ME REW-3 2023 free printable template

Show details

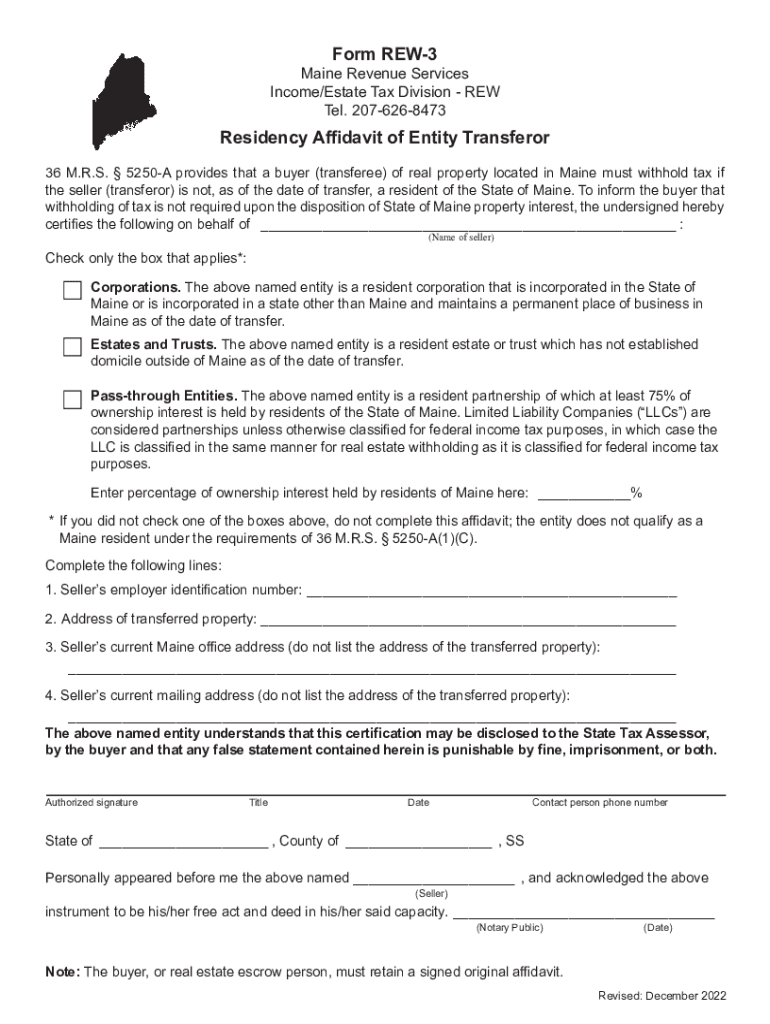

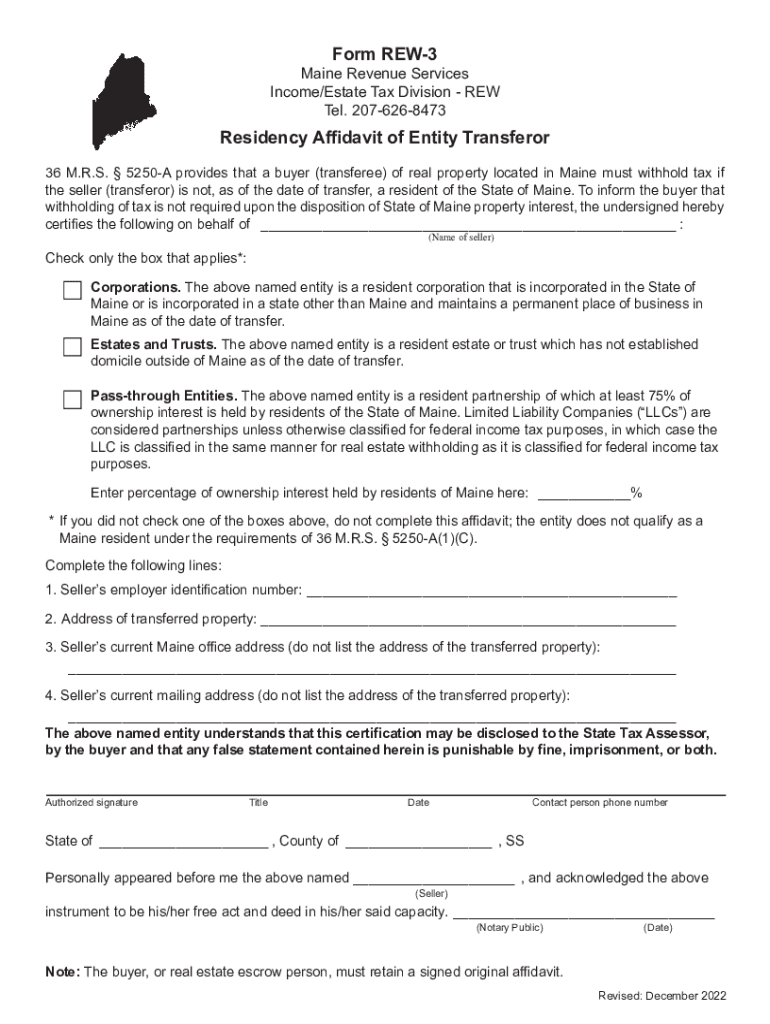

ClearPrintForm REW3Maine Revenue Services Income/Estate Tax Division NEW Tel. 2076268473Residency Affidavit of Entity Transferor 36 M.R.S. 5250A provides that a buyer (transferee) of real property

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ME REW-3

Edit your ME REW-3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ME REW-3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ME REW-3 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ME REW-3. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ME REW-3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ME REW-3

How to fill out ME REW-3

01

Obtain the ME REW-3 form from the Michigan Department of Treasury website or local tax office.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Provide details about your income sources and any deductions you are claiming.

04

Complete the sections regarding your property tax information.

05

Review the completed form for any errors or omissions.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the form by the required deadline either online or via mail.

Who needs ME REW-3?

01

Individuals and businesses in Michigan who are filing for property tax exemptions or seeking to claim certain deductions.

02

Homeowners looking to adjust their real estate withholdings in relation to property taxes.

Fill

form

: Try Risk Free

People Also Ask about

Who must file 2663?

Married couples who are nonresident transferors/sellers, and who transfer or sell their interest in New York State real property, may file one Form IT-2663 and use one check or money order. The term married includes a marriage between same-sex spouses.

Who is exempt from transfer tax in Maine?

The federal government and the State of Maine, and their instrumentalities, agencies, and subdivisions are exempt from the real estate transfer tax, both as grantor and grantee.

Do I have to file a NY nonresident return?

ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction. You want to claim a refund for any New York State, New York City, or Yonkers taxes that were withheld from your pay.

Do non residents have to pay NYC tax?

All city residents' income, no matter where it is earned, is subject to New York City personal income tax. Nonresidents of New York City are not liable for New York City personal income tax.

How much does a deed transfer cost in Maine?

The rate of tax is $2.20 for each $500 or fractional part of $500 of the value of the property being transferred. The tax is imposed ½ on the grantor, ½ on the grantee.

What is the REW tax in Maine?

The buyer of the property will withhold and remit the Real Estate Withholding money to Maine Revenue Services using form REW-1. The amount to be withheld is equal to 2.5% of the sale price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ME REW-3 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like ME REW-3, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete ME REW-3 online?

Completing and signing ME REW-3 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an electronic signature for the ME REW-3 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ME REW-3 in seconds.

What is ME REW-3?

ME REW-3 is a form used for reporting and documenting the wage and employment information of employees in the state of Maine.

Who is required to file ME REW-3?

Employers in Maine who have employees and are required to report wage information to the state must file ME REW-3.

How to fill out ME REW-3?

To fill out ME REW-3, employers should enter the total wages paid, the number of employees, and any other required information as specified in the instructions provided with the form.

What is the purpose of ME REW-3?

The purpose of ME REW-3 is to collect information on wages paid by employers to ensure compliance with tax and employment regulations in Maine.

What information must be reported on ME REW-3?

The information that must be reported on ME REW-3 includes the total wages paid to employees, the total number of employees, and any required identification information for the employer.

Fill out your ME REW-3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ME REW-3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.