs), and depreciation if applicable.

Fill out your IRS 8829 Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8829 Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.