SC DoR SC4868 2009 free printable template

Show details

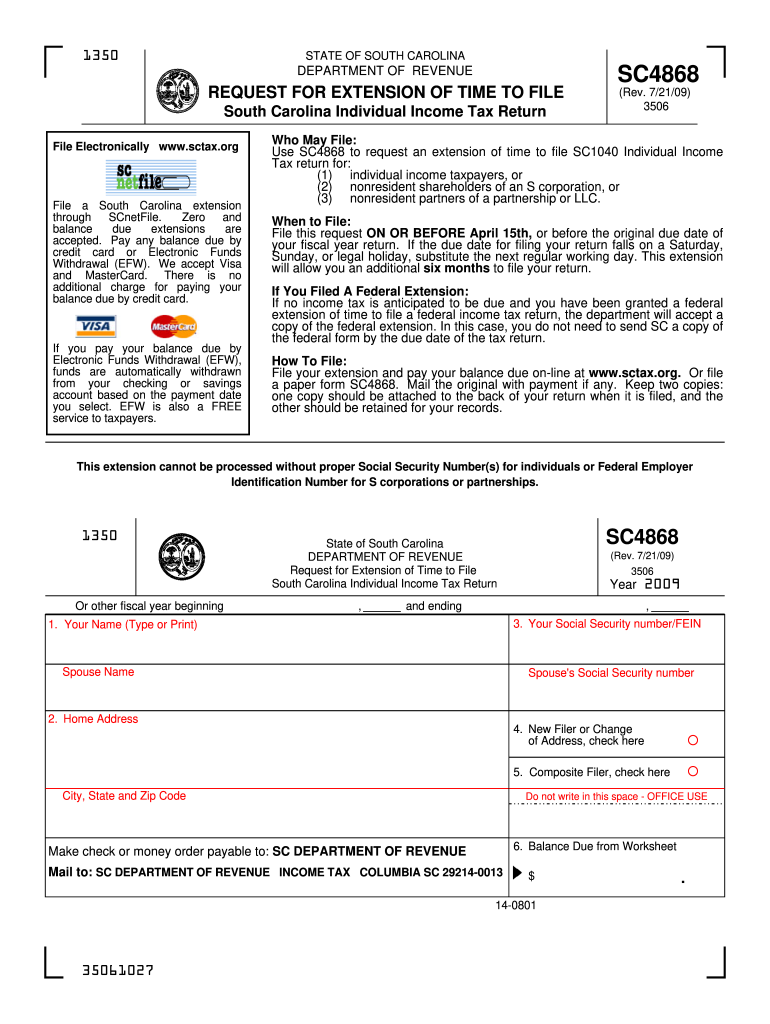

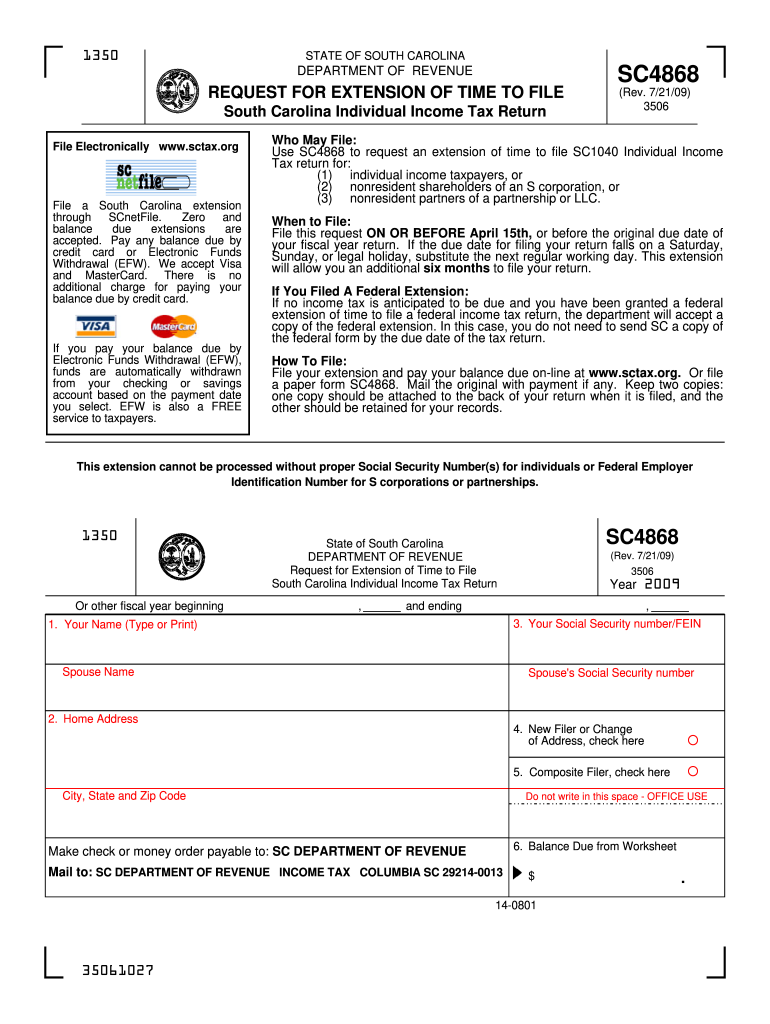

F G. Total credits add lines D E F. G H. Balance Due subtract line G from line C. Enter this amount on Line 6 of the SC4868. H SC4868 INSTRUCTIONS General Instructions Individual Income Tax return including a composite return for partnership or LLC. Line 5 Line 6 Enter the amount from line H from the Tax Computation Worksheet. This amount must be paid in full with SC4868. Sctax. org. Or file a paper form SC4868. Mail the original with payment if any. Keep two copies one copy should be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sc4868 2009 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc4868 2009 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sc4868 2009 form online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sc4868 2009 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

SC DoR SC4868 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sc4868 2009 form

How to fill out sc4868 2009 form?

01

First, gather all necessary information, including your personal details, such as your name, address, and social security number, as well as any relevant financial documentation, such as your income and deductions.

02

Next, carefully read the instructions provided with the sc4868 2009 form. It is crucial to familiarize yourself with the specific requirements and guidelines for completing the form accurately.

03

Fill in the appropriate sections of the form, providing all requested information and ensuring accuracy. Be sure to double-check your entries to avoid any errors that may lead to potential issues or delays.

04

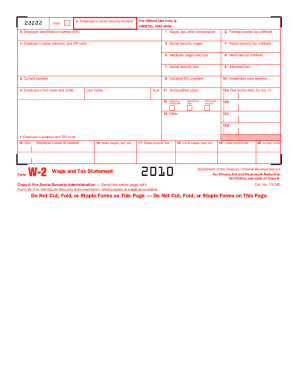

If applicable, attach any supporting documents that may be required, such as W-2 forms or other relevant schedules and statements.

05

Once you have completed the form and attached any necessary documents, review everything thoroughly. Look for any mistakes or omissions and make any necessary corrections before submitting the form.

06

Finally, sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge. Keep a copy of the completed form for your records.

Who needs sc4868 2009 form?

01

Individuals who are unable to file their federal income tax return by the original due date and who need additional time to complete their return.

02

Taxpayers who anticipate owing taxes but require extra time to gather the necessary financial information or make payment arrangements.

03

Those who have experienced extenuating circumstances that prevent them from filing their tax return on time, such as medical emergencies or natural disasters.

Instructions and Help about sc4868 2009 form

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sc4868 form?

The sc4868 form is a tax extension form for South Carolina state income taxes.

Who is required to file sc4868 form?

Any individual or business entity that needs more time to file their South Carolina state income tax return must file the sc4868 form.

How to fill out sc4868 form?

To fill out the sc4868 form, you will need to provide your personal and financial information, estimate your tax liability, and calculate any payments or refunds.

What is the purpose of sc4868 form?

The purpose of the sc4868 form is to request an extension of time to file your South Carolina state income tax return.

What information must be reported on sc4868 form?

The sc4868 form requires you to report your personal information, estimated tax liability, and any tax payments made.

When is the deadline to file sc4868 form in 2023?

The deadline to file the sc4868 form in 2023 is April 15th.

What is the penalty for the late filing of sc4868 form?

The penalty for the late filing of the sc4868 form is 5% of the unpaid tax liability per month, up to a maximum of 25%.

How can I modify sc4868 2009 form without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including sc4868 2009 form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in sc4868 2009 form?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your sc4868 2009 form to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for signing my sc4868 2009 form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your sc4868 2009 form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your sc4868 2009 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.