SC SC1065 K-1 2015 free printable template

Show details

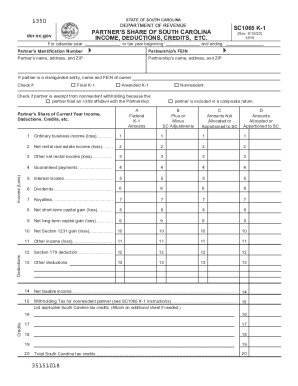

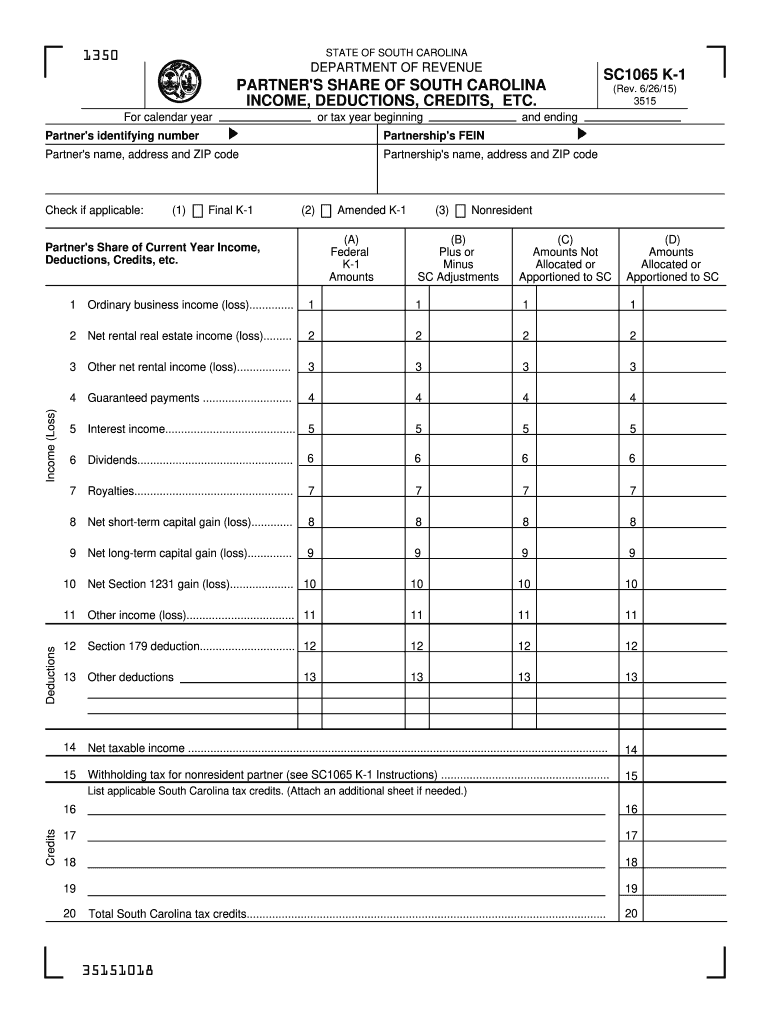

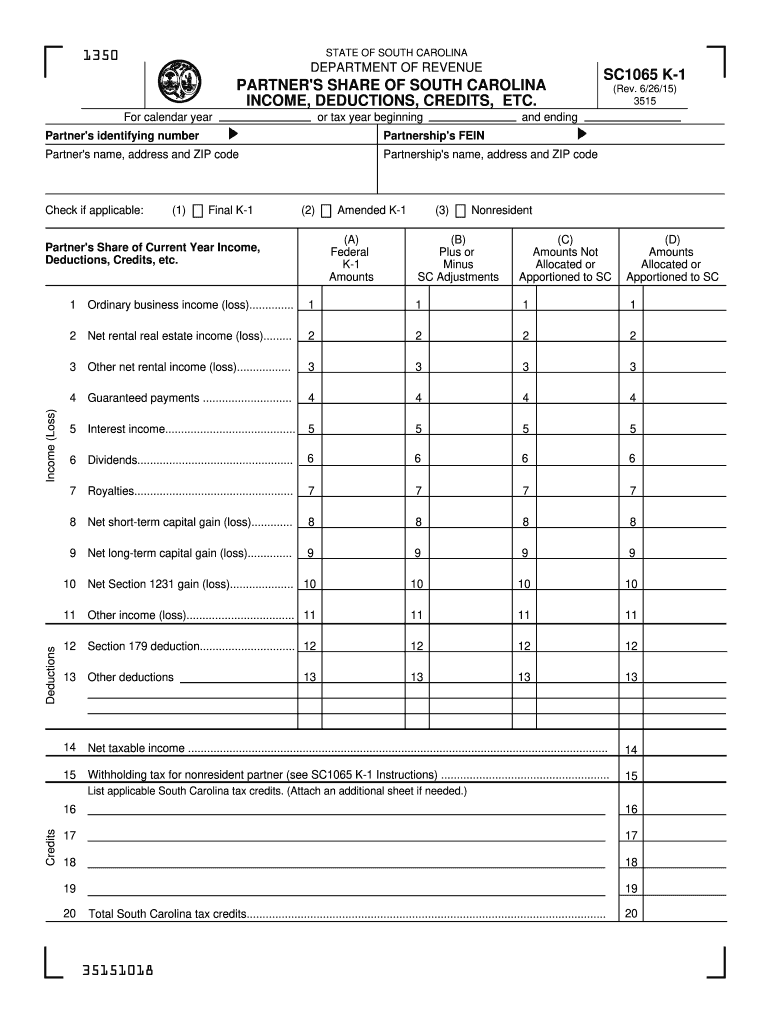

STATE OF SOUTH CAROLINA 1350 DEPARTMENT OF REVENUE PARTNER'S SHARE OF SOUTH CAROLINA INCOME, DEDUCTIONS, CREDITS, ETC. For calendar year or tax year beginning SC1065 K-1 (Rev. 6/26/15) 3515 and ending

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC SC1065 K-1

Edit your SC SC1065 K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC SC1065 K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC SC1065 K-1 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit SC SC1065 K-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC SC1065 K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC SC1065 K-1

How to fill out SC SC1065 K-1

01

Gather all necessary financial information for the partnership.

02

Open the SC SC1065 K-1 form.

03

Fill in the partnership's name, address, and federal identification number at the top of the form.

04

Enter the partner's name, address, and identification number in the designated sections.

05

Report the partner's share of income, deductions, and credits from the partnership's operation in the respective boxes.

06

Complete any additional information required, such as the partner's capital account and distributions.

07

Review all entries for accuracy.

08

Sign and date the form before providing a copy to the partner.

Who needs SC SC1065 K-1?

01

Partners in a partnership business registered in South Carolina who receive earnings or losses through the partnership.

Fill

form

: Try Risk Free

People Also Ask about

Can I file a 1065 for my LLC?

If the LLC is a partnership, normal partnership tax rules will apply to the LLC and it should file a Form 1065, U.S. Return of Partnership Income. Each owner should show their pro-rata share of partnership income, credits and deductions on Schedule K-1 (1065), Partner's Share of Income, Deductions, Credits, etc.

Is South Carolina accepting state tax returns?

Yes, as long as you filed a 2021 South Carolina Individual Income Tax return and meet the eligibility requirements. If you need to update your address, see the instructions above.

What is an SC K 1?

General purpose SC1065 K-1 is prepared by the partnership to show each partner's share of the entity's income. Each item of income is adjusted as required by South Carolina law and allocated or apportioned to South Carolina or to states other than South Carolina.

Does North Carolina allow consolidated returns?

North Carolina Conforms to Federal Law Unlike federal law, however, North Carolina law does not permit a corporation to elect to file a consolidated income tax return.

Can you file a consolidated S corp return?

To combine the information from the parent S Corporation, and the QSSS members in UltraTax/1120, you can set up an S Corporation consolidated group, similar to how a C Corporation consolidated group is set up.

What is SC1065?

Partnerships must file a Declaration of Estimated Tax if: they choose to pay their Active Trade or Business Income Tax at the entity level, and. they expect to owe an Active Trade or Business Income Tax liability of $100 or more with the filing of their SC1065, Partnership Tax Return.

Who is responsible for filing of the partnership return?

The precedent partner is responsible to file Form P to declare all income, losses, expenses, profit, loss, and assets, based on the profit and loss account, and balance sheet of the partnership business. As is normal practice, all business records must be kept for a period of 7 years for audit purposes.

Can a sole proprietor file a 1065?

If you are a single member LLC (sole proprietor) you would file your business income and expenses on Schedule C. You do not need to file a Form 1065.

Does South Carolina allow composite return?

Participants are limited to individuals, trusts, or estates who are partners of the partnership, shareholders of the S corporation, or members of an LLC taxed as an S corporation or partnership. Corporate partners and members may not participate in composite returns.

Can I file 1065 on my own?

You can find the 1065 tax form on the IRS website. You can fill out the form using tax software or print it to complete it by hand. If your partnership has more than 100 partners, you're required to file Form 1065 online. Other partnerships may be able to file by mail.

Who can file a South Carolina composite return?

A composite return is a single return filed by a partnership, S corporation, or Limited Liability Company (LLC) taxed as a partnership or S corporation on behalf of two or more nonresident participants.

Who must file South Carolina partnership return?

Partnership taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically. To file by paper, use the SC 1065 Partnership Return.

Who is required to file SC tax return?

ing to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages.

Who must file a SC corporate tax return?

Generally Corporate taxpayers whose South Carolina tax liability is $15,000 or more per filing period must file and pay electronically.

Who must file a South Carolina tax return?

You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages. You are married filing jointly, age 65 or older and your gross income is greater than federal gross income filing requirement amount plus $30,000.

How much does it cost to file form 1065?

Corporations filing Form 1120: $826. S Corporations filing Form 1120S: $809. Partnerships filing Form 1065: $656. Fiduciary filing Form 1041: $482.

Does South Carolina have a pass through entity tax?

On May 17, 2021, South Carolina enacted Senate Bill 627, which permits pass-through entities to elect to pay South Carolina tax on active trade or business income at the entity level.

Does South Carolina allow consolidated returns?

A consolidated return must include the income allocated to South Carolina and the calculation of a separate License Fee for the parent and each subsidiary. A separate annual report and profit-and-loss statement are also required using each member's own apportionment ratio.

Who files a partnership return?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify SC SC1065 K-1 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your SC SC1065 K-1 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I execute SC SC1065 K-1 online?

pdfFiller has made it easy to fill out and sign SC SC1065 K-1. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I create an electronic signature for the SC SC1065 K-1 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your SC SC1065 K-1 and you'll be done in minutes.

What is SC SC1065 K-1?

SC SC1065 K-1 is a tax form used in South Carolina for reporting income, deductions, and credits for partnerships or pass-through entities to their partners or members.

Who is required to file SC SC1065 K-1?

Partnerships or pass-through entities operating in South Carolina are required to file SC SC1065 K-1 for each partner or member to report their share of income, deductions, and other relevant information.

How to fill out SC SC1065 K-1?

To fill out SC SC1065 K-1, provide the partnership’s information, the partner’s details, and allocate the partner’s share of income, deductions, and credits from the entity’s tax return accurately on the form.

What is the purpose of SC SC1065 K-1?

The purpose of SC SC1065 K-1 is to inform partners or members of their share of the entity's income, deductions, and credits, which they need to report on their individual tax returns.

What information must be reported on SC SC1065 K-1?

Information that must be reported on SC SC1065 K-1 includes the partner’s name, address, tax identification number, the partnership’s income, losses, and other tax items that are passed through to the partner.

Fill out your SC SC1065 K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC sc1065 K-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.