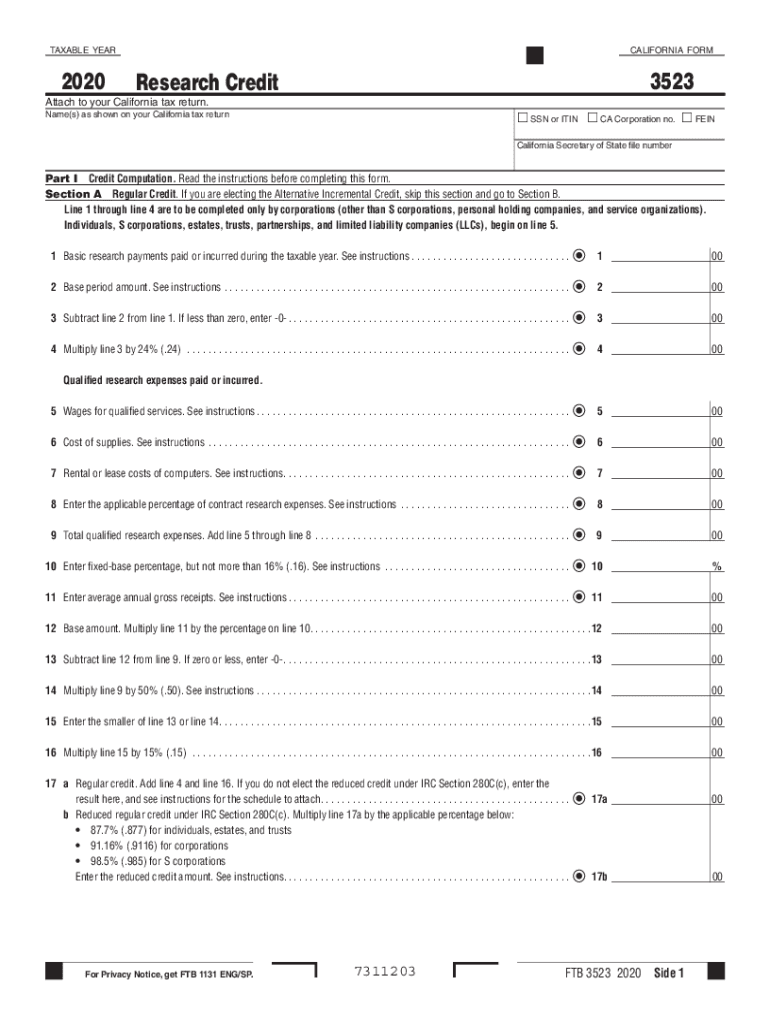

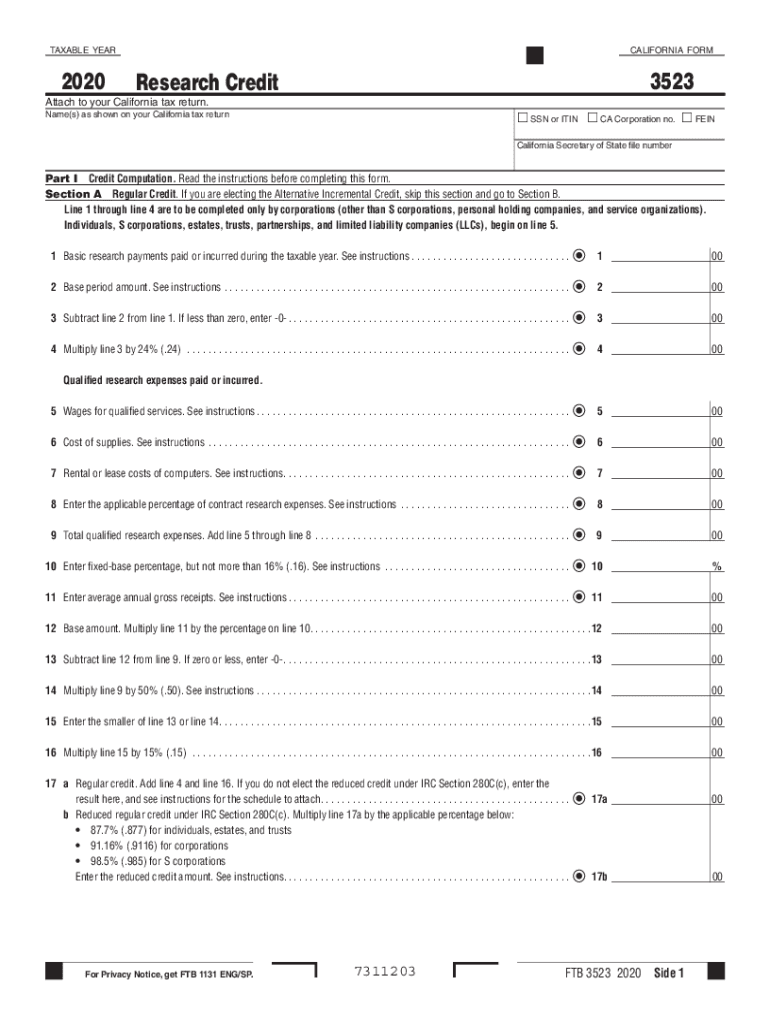

CA FTB 3523 2020 free printable template

Get, Create, Make and Sign form 3523

Editing form 3523 online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 3523 Form Versions

How to fill out form 3523

How to fill out CA FTB 3523

Who needs CA FTB 3523?

Instructions and Help about form 3523

Welcome everyone, and thank you for joining our webinar today will be sharing important information with you regarding New York States paid family leave we have a full agenda today for you well start by reviewing how paid frame the leaf helps employees and employers and well give an overview of the benefit will cover how your employees apply for paid family leave in your role in the process well discuss what your responsibilities are as an employer well review some frequently asked questions about paid family leave and other leave policies and well highlight resources available to you so lets get started why do we need paid family leave for too long employees have struggled to maintain the jobs when they needed a care for a loved one during a specific time of need whether that was welcoming a new baby caring for a sick family member or dealing with family pressures when a loved one is deployed abroad an active military service these pressures can affect job performance and spill over into the workplace research shows that paid leave increases the likelihood that employees will return to work which increases retention and ultimately lowers costs for you as their employer, so New York took action Governor Cuomo will work to develop the strongest and most comprehensive paid family leave in the nation in an April 2016 paid family leave was signed into law paid family leave is employee funded insurance that will help employees be there for the family when they're most needed across New York no longer have to choose between caring for the loved ones and the jobs because we now have employee paid insurance to help in these critical times as employers paid family leave gives you a predictable and defined structure for the time off your employees take to handle their family situations paid family leave is insurance which is fully covered by employee contributions collected through a small weekly payroll deduction as of January 1st 2018 paid family leave provides job protected paid time off to employees who need time away from the job sue bond with a newly born adopted or foster child care for a family member with a serious health condition or assist loved ones of my family member is deployed abroad on active military service lets take a closer look at these three uses of paid family leave well start with bonding with a child paid family leave provides both parents time to bond with a new child within the first 12 months of the birth adoption or foster placement of the child this includes children born adopted or fostered in 2017 as long as the leave is taken within the first 12 months of the birth adoption or foster placement parents who work for different employers can take paid family leave at the same time to bond with the same child parents who work for the same employer and want to take paid family leave at the same time to care for the same family member must have their employees approval first otherwise they can take leave separately over the...

People Also Ask about

Who qualifies for California research credit?

What is Form 3523?

What is the California state tax credit for R&D?

What is Form 3523 2019 CA?

How do I claim my R&D tax credit?

What is the research credit limitation in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 3523 to be eSigned by others?

How can I edit form 3523 on a smartphone?

How do I edit form 3523 on an iOS device?

What is CA FTB 3523?

Who is required to file CA FTB 3523?

How to fill out CA FTB 3523?

What is the purpose of CA FTB 3523?

What information must be reported on CA FTB 3523?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.