SC DoR SC4868 2020 free printable template

Show details

1350

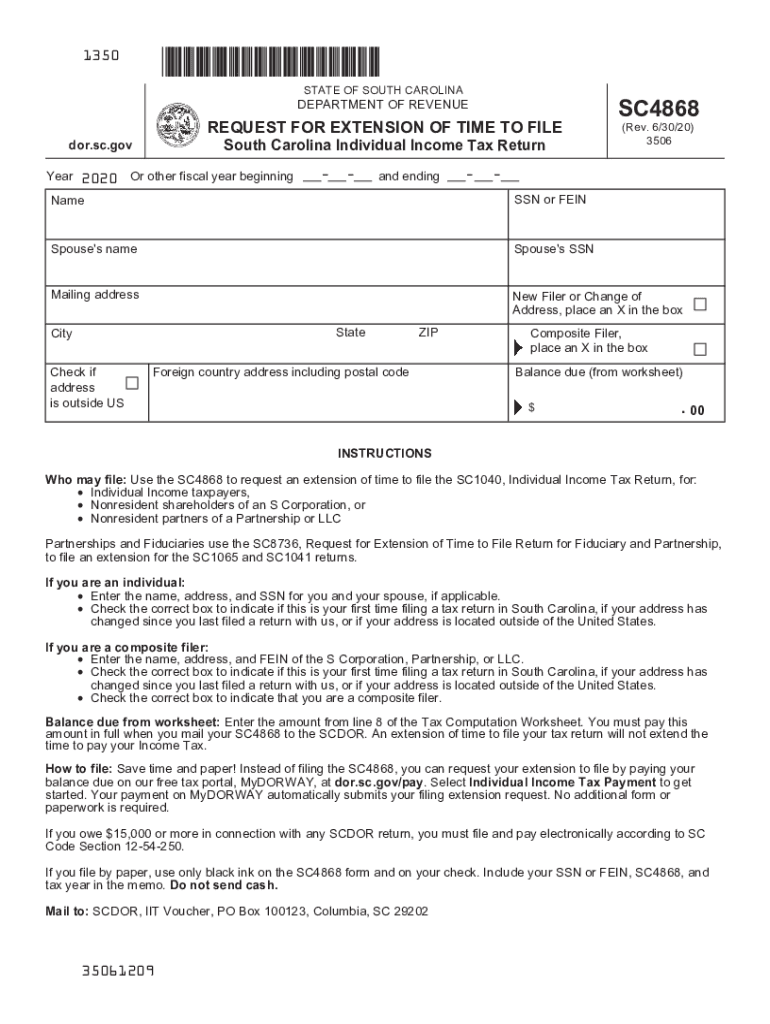

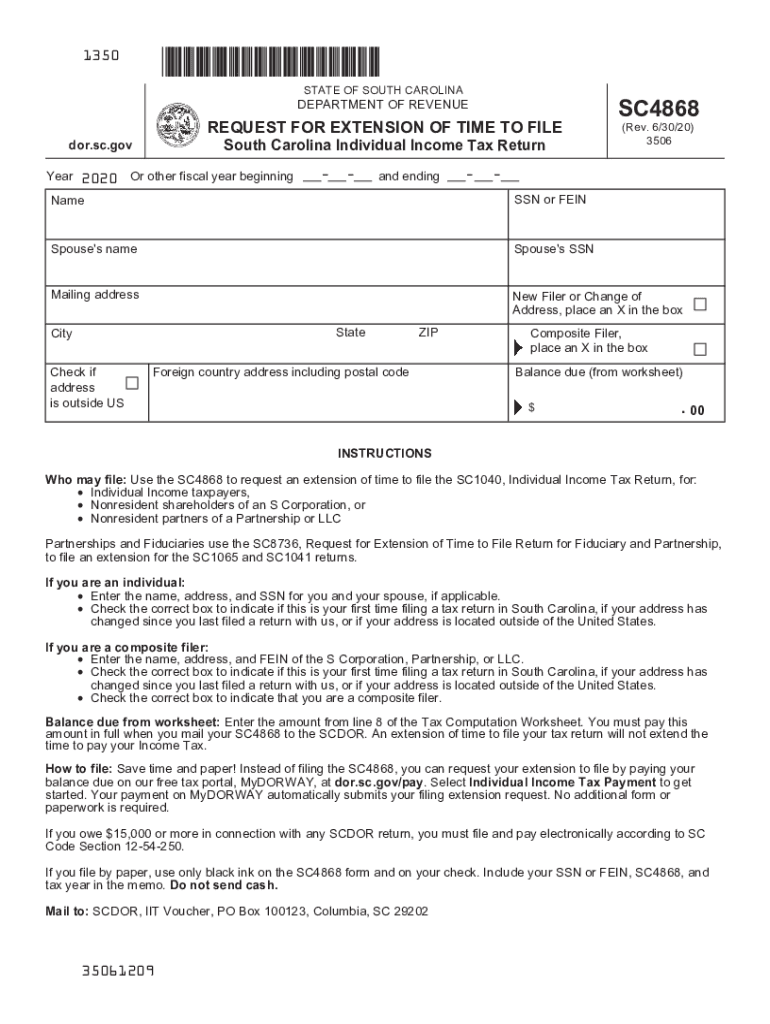

STATE OF SOUTH CAROLINADEPARTMENT OF REVENUEREQUEST FOR EXTENSION OF TIME TO FILE

South Carolina Individual Income Tax Returner.SC.gov

Year2020 Or other fiscal year beginning and endingSC4868

(Rev.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR SC4868

Edit your SC DoR SC4868 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC4868 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SC DoR SC4868 online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit SC DoR SC4868. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC4868 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SC DoR SC4868

How to fill out SC DoR SC4868

01

Obtain Form SC DoR SC4868 from the relevant tax authority's website.

02

Fill out your personal information, including your name, address, and Social Security Number.

03

Indicate the tax period for which you are requesting an extension.

04

Provide an estimated tax liability if applicable.

05

Sign and date the form.

06

Submit the form by the deadline either electronically or via mail.

Who needs SC DoR SC4868?

01

Individuals who need additional time to file their tax returns.

02

Taxpayers who are unable to meet the original filing deadline for specific tax forms.

03

Those who anticipate owing taxes and want to avoid penalties.

Fill

form

: Try Risk Free

People Also Ask about

What is SC1040 form?

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

Does South Carolina have an extension form?

Regardless of the reason, the South Carolina Department of Revenue (SCDOR) wants you to know that filing an extension is easy, and you do not have to provide the reason to the SCDOR. Those who request an extension have until October 16, 2023 to file their 2022 returns.

Does South Carolina follow the federal extension?

Does South Carolina accept a federal extension? A. If the taxpayer files an extension with the Internal Revenue Service, then the Department accepts the federal extension and will grant an automatic extension of time to file the South Carolina return for the same length of time allowed by the Internal Revenue Service.

How do I file an extension on my South Carolina State taxes?

Request a six month filing extension for your South Carolina Individual Income Taxes by: Paying your balance due online using MyDORWAY on or before the due date. Choose the individual payment option, enter your taxpayer information, and then choose the "Extension Payment" option on the following screen.

Do I need to file a State tax extension for South Carolina?

If you expect to owe South Carolina income tax and you need more time to file your return you can request an extension for your SC1040 individual income tax return. You must still pay the tax due by April 18, 2023 (or May 1, 2023 if you file your return and pay electronically).

Does South Carolina have an automatic extension?

If you have an approved Federal tax extension (IRS Form 4868) and you're due a South Carolina tax refund, you will automatically be granted a South Carolina extension.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my SC DoR SC4868 directly from Gmail?

SC DoR SC4868 and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit SC DoR SC4868 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing SC DoR SC4868 right away.

How do I fill out the SC DoR SC4868 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign SC DoR SC4868 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is SC DoR SC4868?

SC DoR SC4868 is a form used to request an extension of time to file individual income tax returns in South Carolina.

Who is required to file SC DoR SC4868?

Any individual or entity seeking an extension for filing their South Carolina state income tax return is required to file SC DoR SC4868.

How to fill out SC DoR SC4868?

To fill out SC DoR SC4868, individuals should provide their personal information, including name, address, and Social Security number, along with an estimate of their tax liability for the fiscal year.

What is the purpose of SC DoR SC4868?

The purpose of SC DoR SC4868 is to grant taxpayers an extension of time to file their income tax returns without incurring penalties for late filing.

What information must be reported on SC DoR SC4868?

SC DoR SC4868 requires reporting personal information such as name, address, and Social Security number, as well as an estimate of total income tax due.

Fill out your SC DoR SC4868 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc4868 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.