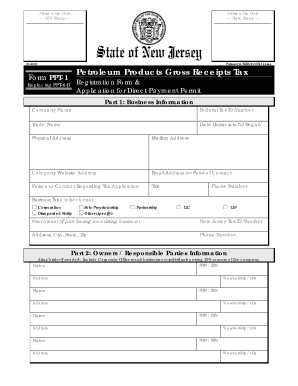

NJ PPT-1 (Formerly PPT-6-B) 1998 free printable template

Show details

PPT-6-B (11-98) Application Required by NJ Motor Fuel Tax Law STATE OF NEW JERSEY DIVISION OF TAXATION PETROLEUM PRODUCTS GROSS RECEIPTS TAX PO BOX 189 TRENTON, NEW JERSEY 08695-0189 APPLICATION FOR

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ PPT-1 Formerly PPT-6-B

Edit your NJ PPT-1 Formerly PPT-6-B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ PPT-1 Formerly PPT-6-B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NJ PPT-1 Formerly PPT-6-B online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NJ PPT-1 Formerly PPT-6-B. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ PPT-1 (Formerly PPT-6-B) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ PPT-1 Formerly PPT-6-B

How to fill out NJ PPT-1 (Formerly PPT-6-B)

01

Obtain the NJ PPT-1 form from the New Jersey Division of Taxation website or your local tax office.

02

Fill in your name, address, and contact information at the top of the form.

03

Provide details about the property, including its location and description.

04

Indicate the type of property by checking the appropriate box.

05

Enter the assessed value of the property as indicated on your tax bill.

06

Specify any applicable exemptions or deductions that you are claiming.

07

Attach any supporting documentation required for your claims.

08

Review the completed form for accuracy and completeness.

09

Sign and date the form before submitting it to the appropriate tax authority.

Who needs NJ PPT-1 (Formerly PPT-6-B)?

01

Property owners in New Jersey who are claiming a property tax exemption or appeal.

02

Individuals seeking to adjust property assessments for tax purposes.

03

Homeowners eligible for specific programs related to property tax relief.

Fill

form

: Try Risk Free

People Also Ask about

How do I verify my resale certificate in New Jersey?

You may validate any certificate that is issued by the Division and that contains a validation number under the printed seal of the State of New Jersey. For validation of a Certificate of Authority you will need to use the Document Locator Number.

What is NJ Petroleum Gross Receipts Tax?

The gross receipts and dollar consideration of all other petroleum products should be reflected in the “RECEIPTS / CONSIDERATION” Column. This will be taxed at the rate of 2-3/4%.

How do I get a resale certificate in NJ?

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).

How do I get a NJ Sales Tax ID number?

File Form NJ-REG (Business Registration Application) to register with the state to collect/remit New Jersey taxes such as sales tax or employee withholdings, and to obtain a New Jersey tax identification number. You can register online or file a paper application.

How do I get a copy of my NJ sales tax certificate?

To request a copy of a filed tax return, submit a request to the Division of Taxation. This optional service, which provides processing within 8.5 business hours is available for these requests received in person, by FAX or by courier service. All FAX requests are considered to be requests for expedited service.

What is a NJ resale certificate?

Resale Certificate Resale Certificates allow your business to purchase items for resale without paying Sales Tax. Sales Tax should only be collected when the items are sold at retail. Registered businesses can obtain the resale certificate online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NJ PPT-1 Formerly PPT-6-B in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your NJ PPT-1 Formerly PPT-6-B, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out NJ PPT-1 Formerly PPT-6-B using my mobile device?

Use the pdfFiller mobile app to complete and sign NJ PPT-1 Formerly PPT-6-B on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete NJ PPT-1 Formerly PPT-6-B on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your NJ PPT-1 Formerly PPT-6-B, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is NJ PPT-1 (Formerly PPT-6-B)?

NJ PPT-1 is a form used to report personal property taxation in New Jersey. It is a declaration form for businesses and it helps municipalities assess the value of business personal property.

Who is required to file NJ PPT-1 (Formerly PPT-6-B)?

All businesses in New Jersey that own personal property with a total value exceeding $5,000 are required to file NJ PPT-1.

How to fill out NJ PPT-1 (Formerly PPT-6-B)?

To fill out NJ PPT-1, businesses must include details about their assets, such as the type of property, location, and its value. The form must be signed and submitted to the appropriate local tax authority by the designated deadline.

What is the purpose of NJ PPT-1 (Formerly PPT-6-B)?

The purpose of NJ PPT-1 is to accurately report and assess the taxable value of personal property owned by businesses, ensuring that appropriate property taxes are levied.

What information must be reported on NJ PPT-1 (Formerly PPT-6-B)?

The information that must be reported on NJ PPT-1 includes the list of personal property items, their descriptions, locations, and the total value of each item.

Fill out your NJ PPT-1 Formerly PPT-6-B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ PPT-1 Formerly PPT-6-B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.