Get the free IRA to HSA TRANSFER FORM

Show details

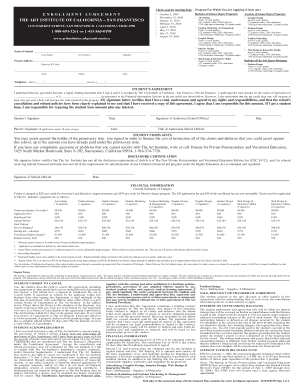

IRA to HSA TRANSFER FORM FDIC Insured Instructions: Mail or fax the completed form to Resource Bank, Fax# (985)892-9971 5100 Village Walk, Ste. 102 Street Address: Covington, LA 70433 City, State,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira to hsa transfer

Edit your ira to hsa transfer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira to hsa transfer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira to hsa transfer online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ira to hsa transfer. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira to hsa transfer

How to fill out ira to hsa transfer?

01

Gather necessary documents including your IRA account information, HSA account information, and any transfer forms provided by your HSA provider.

02

Contact your HSA provider to confirm their specific requirements for initiating the transfer and to obtain any additional forms or instructions.

03

Fill out the transfer forms accurately with your personal information, IRA account details, and HSA account details. Be sure to double-check all information for accuracy.

04

If required, include any supporting documentation such as a letter of instruction or a copy of your most recent IRA statement.

05

Review the completed forms thoroughly to ensure everything is filled out correctly and signed where necessary.

06

Submit the transfer forms and any additional documentation to your HSA provider by either mailing them or submitting them electronically, following their preferred method.

07

Keep copies of all submitted documents for your own records.

08

Monitor the progress of the transfer by contacting your HSA provider and IRA custodian periodically until the transfer is completed.

09

Once the transfer is complete, review your HSA account to ensure the funds have been successfully transferred and are available for use.

Who needs ira to hsa transfer?

01

Individuals who have both an Individual Retirement Account (IRA) and a Health Savings Account (HSA) may need to consider an IRA to HSA transfer.

02

Those who wish to utilize the tax advantages and flexibility offered by an HSA may decide to transfer funds from their IRA to their HSA.

03

Some people may prefer to use their HSA funds for medical expenses rather than relying solely on their retirement savings from the IRA.

04

Individuals who anticipate high medical expenses in the future may find it beneficial to transfer funds from their IRA to their HSA to build up a tax-advantaged pool of funds specifically for healthcare costs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ira to hsa transfer?

IRA to HSA transfer refers to the movement of funds from an Individual Retirement Account (IRA) to a Health Savings Account (HSA). This can be done to consolidate retirement savings or to use the funds for qualified medical expenses.

Who is required to file ira to hsa transfer?

Any individual who wants to transfer funds from their IRA to an HSA is required to initiate the transfer. However, it is important to consult with a tax advisor or financial professional for guidance specific to your situation.

How to fill out ira to hsa transfer?

To fill out an IRA to HSA transfer, you typically need to contact your IRA custodian or financial institution and complete the necessary forms or provide written instructions. The process and required documentation may vary depending on your specific IRA and HSA providers, so it's advisable to reach out to them for guidance.

What is the purpose of ira to hsa transfer?

The purpose of an IRA to HSA transfer can vary based on individual circumstances. Some common purposes include using the funds for qualified medical expenses, consolidating retirement savings, or taking advantage of potential tax benefits associated with HSAs.

What information must be reported on ira to hsa transfer?

The specific information that must be reported on an IRA to HSA transfer may vary depending on the regulations of the involved financial institutions. Generally, the transfer will require details such as account numbers, names, and transfer amounts. It's important to consult with your IRA and HSA providers for their specific reporting requirements.

How do I execute ira to hsa transfer online?

pdfFiller makes it easy to finish and sign ira to hsa transfer online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I edit ira to hsa transfer on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign ira to hsa transfer right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How can I fill out ira to hsa transfer on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your ira to hsa transfer from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your ira to hsa transfer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira To Hsa Transfer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.