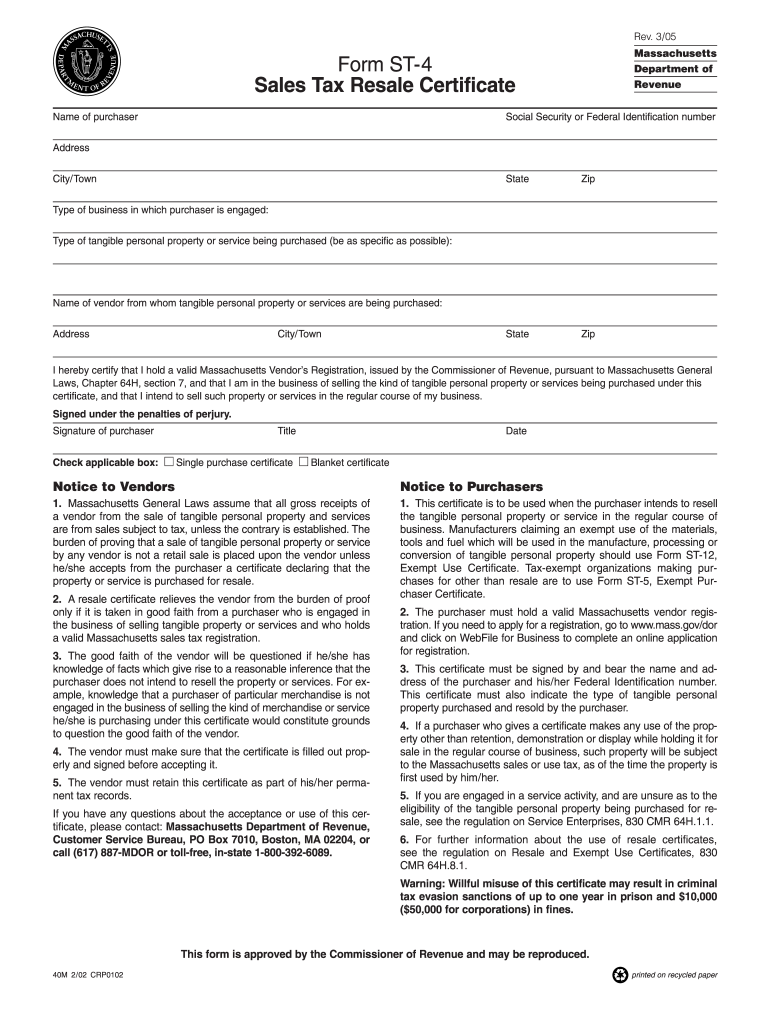

Who needs a Form ST-4?

The full name of Form ST-4 MA is Sales Tax Resale Certificate. This is Massachusetts Department of Revenue form, that should be filled out by a purchaser, who aims to acquire a property or a service for resale as it is at present or as a component to other property. It is only possible in case a purchase in engaged in a regular business of reselling the certain property.

What is the Massachusetts Tax Resale Certificate for?

With the help of completion of an MA Sales Tax Resale Certificate, a registered seller can get an exemption from the sales tax as a purchaser would resell an item and report proper taxes on the final sale. However, to make this possible, the deal must be adequately recorded using a resale certificate.

Is the MA ST-4 form accompanied by other forms?

No, there isn’t such a requirement to attach any forms to Sales Tax Resale Certificate. Though, a purchaser has a right to request any documentation regarding a purchased item or a confirmation of certain price paid for it.

When is the form ST-4 due?

The certificate should be completed when required. After the transaction, it should be kept on file for at least 60 days for an inspection.

How do I fill out the ST-4 form MA?

The Sales Tax Resale Certificate is considered to be properly filled out when it clearly states:

- name and address of a purchaser

- type of purchaser’s business

- typed of purchased property or service

- name and address of vendor (seller)

Finally, it must be signed and dated by vendor and purchaser.

Where do I send Sales Tax Resale Certificate?

The filed original Sales Tax Resale Certificate is to be kept by the seller.