IL LLC-50.1 2012 free printable template

Get, Create, Make and Sign IL LLC-501

How to edit IL LLC-501 online

Uncompromising security for your PDF editing and eSignature needs

IL LLC-50.1 Form Versions

How to fill out IL LLC-501

How to fill out IL LLC-50.1

Who needs IL LLC-50.1?

Instructions and Help about IL LLC-501

Your state will require you to file an annual report in order to keep your LLC in compliance, your contact information updated, and your LLC in good standing. Fees and due dates vary by the state. Once your LLC is formed, paperwork with the state is not over. As a part of the ongoing requirements for your LLC, your state requires that you file an annual report and pay a filing fee. The annual report can take many names, such as the annual report, annual statement, statement of information, periodic report, biennial statement, decennial report, and many more, and not all annual reports are annual. Some may be required to file every year, some every two years, and some may be lucky enough to only have to file every ten years. It just depends on your state and their requirements. Since most states refer to the report as the 'annual report,' we'll do so as well, just for simplicity. The purpose of the annual report is to keep your LLC in compliance and in good standing. Additionally, it keeps the state updated with your LLC's contact information. If you fail to file your annual report, the state will automatically dissolve or shut down your LLC. Your annual report will include your LLC name, your office address, your registered agent information, and an LLC number from your Secretary of State. The LLC number is just a number that your state uses to reference and identify your LLC. How do you file and pay your annual report? Generally, there are two ways you can file your annual report with your state: You can file it by mail, or you can file it online. If you file by mail, you will fill out your annual report on your computer, or fill it out by hand. Next, you'll make a copy for your business records, and then mail the original to the state, along with a check or money order to pay the filing fee. If you file online, you'll prepare and submit your annual report on the state's website and pay the filing fee with a debit or credit card. Regardless of what option you choose, it's important that you file your annual report on time. Most states will send you a reminder to pay and file your annual report prior to the deadline, but not all of them do that. For this reason, we recommend that you keep a repeating reminder on your calendar. What are the consequences for not filing your annual report? If you don't file your annual report on time, the state will charge you a late fee. If you continue to ignore this requirement, the state will automatically dissolve and shut down your LLC. Some states are stricter than others, so it's best not to push your luck here. Where do you get your annual report? If you have formed an LLC, but are not sure how to get your annual report from the state, you can visit your state's website and contact them for guidance. The links to the various states' websites can be found on our website. If you hired a company to form your LLC, then you need to verify whether they will file it on your behalf, and charge you to do so, or if...

People Also Ask about

Does Illinois require an annual report?

How much is the late fee for the secretary of state annual report in Illinois?

Do I need to file an annual report for my LLC in Illinois?

What is corporate annual report Illinois?

How much is Illinois corporate annual report?

How much is annual report for LLC in Illinois?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IL LLC-501 straight from my smartphone?

Can I edit IL LLC-501 on an iOS device?

How do I complete IL LLC-501 on an iOS device?

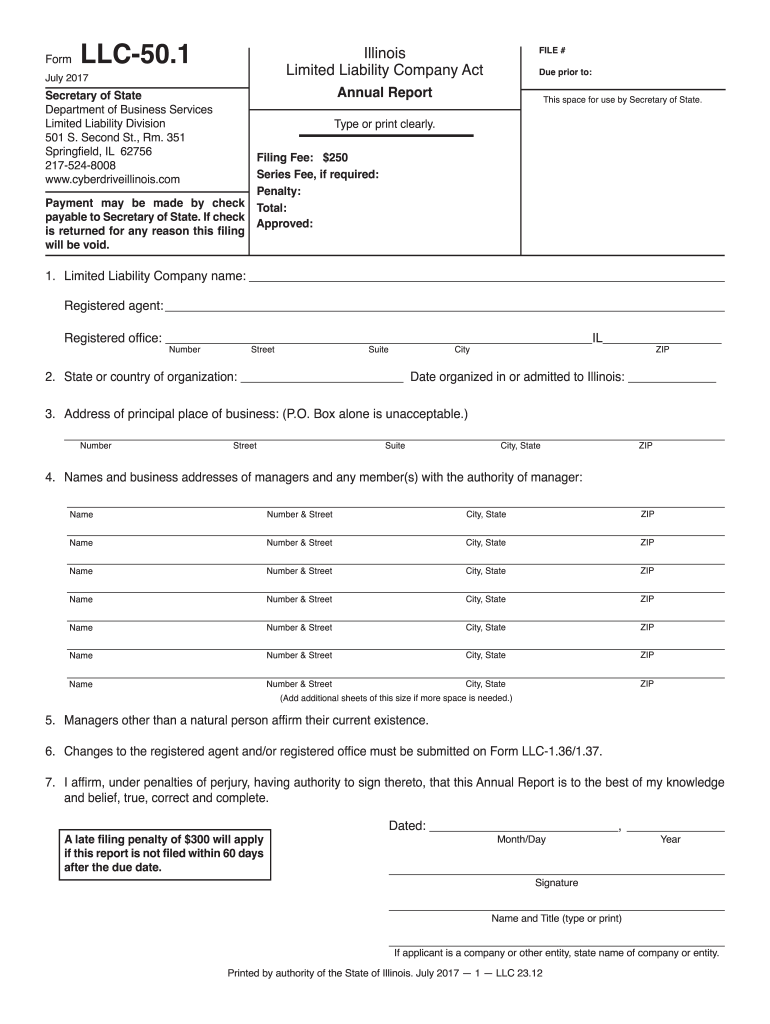

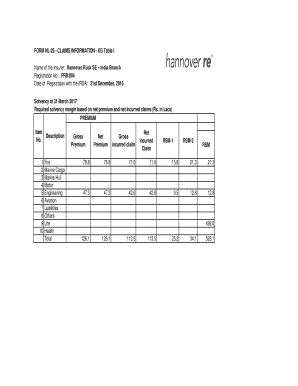

What is IL LLC-50.1?

Who is required to file IL LLC-50.1?

How to fill out IL LLC-50.1?

What is the purpose of IL LLC-50.1?

What information must be reported on IL LLC-50.1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.