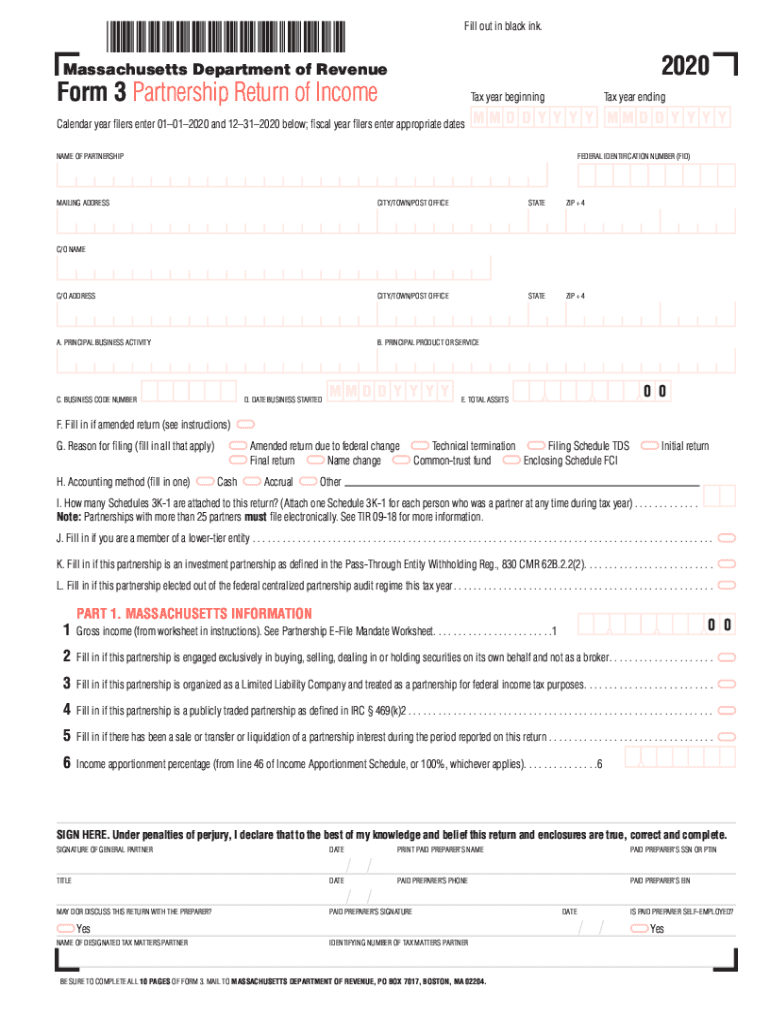

MA Form 3 2020 free printable template

Show details

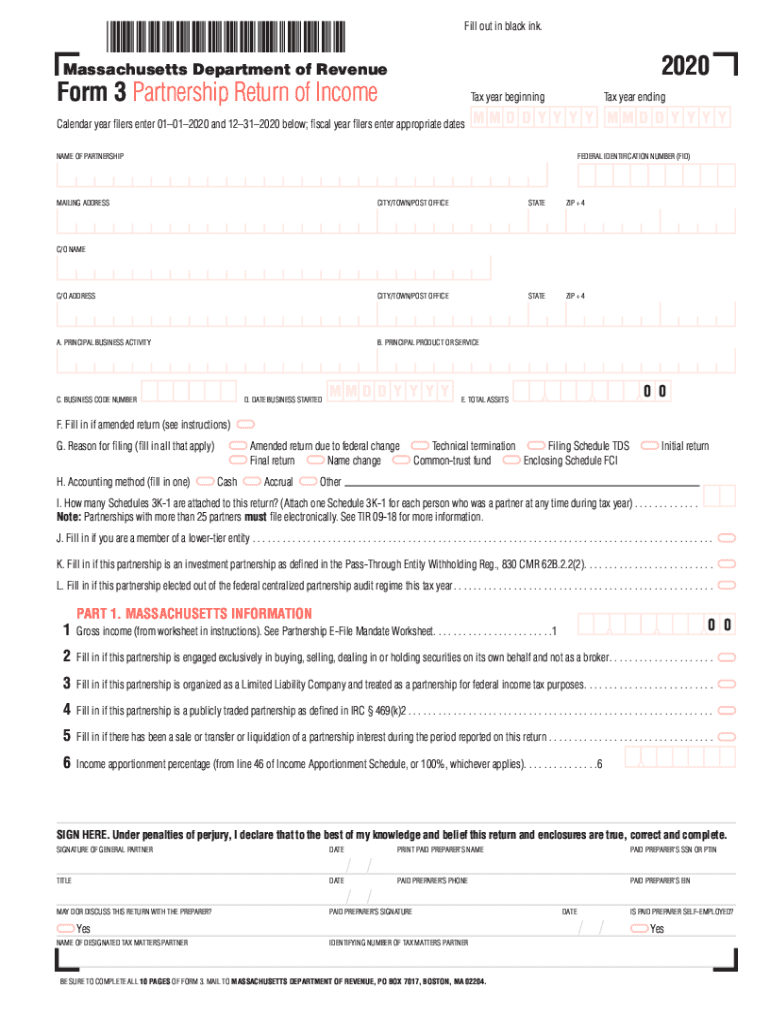

BE SURE TO COMPLETE ALL 10 PAGES OF FORM 3 Fill in if self-employed 2017 FORM 3 PAGE 2 Fill in if any partners in this partnership file as part of a nonresident composite income tax return. Fiscal year filers enter appropriate dates. Tax year beginning Tax year ending Form 3 Partnership Return of Income FEDERAL IDENTIFICATION NUMBER FID PARTNERSHIP NAME MAILING ADDRESS CITY/TOWN/POST OFFICE STATE ZIP 4 C/O ADDRESS A PRINCIPAL BUSINESS ACTIVITY B PRINCIPAL PRODUCT OR SERVICE C/O NAME BUSINESS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA Form 3

Edit your MA Form 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA Form 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MA Form 3 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MA Form 3. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA Form 3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA Form 3

How to fill out MA Form 3

01

Obtain a copy of the MA Form 3 from the official state website or relevant authority.

02

Fill out the applicant's information at the top of the form, including name, address, and contact details.

03

Provide the required details about the specific transaction or request being made.

04

Include any necessary financial information or documentation as instructed on the form.

05

Review the filled form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form to the designated agency or office, ensuring to keep a copy for your records.

Who needs MA Form 3?

01

Any individual or business that is engaging in specific transactions or requires approval from the relevant state agency.

02

Professionals seeking to report certain financial activities or changes that require compliance with state regulations.

Instructions and Help about MA Form 3

Fill

form

: Try Risk Free

People Also Ask about

What tax return do you file for a partnership?

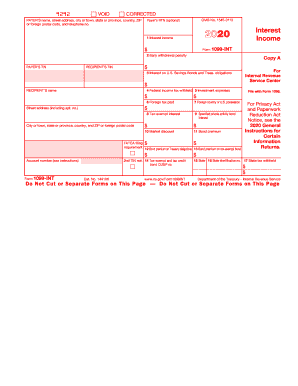

Partnerships file Schedule M-3 (Form 1065) to: Answer questions about their financial statements and reconcile financial statement net income (loss) for the consolidated financial statement group to income (loss) per the income statement for the partnership.

Where do you find partnership income?

Each partner reports their share of the partnership's income or loss on their personal tax return. Partners are not employees and shouldn't be issued a Form W-2. The partnership must furnish copies of Schedule K-1 (Form 1065) to the partner. For deadlines, see About Form 1065, U.S. Return of Partnership Income.

Do you have to register a general partnership in Massachusetts?

In Massachusetts there is no separate tax form required for partnerships, but the state does require an annual report to be filed. For information about federal taxes, see the Internal Revenue Service website. Personal liability is the other important topic to consider when forming a business.

What are the requirements to form a partnership?

Partnership Requirements: Partnership name. Registration with SEC depending on the amount of capital. Duly notarized Articles of Partnership. SEC Form F-105 for those with foreign partners. Registration with BIR. Registration with government agencies if hiring employees.

Do partnerships file T2?

All income and losses are flowed out to the partners who report their share of the partnership's income on their income tax return (whether it is a T1, T2, or T3 return). As a result, a partnership does not file an income tax return and is not taxed at the partnership level.

What tax return does a partnership file?

Prepare Form 1065, U.S. Return of Partnership Income Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065. On this form, you'll be asked to provide the partnership's total income or loss.

Who Must File Florida partnership Return?

Who Must File Florida Form F-1065? Every Florida partnership having any partner subject to the Florida Corporate Income Tax Code must file Florida Form F-1065. A limited liability company with a corporate partner, if classified as a partnership for federal tax purposes, must also file Florida Form F-1065.

Who must file Massachusetts Form 3?

For calendar year filers Form 3 is due on or before March 15, 2022. Currently all partnerships at or above the appli- cable annual income or loss threshold (or with 25 or more partners) must submit all Forms 3 and Schedules 3K-1 to the Department by elec- tronic means.

Who is responsible for filing of the partnership return?

The precedent partner is responsible to file Form P to declare all income, losses, expenses, profit, loss, and assets, based on the profit and loss account, and balance sheet of the partnership business. As is normal practice, all business records must be kept for a period of 7 years for audit purposes.

Is partnership income on the 1040?

A partner will report his or her share of ordinary partnership income on Schedule E of Form 1040. Separately stated items of income or loss are reported on the appropriate forms or schedules. For example, capital gains shown on the partner's Schedule K-1 are reported on Schedule D of the partner's Form 1040.

How do I set up a partnership in Massachusetts?

Steps to Create a Massachusetts General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN)

Who must file a Massachusetts fiduciary return?

Every executor, administrator, trustee, guardian, conservator, trustee in a noncorporate bankruptcy or receiver of a trust or estate that received in- come in excess of $100 that is taxable under MGL ch 62 at the entity level or to a beneficiary(ies) and that is subject to Massachusetts jurisdiction must file a Form 2.

Who must file Massachusetts partnership return?

A partnership must annually report the partnership's income to the Department of Revenue on a Form 3, Partnership Return of Income if: It has a usual place of business in Massachusetts, or. Receives federal gross income of more than $100 during the taxable year.

Do partnerships have to register with HMRC?

You must register your partnership for Self Assessment with HM Revenue and Customs ( HMRC ) if you're the 'nominated partner'. This means you're responsible for sending the partnership tax return. The other partners need to register separately. All partners also need to send their own tax returns as individuals.

Does a general partnership file taxes?

A general partnership does not need to incorporate to function as a legal business. If it isn't officially incorporated, it will operate with the same tax and legal obligations as a sole proprietorship, with the partners reporting profit and losses on their own individual tax forms.

Can you create your own partnership agreement?

To create your Partnership Agreement, you should include the following things in your contract: Partnership start date, address, name, and purpose. Contact information and duties for each general partner. Description of partner capital contributions.

When must a partnership file its return?

For partnership tax years ending after December 31, 2015, partnerships must file a Form 1065 by the 15th day of the 3rd month after the partnerships tax year end. For example, if the partnership had a calendar year end, the partnership must file by March 15th.

Do I need to complete a partnership tax return?

You must fill in the Partnership Trading pages (pages 2 to 5 of the Partnership Tax Return) if, at any time in the period 6 April 2020 to 5 April 2021, the partnership carried on a trade or profession. In some circumstances you may have to fill in more than one set of Partnership Trading pages.

How do I form a partnership in Massachusetts?

Steps to Create a Massachusetts General Partnership Determine if you should start a general partnership. Choose a business name. File a DBA name (if needed) Draft and sign partnership agreement. Obtain licenses, permits, and clearances. Get an Employer Identification Number (EIN)

Do you need to do a tax return for a partnership?

Under a partnership, you'll need to submit a tax return both for your business, and an individual return as a partner of the business, allowing you to separate business expenses and deductions from private expenses. Some deductions are not available to the partnership, but may be claimed by the partners.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MA Form 3 to be eSigned by others?

When you're ready to share your MA Form 3, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I make edits in MA Form 3 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing MA Form 3 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit MA Form 3 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign MA Form 3 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is MA Form 3?

MA Form 3 is a state tax form used by businesses in Massachusetts to report income and calculate corporate excise tax.

Who is required to file MA Form 3?

Corporations doing business in Massachusetts, including foreign corporations that operate or have a presence in the state, are required to file MA Form 3.

How to fill out MA Form 3?

To fill out MA Form 3, you need to provide information on your corporation's income, deductions, and any applicable credits. Follow the instructions provided with the form and ensure that all relevant financial information is accurate.

What is the purpose of MA Form 3?

The purpose of MA Form 3 is to assess the corporate excise tax owed by Massachusetts corporations, providing authorities with financial information necessary for tax collection.

What information must be reported on MA Form 3?

MA Form 3 requires reporting of corporate income, deductions, total assets, number of shares, and information regarding the corporation's business activities in Massachusetts.

Fill out your MA Form 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA Form 3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.