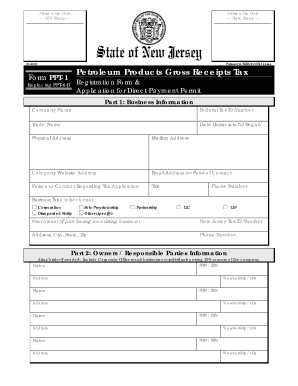

NJ PPT-1 (Formerly PPT-6-B) 1999 free printable template

Show details

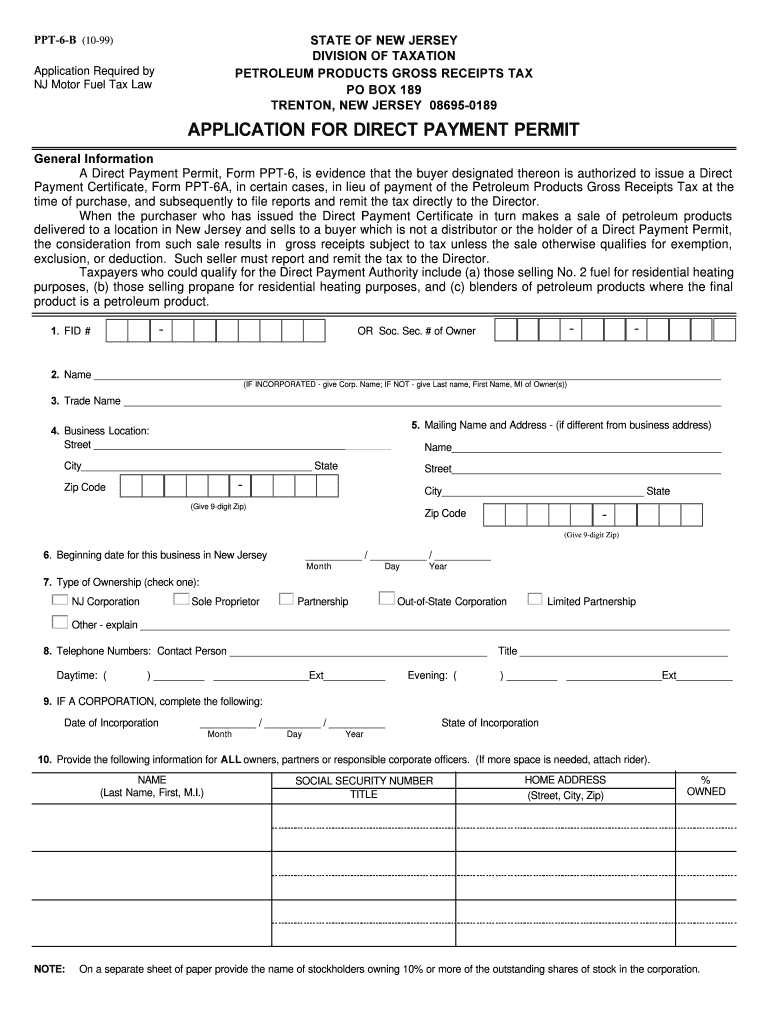

PPT-6-B (10-99) STATE OF NEW JERSEY DIVISION OF TAXATION PETROLEUM PRODUCTS GROSS RECEIPTS TAX PO BOX 189 TRENTON, NEW JERSEY 08695-0189 Application Required by NJ Motor Fuel Tax Law APPLICATION FOR

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NJ PPT-1 Formerly PPT-6-B

Edit your NJ PPT-1 Formerly PPT-6-B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NJ PPT-1 Formerly PPT-6-B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NJ PPT-1 (Formerly PPT-6-B) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NJ PPT-1 Formerly PPT-6-B

How to fill out NJ PPT-1 (Formerly PPT-6-B)

01

Obtain the NJ PPT-1 form from the New Jersey Division of Taxation website or your local tax office.

02

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Provide details about the personal property you are reporting, including descriptions, acquisition dates, and values.

04

List any exemptions you believe you qualify for and provide the necessary documentation to support your claims.

05

Review the completed form for accuracy and ensure all required information is provided.

06

Sign and date the form to certify that the information provided is true and accurate.

07

Submit the completed form to the appropriate local tax authority by the specified deadline.

Who needs NJ PPT-1 (Formerly PPT-6-B)?

01

Individuals and businesses in New Jersey who own personal property that is subject to taxation.

02

Those claiming exemptions for certain types of personal property, such as agricultural or industrial equipment.

03

People who are required to report their personal property for tax assessment purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I verify my resale certificate in New Jersey?

You may validate any certificate that is issued by the Division and that contains a validation number under the printed seal of the State of New Jersey. For validation of a Certificate of Authority you will need to use the Document Locator Number.

What is NJ Petroleum Gross Receipts Tax?

The gross receipts and dollar consideration of all other petroleum products should be reflected in the “RECEIPTS / CONSIDERATION” Column. This will be taxed at the rate of 2-3/4%.

How do I get a resale certificate in NJ?

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).

How do I get a NJ Sales Tax ID number?

File Form NJ-REG (Business Registration Application) to register with the state to collect/remit New Jersey taxes such as sales tax or employee withholdings, and to obtain a New Jersey tax identification number. You can register online or file a paper application.

How do I get a copy of my NJ sales tax certificate?

To request a copy of a filed tax return, submit a request to the Division of Taxation. This optional service, which provides processing within 8.5 business hours is available for these requests received in person, by FAX or by courier service. All FAX requests are considered to be requests for expedited service.

What is a NJ resale certificate?

Resale Certificate Resale Certificates allow your business to purchase items for resale without paying Sales Tax. Sales Tax should only be collected when the items are sold at retail. Registered businesses can obtain the resale certificate online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NJ PPT-1 (Formerly PPT-6-B)?

NJ PPT-1 (Formerly PPT-6-B) is a tax form used in New Jersey for reporting personal property for tax assessment purposes.

Who is required to file NJ PPT-1 (Formerly PPT-6-B)?

Entities and individuals who own personal property that is subject to taxation in New Jersey are required to file NJ PPT-1.

How to fill out NJ PPT-1 (Formerly PPT-6-B)?

To fill out NJ PPT-1, provide details about the personal property, including its type, value, and location, following the instructions provided with the form.

What is the purpose of NJ PPT-1 (Formerly PPT-6-B)?

The purpose of NJ PPT-1 is to report personal property to the appropriate taxing authority so that it can be assessed for property taxes.

What information must be reported on NJ PPT-1 (Formerly PPT-6-B)?

Information that must be reported includes the owner's name and address, a description of the personal property, its location, and the estimated value of the property.

Fill out your NJ PPT-1 Formerly PPT-6-B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NJ PPT-1 Formerly PPT-6-B is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.