PA RCT-101-I 2020 free printable template

Show details

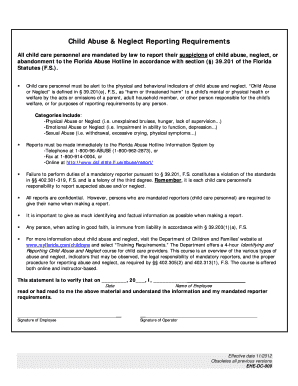

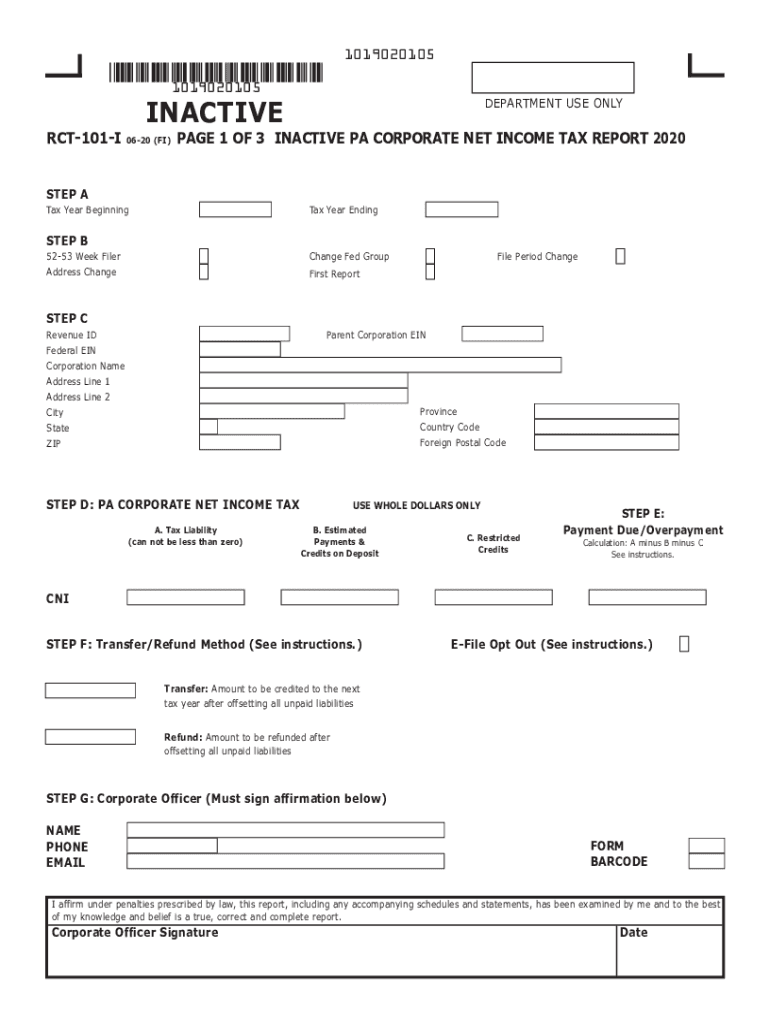

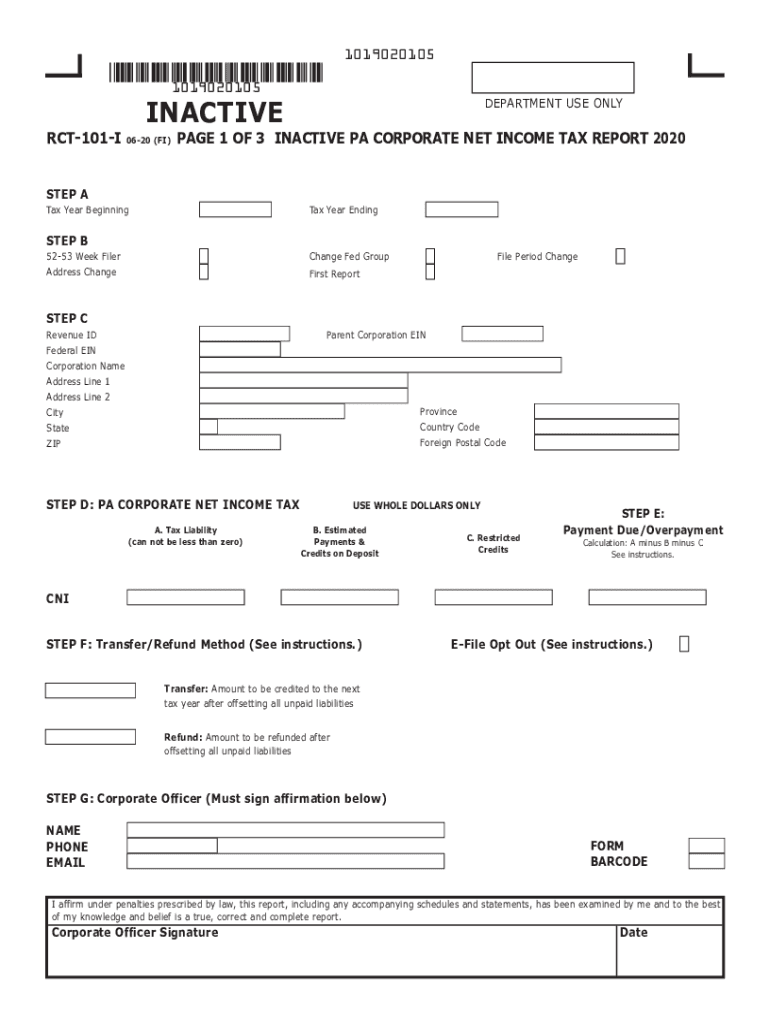

FILL IN FORM USING ALL CAPS.DO NOT USE DASHES () OR SLASHES (/) IN ANY FIELD. ENTER DATES AS MMDDYYYY. USE WHOLE DOLLARS ONLY.

1019020105

1019020105RCT101iSTARTinaCTive

0620 (FI)DEPARTMENT USE ONLY

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA RCT-101-I

Edit your PA RCT-101-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA RCT-101-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA RCT-101-I online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA RCT-101-I. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA RCT-101-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA RCT-101-I

How to fill out PA RCT-101-I

01

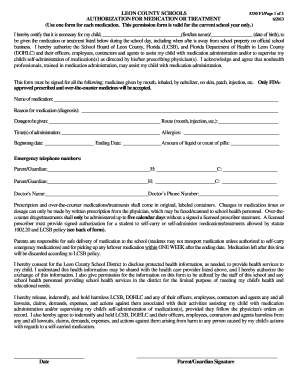

Obtain the PA RCT-101-I form from the Pennsylvania Department of Revenue website or your local tax office.

02

Fill in your business name and address at the top of the form.

03

Enter your Pennsylvania corporation tax account number if applicable.

04

Select the appropriate tax period for which you are filing the form.

05

Provide the necessary financial information as requested, such as gross receipts and deductions.

06

Calculate the tax due based on the amounts reported in the previous step.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form to validate your submission.

09

Submit the form to the appropriate Pennsylvania Department of Revenue office either by mail or online.

Who needs PA RCT-101-I?

01

Businesses operating in Pennsylvania that are liable for corporation taxes.

02

Corporations and limited liability companies (LLCs) filing for corporate tax obligations in Pennsylvania.

03

Any entity that has gross receipts from business activities in Pennsylvania.

Fill

form

: Try Risk Free

People Also Ask about

Do LLCS have to file an annual report in PA?

The deadline for limited liability company annual filings (domestic and foreign) is September 30, and the annual report of any other domestic filing entity or foreign filing association is due December 31 of each year.

How do I dissolve a business in PA?

To dissolve your corporation in Pennsylvania, you provide the completed Articles of Dissolution-Domestic (DSCB: 15-1977/5877) form to the Department of State, Corporation Bureau, by mail or in person. You may fax file if you have a customer deposit account with the Bureau.

Do I need to file an annual report for my LLC Pennsylvania?

Unlike most states, Pennsylvania does not require LLCs to file an annual report. However, Professional Limited Liability Companies (PLLCs) and foreign LLCs engaged in professional services must file a Certificate of Annual Registration (Form DSCB:15-8221/8998) with the Department of State.

Do you have to renew your LLC every year in PA?

This form and the corresponding annual registration fee must be filed on or before April 15 of the following year. Failure to file the annual registration will result in additional fees, penalties and interest.

Who must file PA Form RCT 101?

When filing an RCT-101, PA Corporate Net Income Tax Report, all corporate taxpayers are required to include forms and schedules to support the calculation of the tax liability. The type of information required depends on how the entity reports income to the IRS.

How do I make my LLC inactive in PA?

To dissolve your domestic LLC in Pennsylvania, you must provide the completed Certificate of Dissolution, Domestic Limited Liability Company (DCSB: 15-8975/8978) form to the Department of State by mail, in person, or online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit PA RCT-101-I from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your PA RCT-101-I into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send PA RCT-101-I to be eSigned by others?

When you're ready to share your PA RCT-101-I, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit PA RCT-101-I on an iOS device?

Create, edit, and share PA RCT-101-I from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is PA RCT-101-I?

PA RCT-101-I is a tax form used in Pennsylvania for reporting revenue and expenses related to the tax obligations of corporations and entities operating within the state.

Who is required to file PA RCT-101-I?

Any corporation or entity that has a taxable presence in Pennsylvania or is subject to the Corporate Net Income Tax is required to file PA RCT-101-I.

How to fill out PA RCT-101-I?

To fill out PA RCT-101-I, taxpayers must provide details such as the entity's identification information, revenue and expense figures, and any applicable tax credits. Instructions are available on the Pennsylvania Department of Revenue's website.

What is the purpose of PA RCT-101-I?

The purpose of PA RCT-101-I is to report and assess the tax liability of corporations operating in Pennsylvania, ensuring compliance with state tax laws.

What information must be reported on PA RCT-101-I?

Information required on PA RCT-101-I includes the corporation's name, address, federal employer identification number, total revenue, total deductions, and any applicable adjustments or credits.

Fill out your PA RCT-101-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA RCT-101-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.