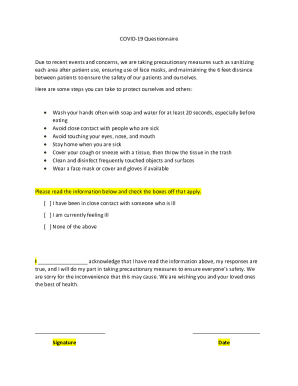

MD Comptroller 515 2020 free printable template

Show details

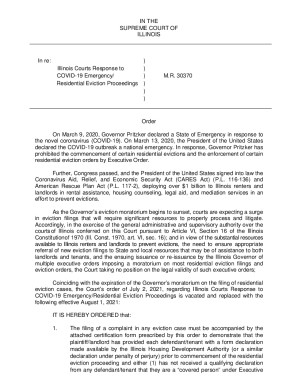

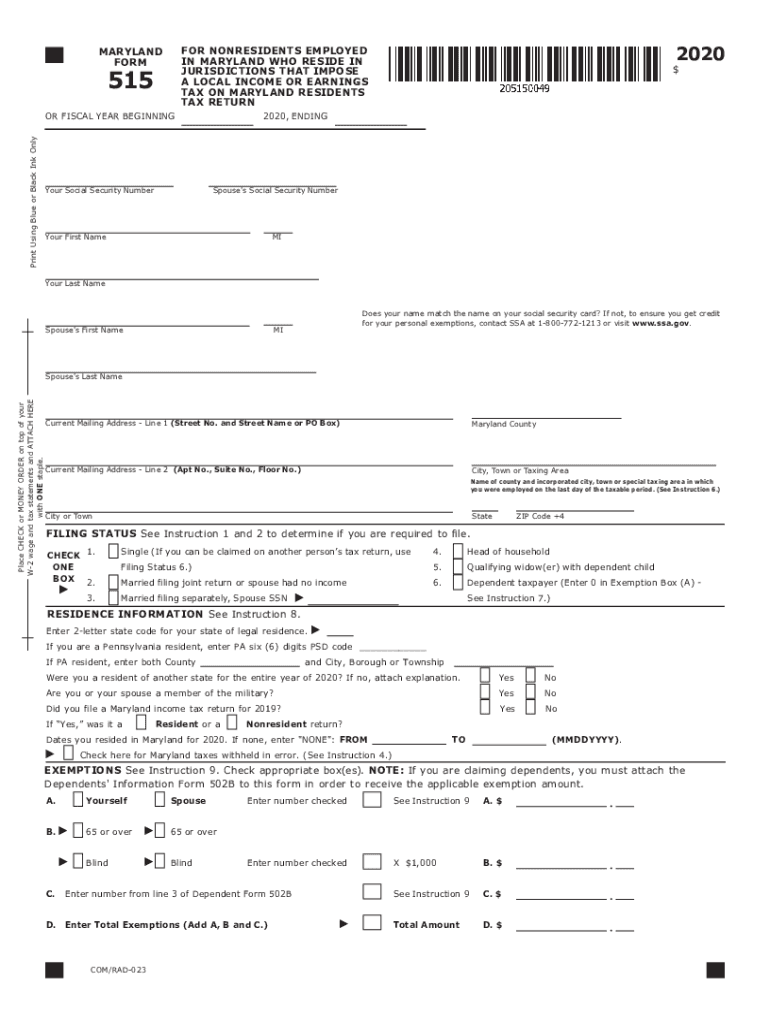

515OR FISCAL YEAR BEGINNINGPrint Using Blue or Black Ink Only2020FOR NONRESIDENTS EMPLOYED

IN MARYLAND WHO RESIDE IN

JURISDICTIONS THAT IMPOSE

A LOCAL INCOME OR EARNINGS

TAX ON MARYLAND RESIDENTS

TAX

pdfFiller is not affiliated with any government organization

Instructions and Help about MD Comptroller 515

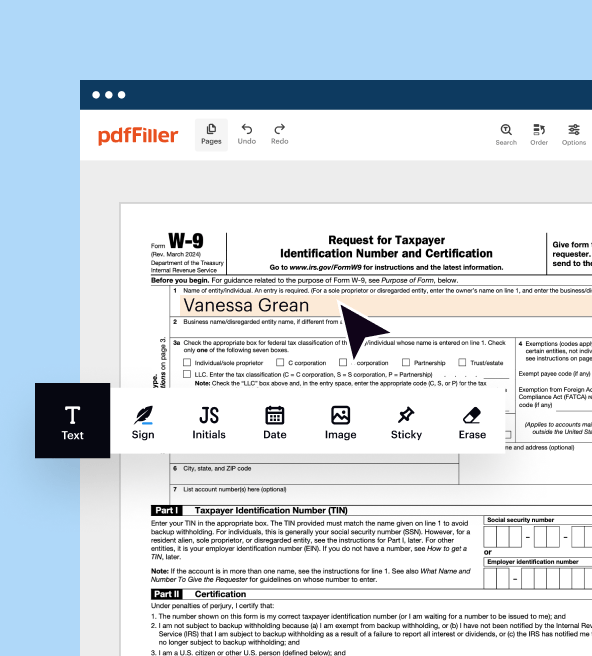

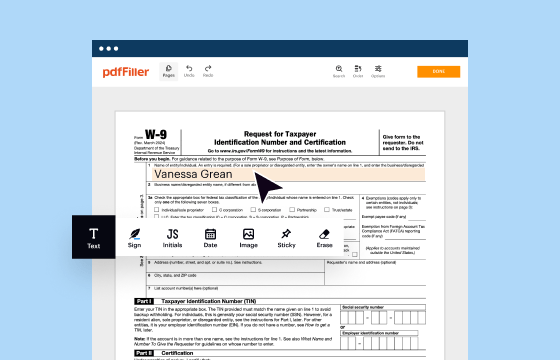

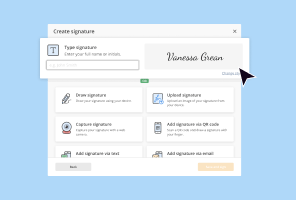

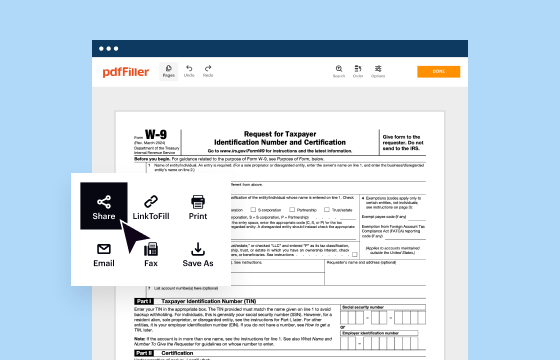

How to edit MD Comptroller 515

How to fill out MD Comptroller 515

Instructions and Help about MD Comptroller 515

How to edit MD Comptroller 515

To edit the MD Comptroller 515 tax form, download the form from an official source. Utilize pdfFiller to make necessary changes directly in the PDF. The platform allows you to add text, change fields, and adjust any requisite information efficiently.

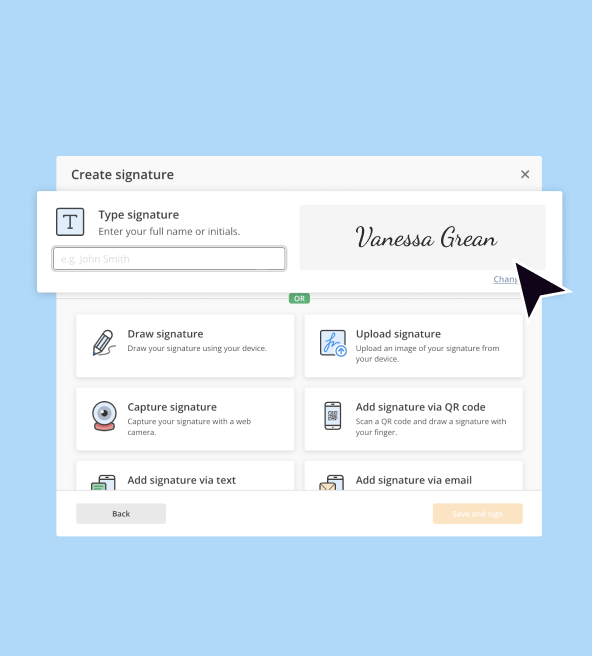

How to fill out MD Comptroller 515

When filling out the MD Comptroller 515, ensure that you gather all necessary information beforehand. The form typically requires accurate details regarding payments made, the recipients of those payments, and any relevant identification numbers. For proper completion, follow these steps:

01

Begin with your identifying information at the top of the form.

02

Provide details of payments made during the tax period.

03

List the names and addresses of all recipients.

04

Sign and date the form at the designated areas.

About MD Comptroller previous version

What is MD Comptroller 515?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MD Comptroller previous version

What is MD Comptroller 515?

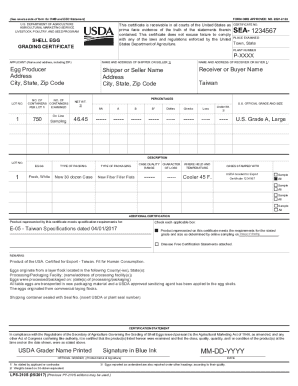

MD Comptroller 515 is a tax form used in Maryland to report payments made in the course of business. This form is crucial for compliance with state tax regulations and ensures accurate reporting of amounts paid to contractors or suppliers. It serves both federal and state tax purposes.

What is the purpose of this form?

The primary purpose of MD Comptroller 515 is to document various payments made to individuals or entities for services rendered. It assists in maintaining transparency and accountability for businesses operating in Maryland, ensuring both the payer and recipient fulfill their tax obligations.

Who needs the form?

Businesses that make payments to contractors, subcontractors, or any vendors during the tax year must complete MD Comptroller 515. This form is particularly relevant for those who engage in professional services, manufacturing, or any transactions where payments exceed the reporting threshold.

When am I exempt from filling out this form?

Exemptions from filing the MD Comptroller 515 may apply if all payments made are below the reporting threshold set by the Maryland Comptroller's office. Additionally, payments to specific types of entities, such as corporations or certain tax-exempt organizations, may not require a form submission.

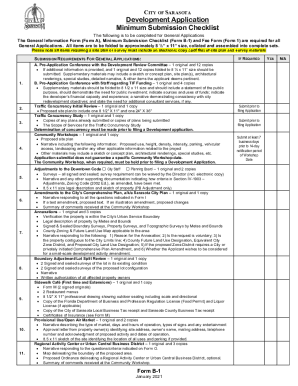

Components of the form

MD Comptroller 515 consists of several key components, including identification sections for both the payer and the payee, detailed payment information, and signature lines. Accurate completion of each section is vital for compliance and accurate processing by tax authorities.

What are the penalties for not issuing the form?

Failure to issue the MD Comptroller 515 can result in significant penalties imposed by the state. These penalties may include fines and interest on unpaid taxes, and could potentially lead to audits or further scrutiny of taxpayer records if discrepancies are found.

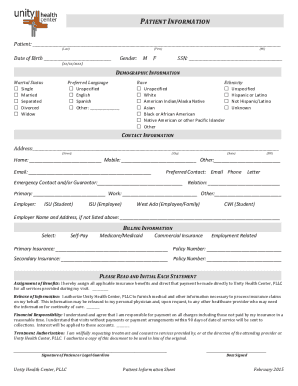

What information do you need when you file the form?

When completing the MD Comptroller 515, gather the following information:

01

The payer’s name, address, and Social Security Number or Employer Identification Number (EIN).

02

The payee’s name, address, and identification number.

03

Details about the payment, including amount and date.

Is the form accompanied by other forms?

MD Comptroller 515 may need to be submitted alongside other forms, depending on specific tax situations. Notably, businesses often also need to complete and submit forms such as 1099s if they are paying independent contractors or non-corporate entities for services rendered.

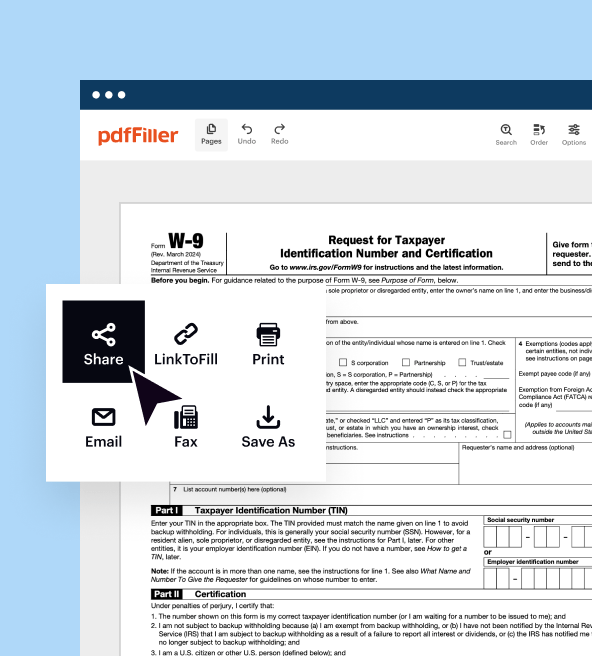

Where do I send the form?

Once completed, MD Comptroller 515 should be sent to the Maryland Comptroller's office. It is recommended to verify the most current mailing address by visiting their official website or contacting their office directly, as this information may change over time.

See what our users say