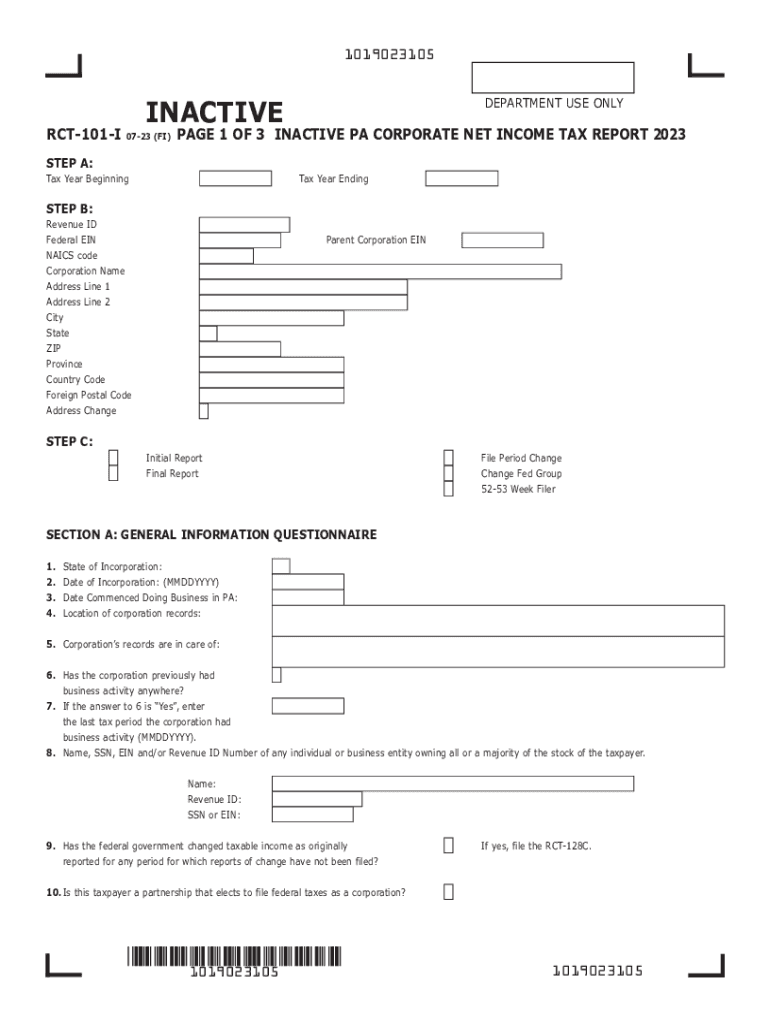

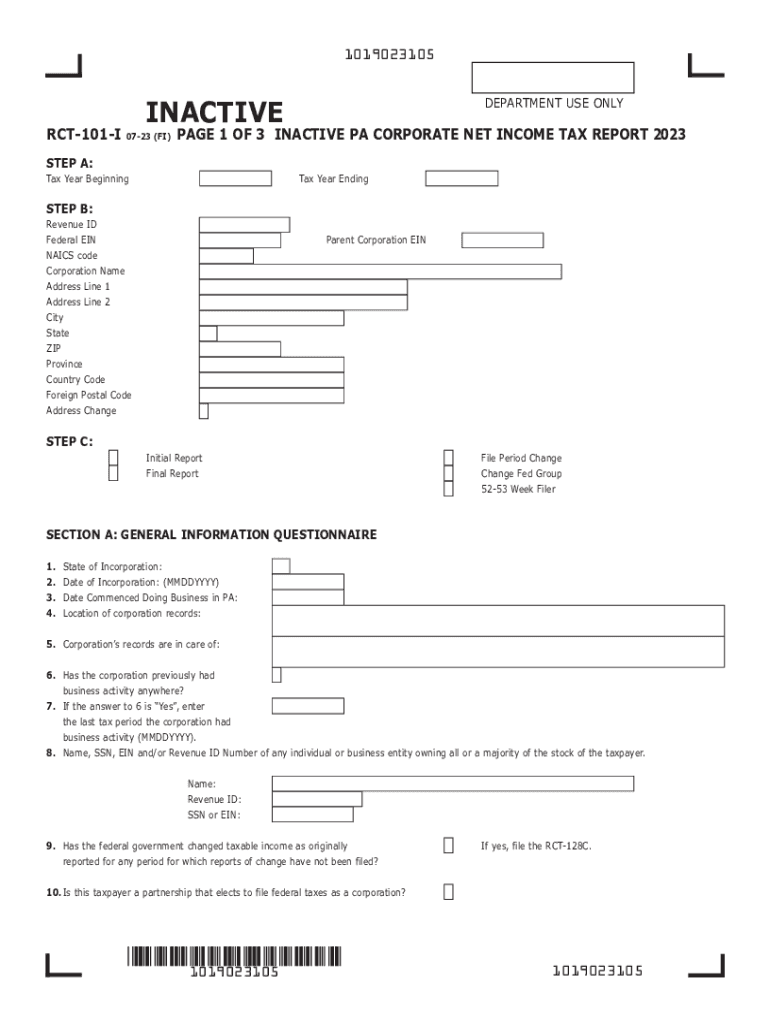

PA RCT-101-I 2023 free printable template

Get, Create, Make and Sign rct 101 instructions 2023 form

How to edit rct 101 form online

Uncompromising security for your PDF editing and eSignature needs

PA RCT-101-I Form Versions

How to fill out rct 101 instructions form

How to fill out PA RCT-101-I

Who needs PA RCT-101-I?

Video instructions and help with filling out and completing pa rct 101 i

Instructions and Help about rct 101 instructions

How to form an LLC in Pennsylvania is an excellent place to form a new LLC boasting the 6th largest economy in the country with a high business survival rate and great access to venture capital Every state has slightly different requirements for forming an LLC Follow along closely to learn the required steps for creating your own Limited Liability Company in the state of Pennsylvania There are two ways to form an LLC in Pennsylvania You can form one yourself, or you can hire a service to do it for you Option 1 Do it Yourself Lets start by looking at the five basic requirements to form an LLC in Pennsylvania on your own One Name your LLC You'll need to choose a company name that complies with Pennsylvania naming requirements and do a name search on the State of Pennsylvania website to make sure the name isn't already taken You should go ahead and register the URL for your business website and email as well Two Choose a Registered Office You are required to submit the address of your registered office for your Pennsylvania LLC A registered office is the official mailing address for all legal mail from the state related to your business Your registered office must be a street address not a PO Box within the state of Pennsylvania Your registered office can also be the address of a commercial registered office provider more commonly known as a registered agent service Three File the Certificate of Organization To register your Pennsylvania LLC you will need to file the Certificate of Organization with the State of Pennsylvania This can be done online or by mail You should decide whether your LLC will bemember-managed or manager-managed Member-managed means all members of the LLC manage the company This is good for small organizations where everyone is involved in day-to-day operations The second option is manager-managed where individuals are appointed to manage the LLC This is appropriate for larger organizations where not everyone is involved in the day-to-day affairs of the business Four Create an Operating Agreement You should also create an operating agreement to establish ownership terms member roles and operating procedures This legal document ensures that all business owners are on the same page and reduces the risk of future conflict A comprehensive operating agreement will further establish your LLC as a separate legal entity however it does not need to be filed with the state Five Obtain an EIN Lastly you'll need to get an Employer IdentificationNumber or EIN from the IRS Also known as a Federal Tax IdentificationNumber your EIN is like a social security number for your LLC and is important for taxes and banking Wins are free of charge and can be obtained from the IRS online or through the mail And with that you will have formed a Pennsylvania LLC on your own Option 2 Hire a Professional Service The second way to create a Pennsylvania LLC is to hire a professional service to create your LLC for you Hiring a professional service to file...

People Also Ask about rct 101 i form

Do LLCS have to file an annual report in PA?

How do I dissolve a business in PA?

Do I need to file an annual report for my LLC Pennsylvania?

Do you have to renew your LLC every year in PA?

Who must file PA Form RCT 101?

How do I make my LLC inactive in PA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the pa form rct 101 instructions in Chrome?

How do I fill out the rct 101 i form on my smartphone?

How do I complete pennsylvania inactive on an iOS device?

What is PA RCT-101-I?

Who is required to file PA RCT-101-I?

How to fill out PA RCT-101-I?

What is the purpose of PA RCT-101-I?

What information must be reported on PA RCT-101-I?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.