SC SC1065 K-1 2020 free printable template

Show details

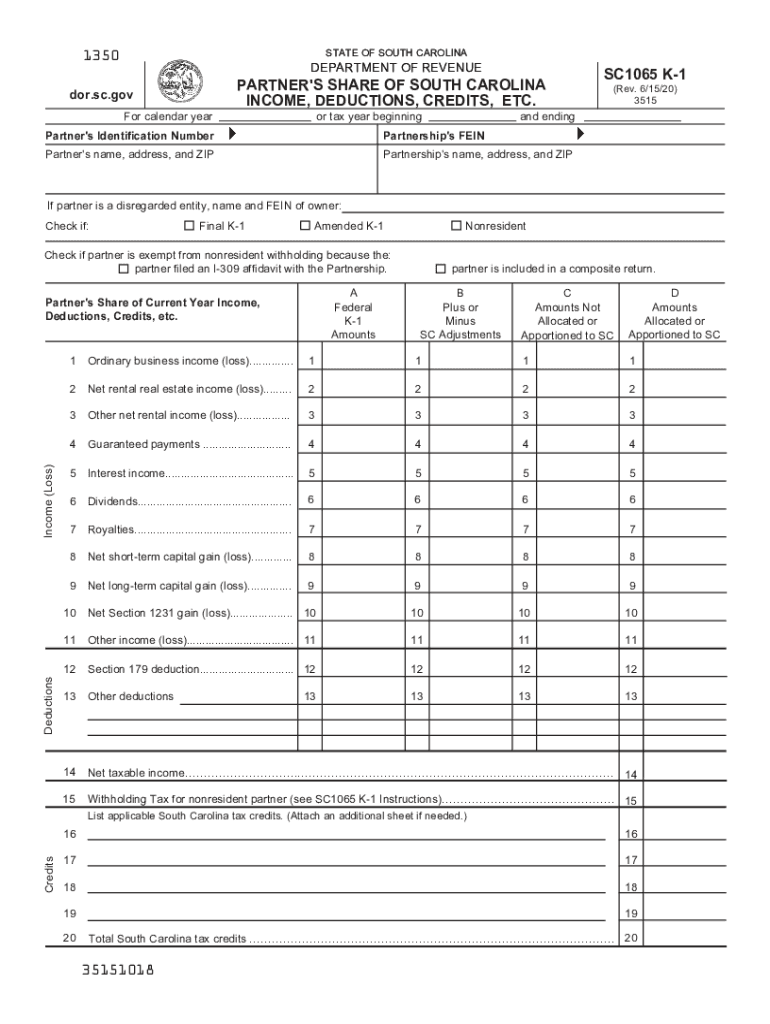

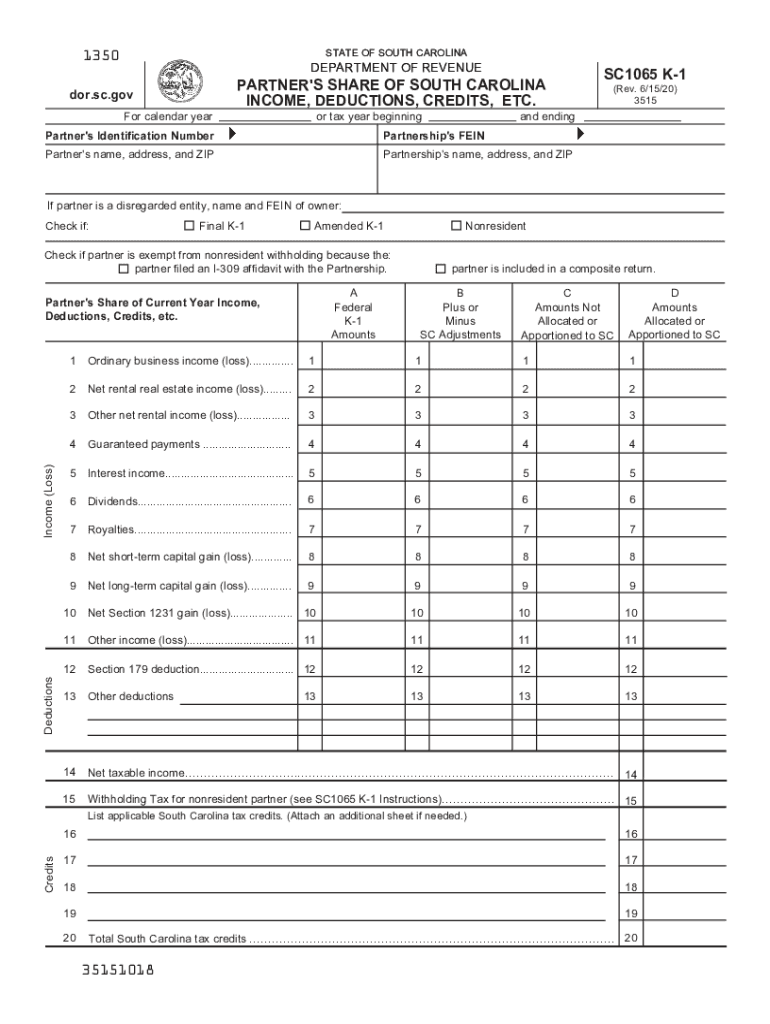

STATE OF SOUTH CAROLINA1350DEPARTMENT OF REVENUEPARTNER\'S SHARE OF SOUTH CAROLINA

INCOME, DEDUCTIONS, CREDITS, ETC.for.SC.gov

For calendar year or tax year beginningSC1065 K1

(Rev. 6/15/20)

3515and

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC SC1065 K-1

Edit your SC SC1065 K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC SC1065 K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC SC1065 K-1 online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC SC1065 K-1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC SC1065 K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC SC1065 K-1

How to fill out SC SC1065 K-1

01

Obtain the SC SC1065 K-1 form from the South Carolina Department of Revenue website or your tax preparer.

02

Enter your name, address, and social security number on the top of the form.

03

Fill in the partnership's name, address, and federal identification number.

04

Report your share of income, deductions, and credits from the partnership as provided by your partnership.

05

Complete any additional sections related to your specific income types or adjustments.

06

Review the completed form for accuracy.

07

Submit the SC SC1065 K-1 form along with your personal income tax return.

Who needs SC SC1065 K-1?

01

Partners in a partnership that conducts business in South Carolina.

02

Individuals who receive a share of income, deductions, or credits from a partnership.

Fill

form

: Try Risk Free

People Also Ask about

What is an SC K 1?

General purpose SC1065 K-1 is prepared by the partnership to show each partner's share of the entity's income. Each item of income is adjusted as required by South Carolina law and allocated or apportioned to South Carolina or to states other than South Carolina.

Does South Carolina allow consolidated returns?

A consolidated return must include the income allocated to South Carolina and the calculation of a separate License Fee for the parent and each subsidiary. A separate annual report and profit-and-loss statement are also required using each member's own apportionment ratio.

Do I have to renew my LLC every year in South Carolina?

South Carolina does not require LLCs to file an annual report. Taxes. For complete details on state taxes for South Carolina LLCs, visit Business Owner's Toolkit or the State of South Carolina . Federal tax identification number (EIN).

Does SC require an annual report?

(A) Except for those corporations described in Section 12-20-110, every domestic corporation, every foreign corporation qualified to do business in this State, and any other corporation required by Section 12-6-4910 to file income tax returns shall file an annual report with the department.

Does South Carolina require Cl 1?

Form CL-1 Initial Annual Report of Corporations must be submitted by both domestic and foreign corporations to the Secretary of State. LLC's filing as a corporation must submit Form CL-1 to SCDOR within 60 days of conducting business in this state.

Who is responsible for filing of the partnership return?

The precedent partner is responsible to file Form P to declare all income, losses, expenses, profit, loss, and assets, based on the profit and loss account, and balance sheet of the partnership business. As is normal practice, all business records must be kept for a period of 7 years for audit purposes.

Is South Carolina accepting state tax returns?

Yes, as long as you filed a 2021 South Carolina Individual Income Tax return and meet the eligibility requirements. If you need to update your address, see the instructions above.

Who must file a SC corporate tax return?

Generally Corporate taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically.

Who must file South Carolina partnership return?

Partnership taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically. To file by paper, use the SC 1065 Partnership Return.

What is the CL-1 form?

The South Carolina Department of Revenue (DOR) April 14 released Form CL-1, Initial Annual Report of Corporations, for corporate income and individual income tax purposes.

Is the state of SC accepting tax returns?

South Carolina State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be completed and e-Filed now along with a Federal or IRS Income Tax Return (or you can learn how to only prepare and file a SC state return). Attention: The deadline to e-file South Carolina Tax Returns is April 18, 2023.

Who must file a South Carolina tax return?

You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages. You are married filing jointly, age 65 or older and your gross income is greater than federal gross income filing requirement amount plus $30,000.

What is SC1065?

Partnerships must file a Declaration of Estimated Tax if: they choose to pay their Active Trade or Business Income Tax at the entity level, and. they expect to owe an Active Trade or Business Income Tax liability of $100 or more with the filing of their SC1065, Partnership Tax Return.

Does South Carolina have a pass through entity tax?

On May 17, 2021, South Carolina enacted Senate Bill 627, which permits pass-through entities to elect to pay South Carolina tax on active trade or business income at the entity level.

Does South Carolina allow composite return?

Participants are limited to individuals, trusts, or estates who are partners of the partnership, shareholders of the S corporation, or members of an LLC taxed as an S corporation or partnership. Corporate partners and members may not participate in composite returns.

Who can file a South Carolina composite return?

A composite return is a single return filed by a partnership, S corporation, or Limited Liability Company (LLC) taxed as a partnership or S corporation on behalf of two or more nonresident participants.

Can you file a consolidated S corp return?

To combine the information from the parent S Corporation, and the QSSS members in UltraTax/1120, you can set up an S Corporation consolidated group, similar to how a C Corporation consolidated group is set up.

Does North Carolina allow consolidated returns?

North Carolina Conforms to Federal Law Unlike federal law, however, North Carolina law does not permit a corporation to elect to file a consolidated income tax return.

Do I need a cl1?

If your LLC is taxed as a C-Corp or your LLC is taxed as an S-Corp, then you must first file Form CL-1, the “Initial Report of Corporations”. The fee is $25 (made payable to the “Secretary of State”) and Form CL-1 must be filed within 60 days of your LLC being formed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my SC SC1065 K-1 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your SC SC1065 K-1 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit SC SC1065 K-1 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing SC SC1065 K-1.

How do I fill out the SC SC1065 K-1 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign SC SC1065 K-1. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is SC SC1065 K-1?

SC SC1065 K-1 is a tax form used in South Carolina to report income, deductions, and credits from a partnership or a multi-member LLC to the individual partners or members.

Who is required to file SC SC1065 K-1?

Partners in a partnership or members of a multi-member LLC that has income, deductions, or credits to report must file the SC SC1065 K-1.

How to fill out SC SC1065 K-1?

To fill out SC SC1065 K-1, you need to provide information about the partnership or LLC, the partner or member's share of income, deductions, and credits, and any other relevant financial details as required by the form.

What is the purpose of SC SC1065 K-1?

The purpose of SC SC1065 K-1 is to report the individual income and tax responsibilities of partners or members from the income generated by the partnership or LLC for tax reporting purposes.

What information must be reported on SC SC1065 K-1?

The information that must be reported on SC SC1065 K-1 includes the name and address of the partnership or LLC, the name and taxpayer identification number of the partner or member, their share of income, losses, deductions, and any credits.

Fill out your SC SC1065 K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC sc1065 K-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.