Get the free Latest & Upcoming IPOs - Taking a Company Public - Nasdaq

Show details

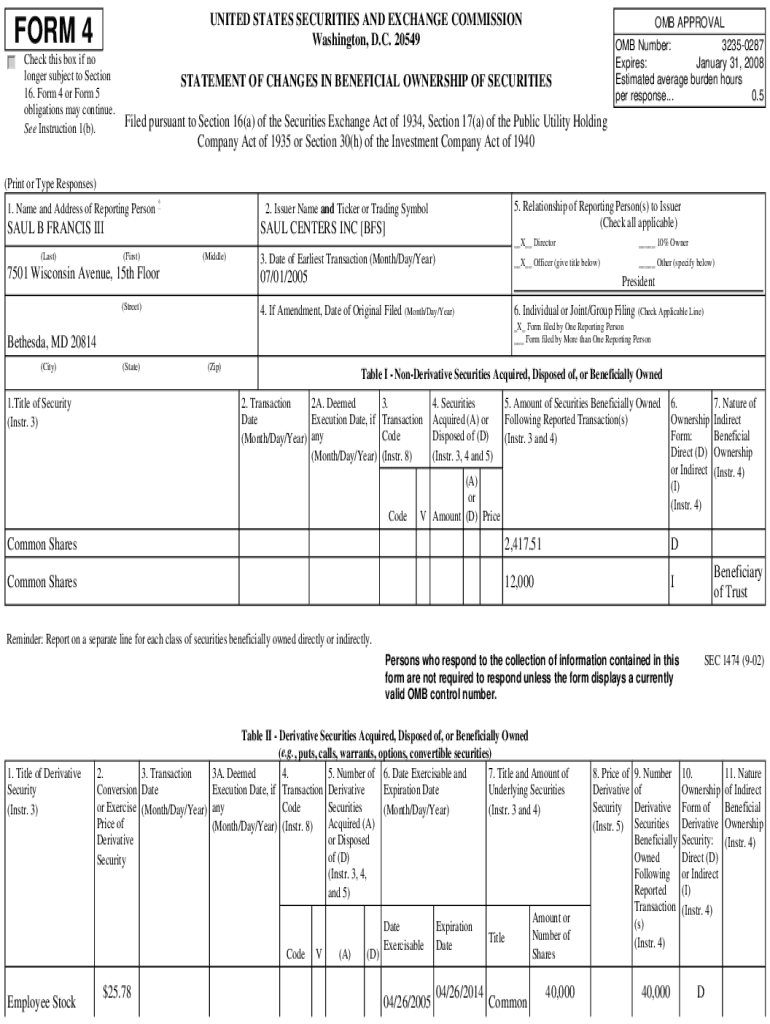

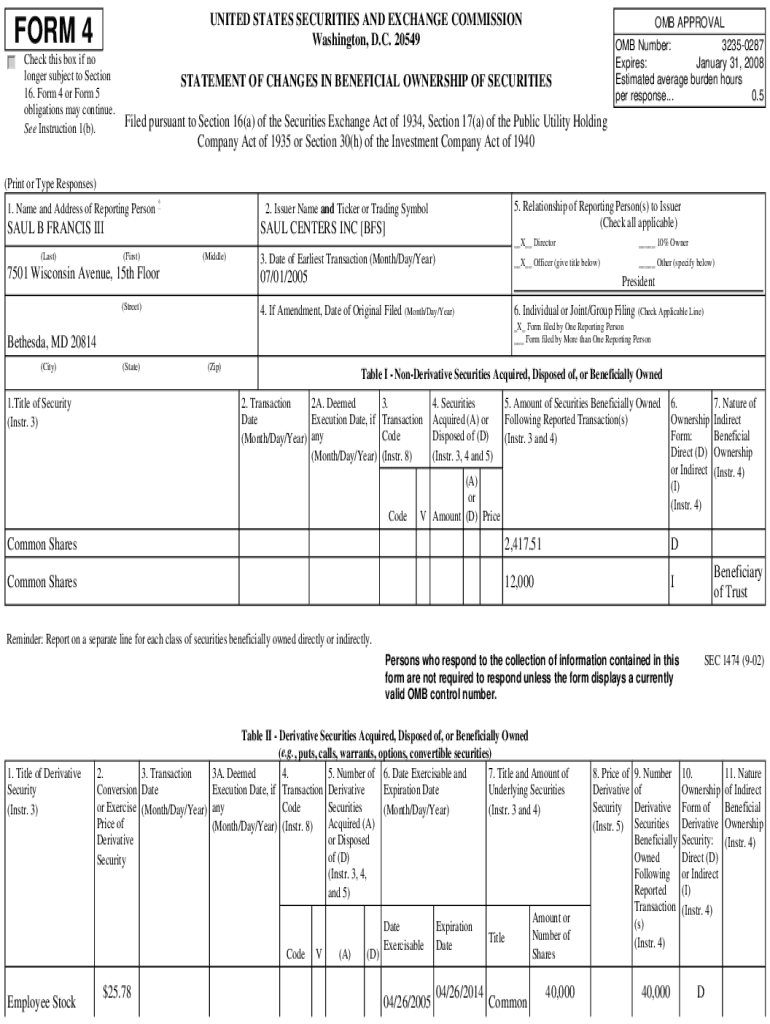

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549FORM 4

c

d

e

f

check this box if no

longer subject to Section

16. Form 4 or Form 5

obligations may continue.

See Instruction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign latest amp upcoming ipos

Edit your latest amp upcoming ipos form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your latest amp upcoming ipos form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit latest amp upcoming ipos online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit latest amp upcoming ipos. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out latest amp upcoming ipos

How to fill out latest amp upcoming ipos

01

Research the company: Start by gathering information about the company that is going public. Look into their business model, financials, management team, and industry trends.

02

Assess the IPO offering: Evaluate the IPO offering by reviewing the prospectus, which contains details about the company, its financials, risks, and the intended use of the proceeds. Consider factors like the offering price, valuation, and potential future growth.

03

Understand the allocation process: Familiarize yourself with how the IPO shares will be allocated. Typically, institutional investors, high-net-worth individuals, and retail investors have different allotment percentages.

04

Consider the risks: Like any investment, IPOs carry risks. Analyze the potential risks associated with the company, industry, and market conditions. Assess factors like competition, regulatory changes, and economic factors.

05

Choose a broker: To participate in an IPO, you'll need a brokerage account. Select a reputable broker that offers IPO access. Make sure you meet their application requirements and understand the fees involved.

06

Submit your application: Follow your broker's instructions to apply for shares in the IPO. Provide the necessary information and indicate the number of shares you wish to purchase.

07

Track the IPO process: Stay updated on the IPO process through announcements and news releases. Monitor the pricing, anticipated listing date, and any changes or updates provided by the company or underwriters.

08

Evaluate the opening price: Once the IPO shares start trading, evaluate the opening price and compare it to your anticipated allocation. Decide whether you want to hold or sell your shares based on your investment goals and market conditions.

09

Manage your investment: After the IPO, monitor your investment and keep up with the company's performance. Adjust your position if needed, based on the company's progress, earnings reports, and market conditions.

10

Seek professional advice: If you are new to IPO investing or unsure about the process, consider seeking advice from a financial advisor or investment professional.

Who needs latest amp upcoming ipos?

01

Investors looking for capital appreciation: Individuals or institutions seeking to invest in companies with growth potential may be interested in IPOs. A successful IPO can result in capital appreciation if the company performs well in the market.

02

Venture capitalists and private equity firms: Investors who have previously invested in the private stage of the company may be interested in IPOs as an opportunity to exit their investment and realize returns.

03

Retail investors seeking diversification: Retail investors looking to diversify their investment portfolio may find IPOs attractive. Investing in IPOs allows them to access early-stage companies and potentially benefit from their growth.

04

Traders looking for short-term opportunities: Traders who specialize in short-term trading strategies may be interested in IPOs. The volatility around IPOs can provide opportunities for quick profits if they can accurately predict market movements.

05

Industry professionals and insiders: People working in the industry or insiders of the company may be interested in IPOs to capitalize on their knowledge and understanding of the sector and company's potential.

06

High-net-worth individuals: High-net-worth individuals looking to invest a significant amount of capital may consider IPOs as a way to allocate their funds and potentially generate substantial returns.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send latest amp upcoming ipos to be eSigned by others?

latest amp upcoming ipos is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit latest amp upcoming ipos straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing latest amp upcoming ipos, you can start right away.

Can I edit latest amp upcoming ipos on an Android device?

With the pdfFiller Android app, you can edit, sign, and share latest amp upcoming ipos on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is latest amp upcoming ipos?

As of October 2023, some of the latest and upcoming IPOs include companies in various sectors such as technology, healthcare, and finance. Specific names and dates may vary, so it's essential to check financial news platforms for the most current information.

Who is required to file latest amp upcoming ipos?

Companies planning to go public must file their IPO with the relevant securities regulatory authorities, such as the SEC in the United States. This includes firms from different sectors and industries intending to sell shares to the public.

How to fill out latest amp upcoming ipos?

To fill out an IPO filing, companies must complete a registration statement, usually Form S-1 in the U.S., detailing financial data, business operations, risk factors, and management information, which is then submitted to the regulatory body for review.

What is the purpose of latest amp upcoming ipos?

The purpose of IPOs is to raise capital for business expansion, pay off debt, or provide liquidity for existing shareholders. It allows companies to access a wider range of investors and increases public visibility.

What information must be reported on latest amp upcoming ipos?

Companies must report financial statements, risk factors, business model description, use of proceeds, management backgrounds, and market conditions in their IPO filings.

Fill out your latest amp upcoming ipos online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Latest Amp Upcoming Ipos is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.