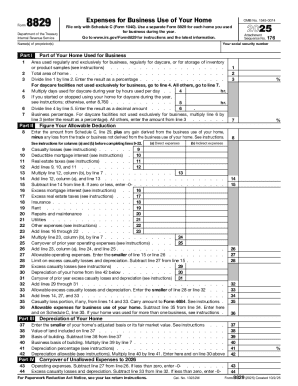

IRS 8829 2024 free printable template

Instructions and Help about IRS Form 8829

How to edit IRS Form 8829

How to fill out IRS Form 8829

Latest updates to IRS Form 8829

All You Need to Know About IRS Form 8829

What is IRS Form 8829?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

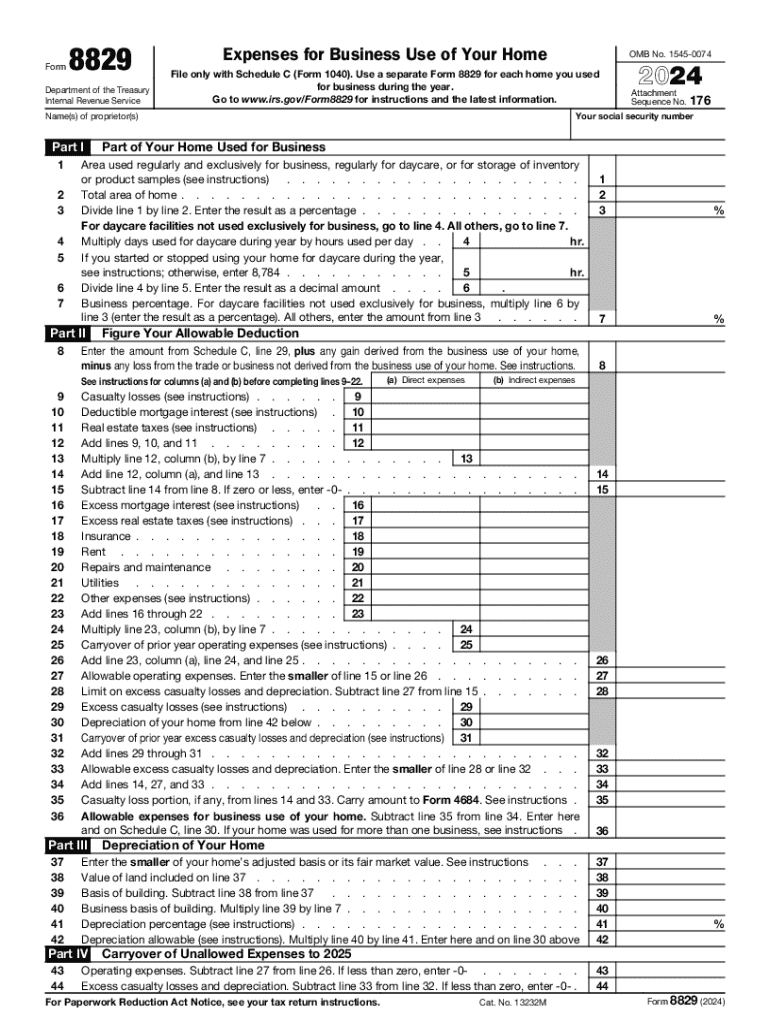

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8829

What should I do if I need to correct an error on my irs form 8829?

If you realize you made a mistake on your irs form 8829 after filing, you can submit an amended return using the correct information. Be sure to use IRS form 1040-X to amend your return, and include the corrected details from your irs form 8829. It is advisable to provide an explanation of the corrections to facilitate the process.

How can I track the status of my irs form 8829 submission?

To check the status of your irs form 8829 submission, you can use the IRS 'Where's My Refund?' tool if filed electronically. This can provide updates on receipt and processing. Common rejection codes may require you to address specific issues before resubmitting, so reviewing those codes is essential.

What is the record retention period for irs form 8829?

The IRS recommends keeping your records related to irs form 8829 for at least three years from the date you filed your tax return or the due date of your return, whichever is later. Retaining these documents ensures you are prepared in case of an audit or any inquiries regarding your deductions.

Can an authorized representative file the irs form 8829 on my behalf?

Yes, an authorized representative can file the irs form 8829 for you, provided they have the necessary power of attorney (POA) documentation. It's crucial that they meet all filing requirements and understand the specific details of the deductions you are claiming.

What common errors do taxpayers make when submitting the irs form 8829?

Some common errors when submitting the irs form 8829 include miscalculating allowable deductions, providing incomplete or incorrect information, and failing to keep adequate supporting documentation. To avoid these pitfalls, double-check all entries and ensure your calculations align with IRS guidelines.

See what our users say