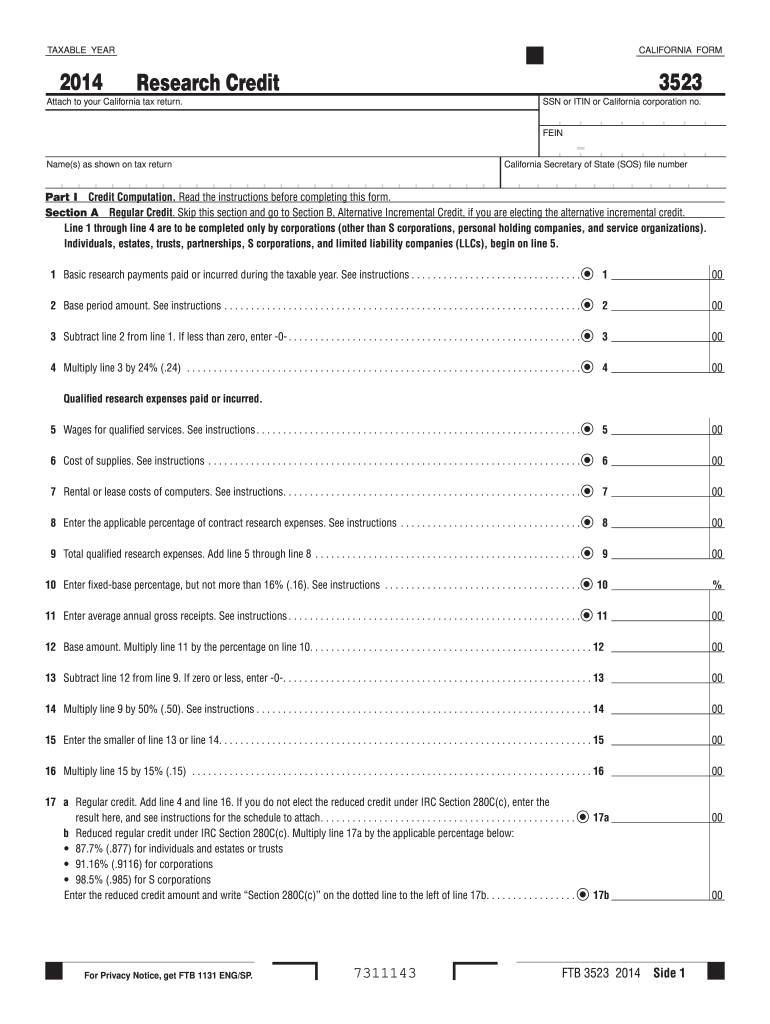

CA FTB 3523 2014 free printable template

Get, Create, Make and Sign 3523 2014 form

How to edit 3523 2014 form online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 3523 Form Versions

How to fill out 3523 2014 form

How to fill out CA FTB 3523

Who needs CA FTB 3523?

Instructions and Help about 3523 2014 form

Good morning. Today we are joined with Barry Gilbert CPA, EA. He’s a former FT AuditAnandnd we really want to get some insights into how the Franchise Tax Board works and how they work with taxpayers. This is really about giving our audience an insider’s view of the Franchise Tax Board and a few concerns or things to worry about. Barry, thank you for joining me today; I wanted to start a little, if you could explain why you became an accountant and give us some guidance on it. Hi Lee, thank you very much for having me I appreciate it. I enjoy being an accountant, I love helping people and that’s why I went to work for the Franchise Tax Board in the first place. I stayed there for 30 years, I enjoyed the public service and I like working with numbers and helping people. If you like working with numbers it would be a good industry to be in. What led you then to a career in the Franchise Tax Board, and then I guess a follow-up question to that would be what made you decide to get into private practice? I have always been curious about taxes since I started working. I thought this would be a good fit for me being that I like numbers and like to help people, and I was interested in taxes. I stayed with the Franchise Tax Board; I worked there for 30 years. Furthermore, I went from Collections to Audit, where I spent most of my years as a tax auditor. My last five years with the Franchise Tax Board was in the Public Affairs office, I was a Public Affairs spokesperson in Southern California. That’s great insight. Let’s start here for our audience and give a difference between what is it like between an IRS action versus a Franchise Tax Board? We hear you should be very afraid of California, but just give California taxpayers a general understanding of what are the main differences in how they operate? Franchise Tax Board in some cases can be just as difficult to deal with as the Internal Revenue Service. In many cases Franchise Tax Board, while they handle the same issues, income tax and franchise tax for businesses, they are quicker sometimes in getting to the taxpayer. They’re very automated as far as their collection activities; they specialize in certain audit areas that are different from the IRS, such as resident and non-resident audits. They have jurisdiction over LLC which the IRS doesn't’t recognize the LLC, so it’s a state issue. Also, with corporations there are differences, there’s non-conformity between federal and California in many tax areas, so that creates some issues for California. We’ve heard a lot in the media lately of the different IRS phone scams and identity theft and the different fraud, is the Franchise Tax Board experiencing some of the same issues right now? I think the Franchise Tax Board does have similar identity theft issues as what’s going on with the IRS. The first thing for most people to know, most taxpayers to know is that both the IRS and the Franchise Tax Board will contact you by mail via correspondence for any...

People Also Ask about

Who qualifies for California research credit?

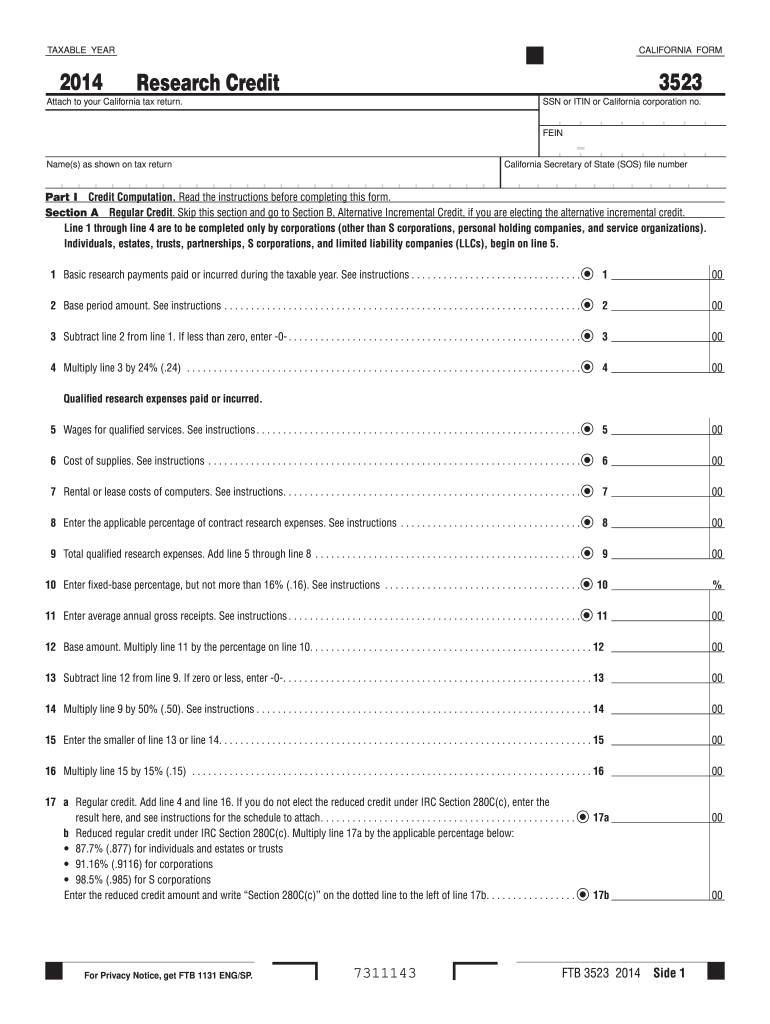

What is Form 3523?

What is the California state tax credit for R&D?

What is Form 3523 2019 CA?

How do I claim my R&D tax credit?

What is the research credit limitation in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 3523 2014 form?

How do I complete 3523 2014 form online?

How do I fill out the 3523 2014 form form on my smartphone?

What is CA FTB 3523?

Who is required to file CA FTB 3523?

How to fill out CA FTB 3523?

What is the purpose of CA FTB 3523?

What information must be reported on CA FTB 3523?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.