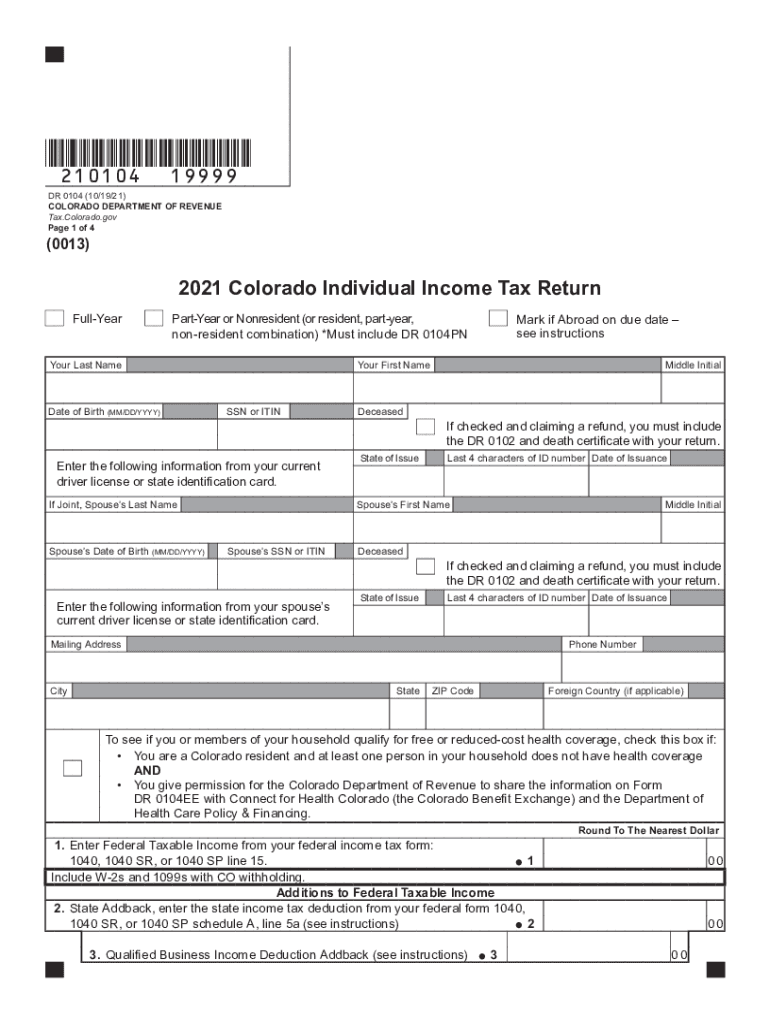

Who needs a Form 104?

This form is completed by taxpayers in Colorado who filed an income tax return with the Colorado Department of Revenue. The IRS uses this form to find out if you have the right to get a refund.

What is the Form 104 for?

The Colorado Individual Income Tax Return provides the information needed by the IRS to determine if you are entitled to a tax refund. This form should be submitted together with the federal income tax return.

Is the Form 104 accompanied by other forms?

This form is supported by tax form 1040.

When is the Form 104 due?

This form must be filed by the 18th of April.

What information should be provided in the Form 104?

The taxpayer has to add the following information to the form:

- Status of residency (full-year resident of Colorado; part-year resident; abroad resident)

- Name, date of birth, SSN and some information from the taxpayer’s driving license

- Name, date of birth, SSN of the taxpayer’s spouse (if joint)

- Mailing address

- Phone number

- Foreign country

- Federal taxable income from form 1040

- Information about the additions (state add back and other)

- Information about the subtractions (government interest, state income tax refund, pension, and annuity subtraction, spouse pension and annuity subtraction, etc.)

- Tax, prepayments, and credits

- Voluntary contribution

- Amount of the refund (see instructions for calculating)

- Taxpayer’s account number

- Amount the taxpayer owns (net tax due, delinquent payment penalty, delinquent payment interest, estimated tax penalty)

The taxpayer and taxpayer’s spouse have to sign and date the form as well.

If the form is completed by the paid preparer, his/her name and address also should be printed.

What do I do with the form after its completion?

The completed and signed form is filed with the Colorado Department of Revenue.