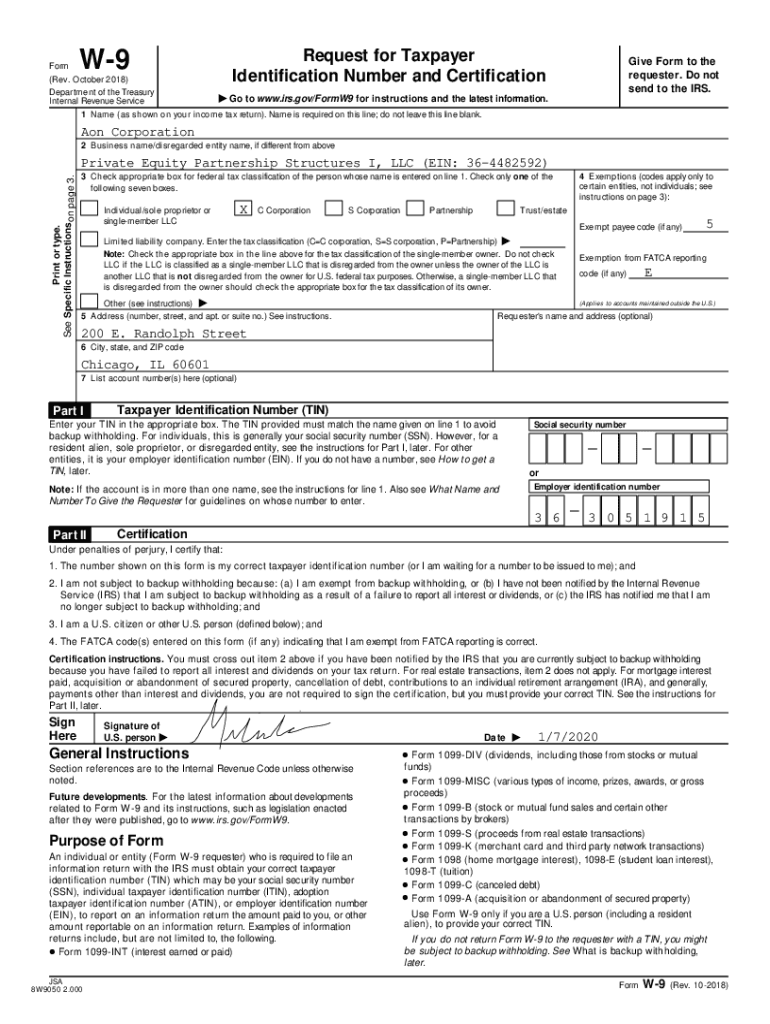

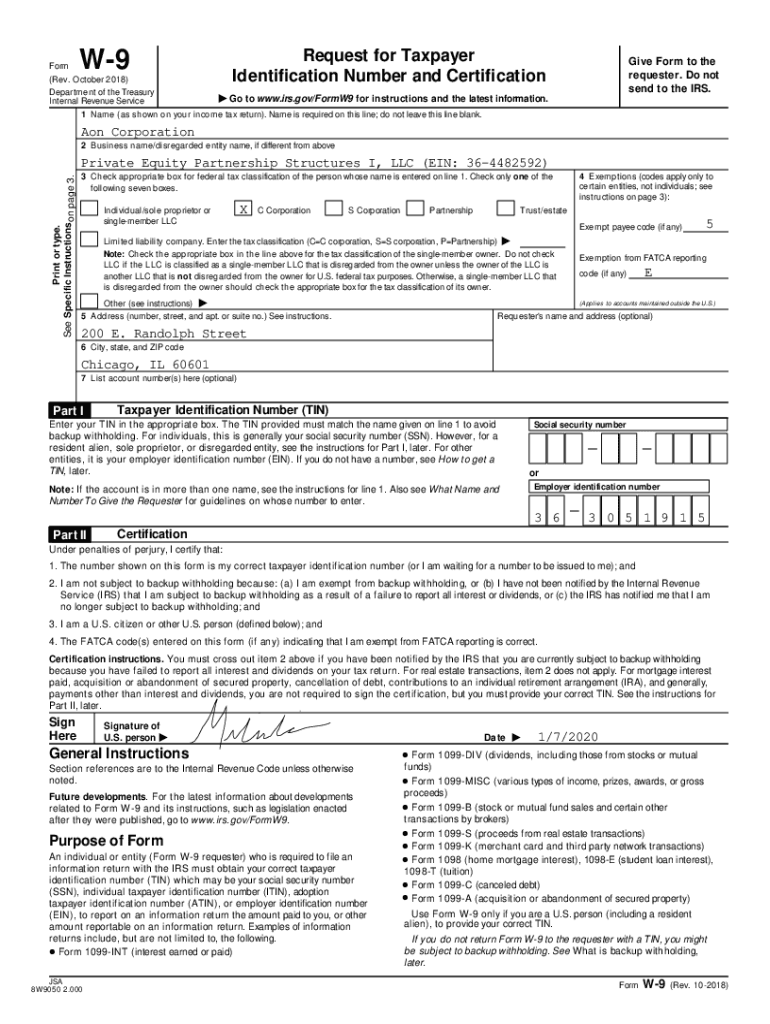

Get the free Private Equity Partnership Structures I, LLC (EIN: 36-4482592)

Show details

FormW9(Rev. October 2018)

Department of the Treasury

Internal Revenue ServiceIRequest for Taxpayer

Identification Number and CertificationGive Form to the

requester. Do not

send to the IRS. Go to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign private equity partnership structures

Edit your private equity partnership structures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private equity partnership structures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit private equity partnership structures online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit private equity partnership structures. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out private equity partnership structures

How to fill out private equity partnership structures

01

Determine the type of partnership structure you wish to establish, such as general partnership, limited partnership, or limited liability partnership.

02

Draft and review the partnership agreement, which lays out the terms and conditions of the partnership, including capital contributions, profit-sharing, decision-making processes, and dispute resolution.

03

Identify and secure potential limited partners, who are passive investors that provide capital to the partnership but do not participate in the day-to-day operations or management.

04

Ensure compliance with relevant regulations and laws governing private equity partnerships, such as securities laws, tax regulations, and licensing requirements.

05

Establish an investment strategy and criteria for selecting and evaluating potential investment opportunities.

06

Raise capital from limited partners by pitching the partnership's investment strategy and potential returns on investment.

07

Evaluate and conduct due diligence on potential investment opportunities to assess their financial performance, market potential, and alignment with the partnership's investment objectives.

08

Negotiate and structure investment deals, including determining the amount of equity to acquire, the terms of the investment, and any potential exit strategies.

09

Monitor and manage the portfolio of investments, including providing strategic guidance, financial oversight, and support to portfolio companies.

10

Regularly communicate and report to limited partners on the performance of the partnership, including financial statements, capital account statements, and investment updates.

11

Handle any conflicts or disputes among partners, which may require mediation, arbitration, or litigation depending on the terms outlined in the partnership agreement.

12

Consider exit opportunities for the partnership's investments, such as selling to strategic buyers, conducting initial public offerings, or merging with other companies.

13

Dissolve the partnership if necessary, following the procedures outlined in the partnership agreement, including distributing remaining assets to partners and settling any outstanding obligations.

Who needs private equity partnership structures?

01

High-net-worth individuals who are looking to invest large sums of capital in privately-held companies or alternative asset classes.

02

Institutional investors, such as pension funds, endowments, and insurance companies, that seek to diversify their investment portfolios and generate higher returns.

03

Entrepreneurs or corporations who are seeking capital to finance their growth, expansion, or acquisitions.

04

Fund managers or investment firms that specialize in private equity and aim to generate attractive returns for their investors.

05

Companies or projects that require significant capital injections to support their operations, research and development, or strategic initiatives.

06

Startup companies or early-stage ventures that lack access to traditional sources of financing and can benefit from the expertise and network of private equity partners.

07

Distressed or underperforming companies that need financial restructuring, operational improvements, or strategic guidance to turn around their businesses.

08

Partnerships and joint ventures between multiple parties who pool their resources and expertise to pursue investment opportunities together.

09

Individuals or entities looking to participate in the potential financial upside of private equity investments while limiting their downside risk through limited liability structures.

10

Investors seeking access to alternative asset classes, such as real estate, infrastructure, natural resources, or venture capital, which can offer diversification and higher returns compared to traditional investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify private equity partnership structures without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your private equity partnership structures into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the private equity partnership structures electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your private equity partnership structures in minutes.

How do I edit private equity partnership structures straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing private equity partnership structures.

What is private equity partnership structures?

Private equity partnership structures refer to the organizational frameworks used by private equity firms to raise and manage funds through partnerships. These structures typically consist of a general partner (GP) who manages the fund and limited partners (LPs) who invest capital but have limited liability.

Who is required to file private equity partnership structures?

Private equity firms that operate as partnerships and have taxable income or meet certain thresholds of revenue or assets are required to file private equity partnership structures.

How to fill out private equity partnership structures?

Filling out private equity partnership structures typically involves completing the necessary forms that detail income, deductions, and distributions, along with financial statements and schedules that provide information about the partnership's operations.

What is the purpose of private equity partnership structures?

The purpose of private equity partnership structures is to facilitate investment from multiple partners, manage pooled resources effectively, and provide a framework for allocating profits, losses, and tax responsibilities among partners.

What information must be reported on private equity partnership structures?

Information that must be reported includes income, expenses, distributions to partners, ownership percentages, and any applicable deductions or credits related to the partnership's activities.

Fill out your private equity partnership structures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Equity Partnership Structures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.