CO DoR 104 2020 free printable template

Show details

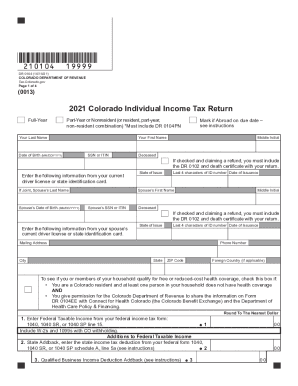

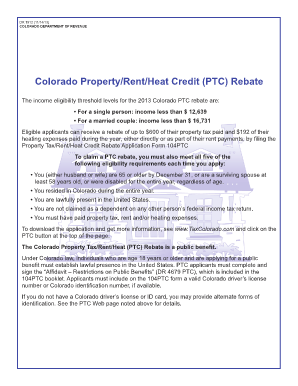

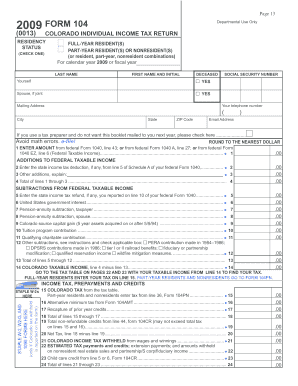

Additions to Federal Taxable Income 2. State Addback enter the state income tax deduction from your federal form 1040 schedule A line 5a see instructions 3. Other Additions explain see instructions Explain Name 4. Subtotal sum of lines 1 through 3 5. Subtractions from the DR 0104AD Schedule line 18 you must submit the DR 0104AD schedule with your return. 6. Colorado Taxable Income subtract line 5 from line 4 Tax Prepayments and Credits full-year residents use DR 0104CR and part-year and...nonresidents use DR 0104PN 7. 180104 19999 DR 0104 09/17/18 COLORADO DEPARTMENT OF REVENUE Colorado. gov/Tax 2018 Colorado Individual Income Tax Return Full-Year Part-Year or Nonresident or resident part-year non-resident combination Must attach DR 0104PN Your Last Name Date of Birth MM/DD/YYYY Your First Name SSN Enter the following information from your current driver license or state identification card. If Joint Spouse s Last Name Spouse s Date of Birth MM/DD/YYYY Mark if Abroad on due date ...see instructions Deceased State of Issue Middle Initial If checked and claiming a refund you must submit the DR 0102 with your return* Last 4 characters of ID number Date of Issuance Spouse s First Name Spouse s SSN current driver license or state identification card. Mailing Address City Phone Number State Zip Code Foreign Country if applicable Round To The Next Dollar 1. Enter Federal Taxable Income from your federal income tax form 1040 line 10 1 Attach W-2s and 1099s with CO withholding...here. Additions to Federal Taxable Income 2. State Addback enter the state income tax deduction from your federal form 1040 schedule A line 5a see instructions 3. Other Additions explain see instructions Explain Name 4. Subtotal sum of lines 1 through 3 5. Subtractions from the DR 0104AD Schedule line 18 you must submit the DR 0104AD schedule with your return* 6. Colorado Taxable Income subtract line 5 from line 4 Tax Prepayments and Credits full-year residents use DR 0104CR and part-year and...nonresidents use DR 0104PN 7. Colorado Tax from tax table or the DR 0104PN line 36 you must submit the DR 0104PN with your return if applicable. 8. Alternative Minimum Tax from the DR 0104AMT you must submit the DR 0104AMT with your return* 9. Recapture of prior year credits 11. Nonrefundable Credits from the DR 0104CR line 39 the sum of lines 11 and 12 cannot exceed line 10 you must submit the DR 0104CR with your return* 12. Total Nonrefundable Enterprise Zone credits used as calculated or...from the DR 1366 line 87 the sum of lines 11 and 12 cannot exceed line 10 you must submit the DR 1366 with your return* 13. Net Income Tax sum of lines 11 and 12. Subtract that sum from line 10. 13 14. Use Tax reported on the DR 0104US schedule line 7 you must submit 15. Net Colorado Tax sum of lines 13 and 14 15 16. CO Income Tax Withheld from W-2s and 1099s you must submit the W-2s and/or 1099s claiming Colorado withholding with your return* 17. Prior-year Estimated Tax Carryforward 18....Estimated Tax Payments enter the sum of the quarterly payments remitted for this tax year 19.

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104

How to edit CO DoR 104

How to fill out CO DoR 104

Instructions and Help about CO DoR 104

How to edit CO DoR 104

To edit the CO DoR 104 tax form, utilize a PDF editor such as pdfFiller. With pdfFiller, you can easily modify text, add signatures, and make necessary updates to ensure the accuracy of your form. Once you have made your edits, save the changes before submitting the form.

How to fill out CO DoR 104

To fill out the CO DoR 104 tax form, follow these steps:

01

Obtain the form from the Colorado Department of Revenue's website or via pdfFiller.

02

Enter your personal information, including your name, address, and Social Security number.

03

Provide details regarding your income and any deductions applicable to your situation.

04

Review your entries for accuracy before submission.

About CO DoR previous version

What is CO DoR 104?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR previous version

What is CO DoR 104?

CO DoR 104 is the Colorado individual income tax form used by residents to file their state tax returns. This form is essential for reporting income earned, calculating taxes owed, and determining any potential refunds. The information provided in CO DoR 104 helps Colorado’s Department of Revenue assess taxpayer obligations accurately.

What is the purpose of this form?

The purpose of the CO DoR 104 is to facilitate state income tax reporting for individual taxpayers in Colorado. It allows individuals to report their financial activities, including wages, interest, and dividends, while also claiming credits and deductions. Proper completion of this form is vital for compliance with Colorado tax laws.

Who needs the form?

Any individual who earns income while residing in Colorado must complete the CO DoR 104 form. This includes full-time residents, part-time residents, and those who have generated income from Colorado sources. Additionally, those claiming a refund or owing taxes must file this form.

When am I exempt from filling out this form?

Individuals may be exempt from filing the CO DoR 104 form if their total income is below the state’s filing threshold, which can vary based on age and filing status. Those who have no Colorado-source income and are not subject to Colorado taxes may also be exempt from filing.

Components of the form

The CO DoR 104 form comprises various sections that require taxpayers to input their identifying information, report income, and claim deductions and credits. Key components include personal identification details, income sections, and a signature area, which must all be accurately filled out to avoid processing delays.

What are the penalties for not issuing the form?

Failure to submit CO DoR 104 can result in significant penalties, including late filing fees and interest on any unpaid taxes. The Colorado Department of Revenue may impose additional fines for intentional disregard of tax laws. To avoid these penalties, ensure that the form is completed and submitted on time.

What information do you need when you file the form?

When filing the CO DoR 104 form, you will need several key pieces of information. This includes your Social Security number, any W-2 forms from employment, 1099 forms for other income, and records of any deductions or credits you intend to claim. Having this information on hand can expedite the filing process.

Is the form accompanied by other forms?

Typically, the CO DoR 104 form may require the inclusion of various supporting documents, such as W-2 forms or Schedules related to specific deductions. Taxpayers should verify if additional forms are necessary based on their individual tax situations.

Where do I send the form?

The completed CO DoR 104 form should be mailed to the Colorado Department of Revenue at the address specified in the instructions provided with the form. Taxpayers can submit the form via standard mail or electronically if using approved e-filing methods.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

PDF filler works better than the pdf…

PDF filler works better than the pdf editor app that is installed on my computer with Microsoft and Windows 11. I haven't tried all the features available yet, but so far I like the program.

Its simple to use

process worked well

Everything I need

I am enjoying the wide array of features and the ease of use.

Loved it then we had a storm and I lost it off my computer! Glad I found you again!

See what our users say