SC DoR SC4868 2021 free printable template

Show details

1350

STATE OF SOUTH CAROLINADEPARTMENT OF REVENUEREQUEST FOR EXTENSION OF TIME TO FILE

South Carolina Individual Income Tax Returner.SC.gov

Year2021 Or fiscal year beginning and endingSC4868

(Rev.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR SC4868

Edit your SC DoR SC4868 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC4868 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

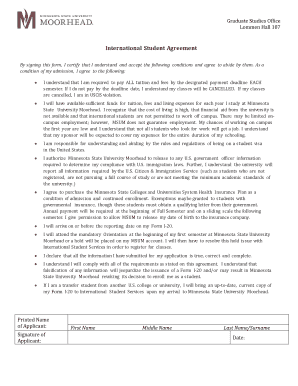

Editing SC DoR SC4868 online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC DoR SC4868. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC4868 Form Versions

Version

Form Popularity

Fillable & printabley

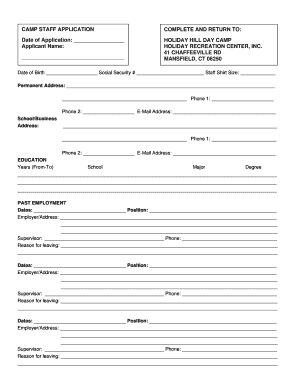

How to fill out SC DoR SC4868

How to fill out SC DoR SC4868

01

Obtain form SC DoR SC4868 from the relevant authority or website.

02

Provide your personal information, including your name, contact details, and tax identification number.

03

Indicate the reason for filing the SC DoR SC4868 in the designated section.

04

Fill out any financial information required, including income and deductions.

05

Make sure to review the form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed form by the specified deadline, either electronically or via mail.

Who needs SC DoR SC4868?

01

Individuals or businesses that require an extension for filing their tax returns.

02

Taxpayers who are unable to meet the regular tax filing deadlines.

03

Those who need additional time to gather financial documents or complete their tax calculations.

Fill

form

: Try Risk Free

People Also Ask about

Who must file a SC 1040?

ing to South Carolina Instructions for Form SC 1040, you must file a South Carolina income tax return if: You are a RESIDENT and: You filed a federal return with income that was taxable by South Carolina. You had South Carolina income taxes withheld from your wages.

Do you have to file a state tax return in South Carolina?

Do I need to file a South Carolina return? If you are a South Carolina resident, you are generally required to file a South Carolina Income Tax return if you are required to file a federal return.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

Is there a state tax form for South Carolina?

These 2021 forms and more are available: South Carolina Form 1040 – Personal Income Tax Return for Residents. South Carolina Schedule NR – Nonresident Schedule. South Carolina Form 1040/Schedule NR – Additions and Subtractions.

Does SC have a state tax withholding form?

Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

What is the SC 1040 form?

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

Where can I get my taxes done for free in South Carolina?

1040Now® offers free federal and free South Carolina Income Tax preparation and eFile of tax returns for taxpayers who meet the following requirements: Your AGI is $32,000 or less and. You live in South Carolina.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC DoR SC4868 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including SC DoR SC4868, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Where do I find SC DoR SC4868?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the SC DoR SC4868 in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an eSignature for the SC DoR SC4868 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your SC DoR SC4868 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

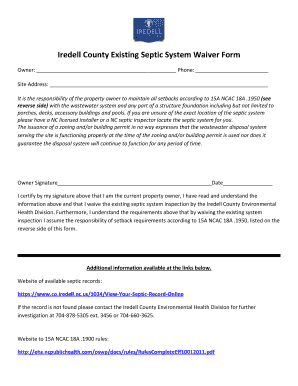

What is SC DoR SC4868?

SC DoR SC4868 is a tax form used in South Carolina to request an extension of time to file individual income tax returns.

Who is required to file SC DoR SC4868?

Taxpayers who are unable to file their South Carolina individual income tax return by the original due date may file SC DoR SC4868 to request an extension.

How to fill out SC DoR SC4868?

To fill out SC DoR SC4868, you must provide your name, address, Social Security number, estimated tax liability, and any payments made. Ensure you complete all required sections accurately.

What is the purpose of SC DoR SC4868?

The purpose of SC DoR SC4868 is to grant taxpayers an extension of time to file their individual income tax returns, allowing them additional time to prepare their taxes without incurring penalties.

What information must be reported on SC DoR SC4868?

The SC DoR SC4868 form requires the taxpayer's name, Social Security number, current address, estimated tax liability, and any previous payments made toward the tax obligation.

Fill out your SC DoR SC4868 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc4868 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.