ME REW-3 2021 free printable template

Show details

FORM REW-3 MAINE REVENUE SERVICES Income/Estate Tax Division - REW P. O. Box 1064 Augusta ME 04332-1064 Tel. 207-626-8473 Fax 207-624-5062 RESIDENCY AFFIDAVIT OF ENTITY TRANSFEROR 36 M. R*S* 5250-A provides that a buyer transferee of real property located in Maine must withhold tax if the seller transferor is not as of the date of transfer a resident of the State of Maine. To inform the buyer that withholding of tax is not required upon the disposition of State of Maine property interest the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ME REW-3

Edit your ME REW-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ME REW-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

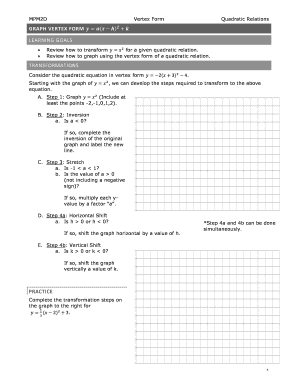

How to edit ME REW-3 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ME REW-3. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME REW-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME REW-3

How to fill out ME REW-3

01

Obtain the ME REW-3 form from the appropriate tax authority website or office.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Provide the details of your income earned in the tax year for which you are filing.

04

Complete any relevant sections regarding deductions or credits you are claiming.

05

Review the instructions for any additional information that may be required specific to your situation.

06

Sign and date the form at the bottom.

07

Submit the completed form by the required deadline either electronically or via mail.

Who needs ME REW-3?

01

Individuals who have earned income within the jurisdiction covered by the ME REW-3 form.

02

Taxpayers seeking to claim certain deductions or tax credits associated with their income.

03

Anyone required to report their income to the tax authority for the tax year.

Fill

form

: Try Risk Free

People Also Ask about

Who must file 2663?

Married couples who are nonresident transferors/sellers, and who transfer or sell their interest in New York State real property, may file one Form IT-2663 and use one check or money order. The term married includes a marriage between same-sex spouses.

Who is exempt from transfer tax in Maine?

The federal government and the State of Maine, and their instrumentalities, agencies, and subdivisions are exempt from the real estate transfer tax, both as grantor and grantee.

Do I have to file a NY nonresident return?

ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction. You want to claim a refund for any New York State, New York City, or Yonkers taxes that were withheld from your pay.

Do non residents have to pay NYC tax?

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

How much does a deed transfer cost in Maine?

The rate of tax is $2.20 for each $500 or fractional part of $500 of the value of the property being transferred. The tax is imposed ½ on the grantor, ½ on the grantee.

What is the REW tax in Maine?

The buyer of the property will withhold and remit the Real Estate Withholding money to Maine Revenue Services using form REW-1. The amount to be withheld is equal to 2.5% of the sale price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ME REW-3 from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ME REW-3 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit ME REW-3 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your ME REW-3, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit ME REW-3 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign ME REW-3 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is ME REW-3?

ME REW-3 is a form used in the state of Maine for reporting real estate withholding for non-resident sellers.

Who is required to file ME REW-3?

Sellers of real estate in Maine who are not residents of the state are required to file ME REW-3.

How to fill out ME REW-3?

To fill out ME REW-3, provide details such as the seller's information, the property address, the sale price, and the amount withheld for tax purposes. Ensure all information is accurate and complete.

What is the purpose of ME REW-3?

The purpose of ME REW-3 is to ensure that state taxes are collected on the gains from the sale of property by non-resident sellers.

What information must be reported on ME REW-3?

ME REW-3 must include the seller's name, address, the buyer's name and address, property address, sale price, and the amount of tax withheld.

Fill out your ME REW-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME REW-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.