Voya Order 144774 2020 free printable template

Show details

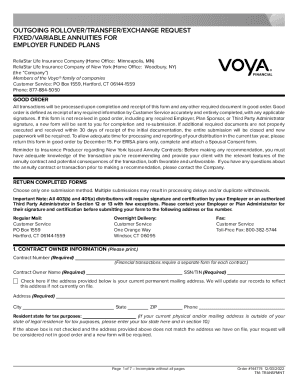

Regular Mail Overnight Delivery PO Box 5050 2000 21st Ave. NW Minot ND 58702-5050 Fax Toll-Free Fax 800-382-5744 1. The RMD for the current tax year has been or will be distributed from this or another contract. If this box is not selected the RMD will be disbursed. c DO distribute the RMD. Nebraska state income tax withholding is not required for premature distributions from 408 Plans. North Carolina does not apply to distributions from NC state and local government or federal retirement...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Voya Order 144774

Edit your Voya Order 144774 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Voya Order 144774 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Voya Order 144774 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Voya Order 144774. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Voya Order 144774 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Voya Order 144774

How to fill out Voya Order 144774

01

Obtain a copy of Voya Order 144774 form.

02

Fill in your personal information at the top of the form including your name and account number.

03

Provide the details regarding the requested transaction, such as type of order and amount.

04

Make sure to double-check the information for accuracy before submission.

05

Sign and date the form at the designated area.

06

Submit the completed form to Voya through the specified method (mail, fax, or online submission) as instructed.

Who needs Voya Order 144774?

01

Individuals or entities looking to make a specific order related to their Voya investment account.

02

Clients who have investment accounts managed by Voya and need to execute particular transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is a 401k rollover form?

What is a 401(k) rollover? A 401(k) rollover is when you direct the transfer of the money in your 401(k) plan to a new 401(k) plan or IRA. The IRS gives you 60 days from the date you receive an IRA or retirement plan distribution to roll it over to another plan or IRA.

How do I rollover my 401k to a new employer?

Rolling over a 401(k) to a new employer is fairly straightforward — you simply call the 401(k) provider at your old company and request the rollover yourself or your current employer plan can do it for you. The other option, which is rolling over a 401(k) into an IRA, is also a popular choice.

Do you get a 5498 for a rollover?

Form 5498 reports your total annual contributions to an IRA account and identifies the type of retirement account you have, such as a traditional IRA, Roth IRA, SEP IRA or SIMPLE IRA. Form 5498 will also report amounts that you roll over or transfer from other types of retirement accounts into this IRA.

Do you get tax forms for rollover IRA?

Like all retirement plans or IRA distributions, rollover distributions are reported to the taxpayer on the Form 1099-R.

How do I transfer my 401k to an IRA without penalty?

Can you roll a 401(k) into an IRA without penalty? You can roll over money from a 401(k) to an IRA without penalty but must deposit your 401(k) funds within 60 days. However, there will be tax consequences if you roll over money from a traditional 401(k) to a Roth IRA.

Do you get a 1099-R for a rollover?

A taxpayer should not receive a Form 1099-R for a trustee-to-trustee transfer from one IRA to another, but should receive a Form 1099-R for a trustee-to-trustee direct rollover from an employer qualified plan to an IRA with code G.

How long does rollover process take?

Once you've met the financial institution's requirements, they'll process your rollover. Rollovers typically take 2-4 weeks to complete.

Can you rollover your 401k whenever you want?

Most people roll over 401(k) savings into an IRA when they change jobs or retire. But, the majority of 401(k) plans allow employees to roll over funds while they are still working. A 401(k) rollover into an IRA may offer the opportunity for more control, more diversified investments and flexible beneficiary options.

How do I request a direct rollover?

To engineer a direct rollover, an account holder needs to ask his plan administrator to draft a check and send it directly to the new 401(k) or IRA. In IRA-to-IRA transfers, the trustee from one plan sends the rollover amount to the trustee from the other plan.

Should I roll over my 401k or leave it alone?

For many people, rolling their 401(k) account balance over into an IRA is the best choice. By rolling your 401(k) money into an IRA, you'll avoid immediate taxes and your retirement savings will continue to grow tax-deferred.

How do I transfer my old 401k to a rollover IRA?

How to roll over your 401(k) into an IRA. Rolling over a 401(k) into an IRA is easy. Choose a good brokerage to hold your account. Ask the brokerage and your 401(k) administrator about the transfer process. Complete the required paperwork. Get your money into your new IRA ASAP. Invest your newly deposited funds.

What is a rollover request form?

IMPORTANT: The IRA Rollover Request Form is used to initiate a rollover of assets to a qualified retirement plan. This form authorizes Retirement Clearinghouse to request a transfer of assets on your behalf.

How do I rollover my 401k from Voya?

How to Transfer a Former Employer 401k at Voya Financial to a Self-Directed Solo 401k Plan This is a Direct Rollover to a Qualified Employer Plan named: provide the name of the solo 401k plan. IMPORTANT: Make the rollover check payable to: provide the name of the solo 401k plan.

Can I rollover my 401k myself?

You can transfer a 401(k) to an IRA if you have left a job. First, open or establish an IRA at IRAR and complete our Rollover Certification Form. Then, contact your plan administrator and request the forms that you need to complete to move the plan assets or retirement savings to the self-directed IRA.

Do you get a tax form for a rollover?

While you should have received a Form 1099-R reporting your rollover, if you didn't, or if you failed to report the IRA when you initially filed your tax return, you can report your 401K rollover on a Form 1040X: Amended Return.

Do I need to report a rollover on my tax return?

This rollover transaction isn't taxable, unless the rollover is to a Roth IRA or a designated Roth account from another type of plan or account, but it is reportable on your federal tax return. You must include the taxable amount of a distribution that you don't roll over in income in the year of the distribution.

What is the rollover process?

COVID-19 Relief for Retirement Plans and IRAs Most pre-retirement payments you receive from a retirement plan or IRA can be “rolled over” by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

What is a rollover request?

A rollover occurs when you withdraw cash or other assets from one eligible retirement plan and contribute all or part of it, within 60 days, to another eligible retirement plan.

Can I move my 401k to all cash?

Key Takeaways. You can change your individual retirement account (IRA) holdings from stocks and bonds to cash, and vice versa, without being taxed or penalized. The act of switching assets is called portfolio rebalancing. There can be fees and costs related to portfolio rebalancing, including transaction fees.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Voya Order 144774 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your Voya Order 144774 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I make changes in Voya Order 144774?

With pdfFiller, it's easy to make changes. Open your Voya Order 144774 in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out Voya Order 144774 on an Android device?

Use the pdfFiller mobile app and complete your Voya Order 144774 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is Voya Order 144774?

Voya Order 144774 is an official directive or regulatory order related to financial transactions or investment activities initiated by Voya Financial.

Who is required to file Voya Order 144774?

Typically, financial entities or individuals engaged in specific transactions governed by the order are required to file Voya Order 144774.

How to fill out Voya Order 144774?

Filling out Voya Order 144774 involves completing the required fields accurately, providing necessary documentation, and submitting it to the appropriate regulatory body or Voya Financial.

What is the purpose of Voya Order 144774?

The purpose of Voya Order 144774 is to ensure compliance with regulatory requirements and to facilitate transparent reporting of financial activities.

What information must be reported on Voya Order 144774?

Information that must be reported on Voya Order 144774 typically includes transaction details, involved parties' identification, monetary amounts, and any relevant dates.

Fill out your Voya Order 144774 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voya Order 144774 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.