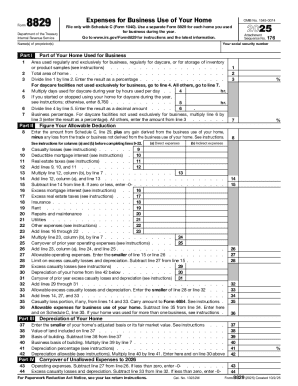

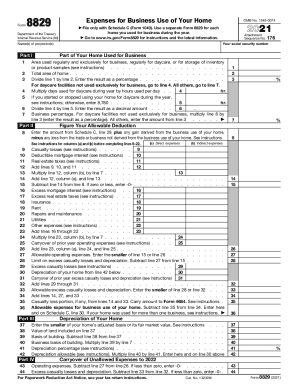

IRS 8829 2020 free printable template

Instructions and Help about IRS 8829

How to edit IRS 8829

How to fill out IRS 8829

About IRS 8 previous version

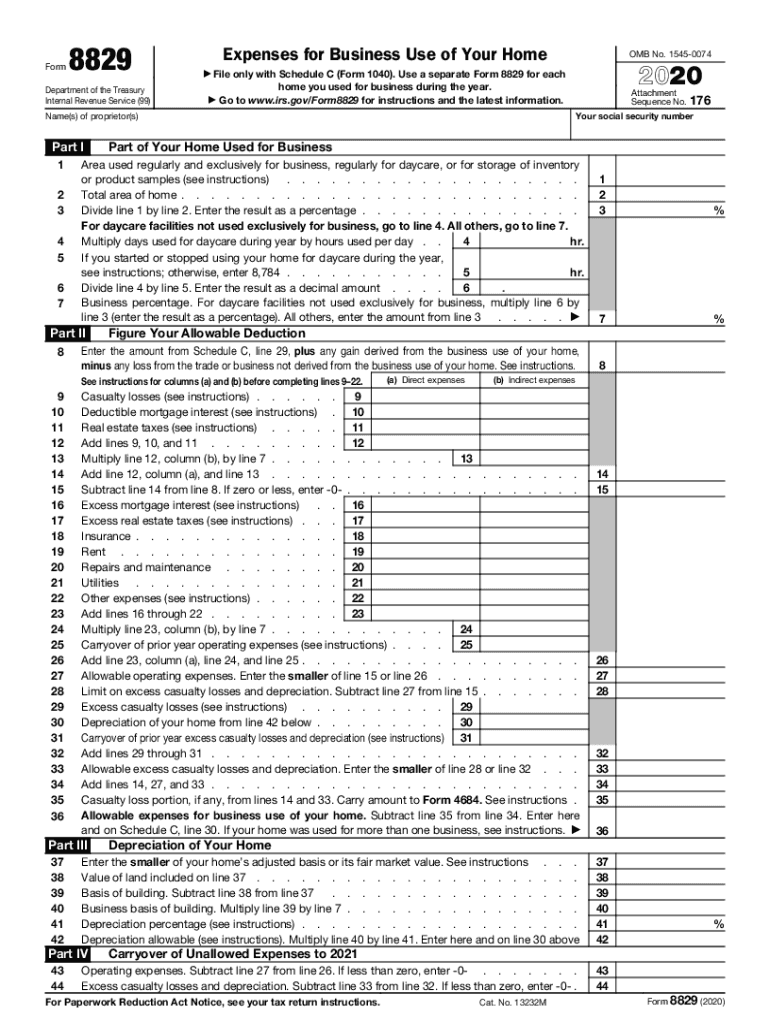

What is IRS 8829?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

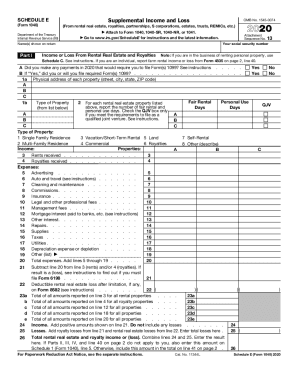

Is the form accompanied by other forms?

FAQ about IRS 8829

What should I do if I realize I've made an error on my IRS 8829 after submission?

If you discover an error on your IRS 8829 after filing, you should file an amended return using Form 1040-X along with a corrected IRS 8829. Make sure to clearly explain the reason for the amendment and attach any necessary documentation to support your corrections.

How can I check the status of my IRS 8829 submission?

To check the status of your IRS 8829 submission, you can use the IRS's online 'Where's My Refund?' tool or contact their customer service directly. If you e-filed, be aware of common rejection codes that could delay processing and ensure you address any issues promptly.

What are some common errors when filing IRS 8829?

Common errors when filing the IRS 8829 include incorrect calculations of your home office expenses and failing to include necessary supporting documentation. To avoid these issues, double-check your numbers and ensure all required records are attached to your filing.

Is a digital signature acceptable when e-filing IRS 8829?

Yes, a digital signature is acceptable for e-filing the IRS 8829. Ensure that you are using compatible software that supports e-signature functionality to secure your submission. Keeping your e-filing process compliant helps ensure a smoother filing experience.

What should I do if my IRS 8829 is rejected?

If your IRS 8829 is rejected, review the rejection notice to determine the cause and make the necessary corrections. You can resubmit your IRS 8829 as soon as you've addressed the identified issues. Keep in mind that tracking your submission is essential to ensure it is processed correctly after resubmission.

See what our users say