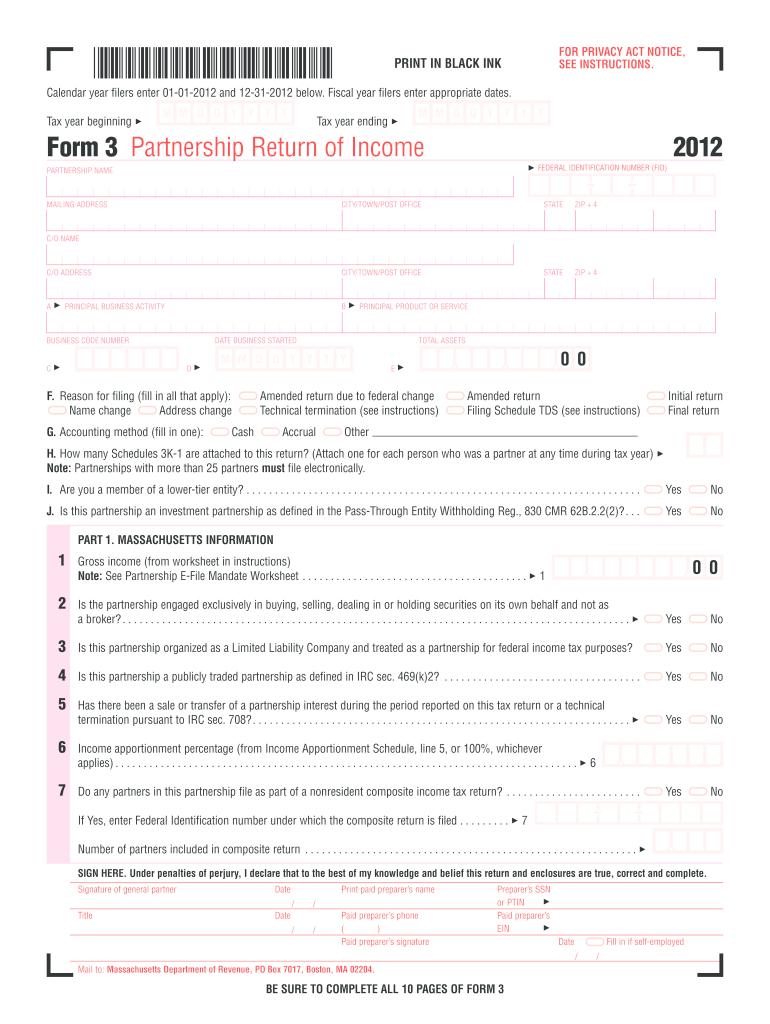

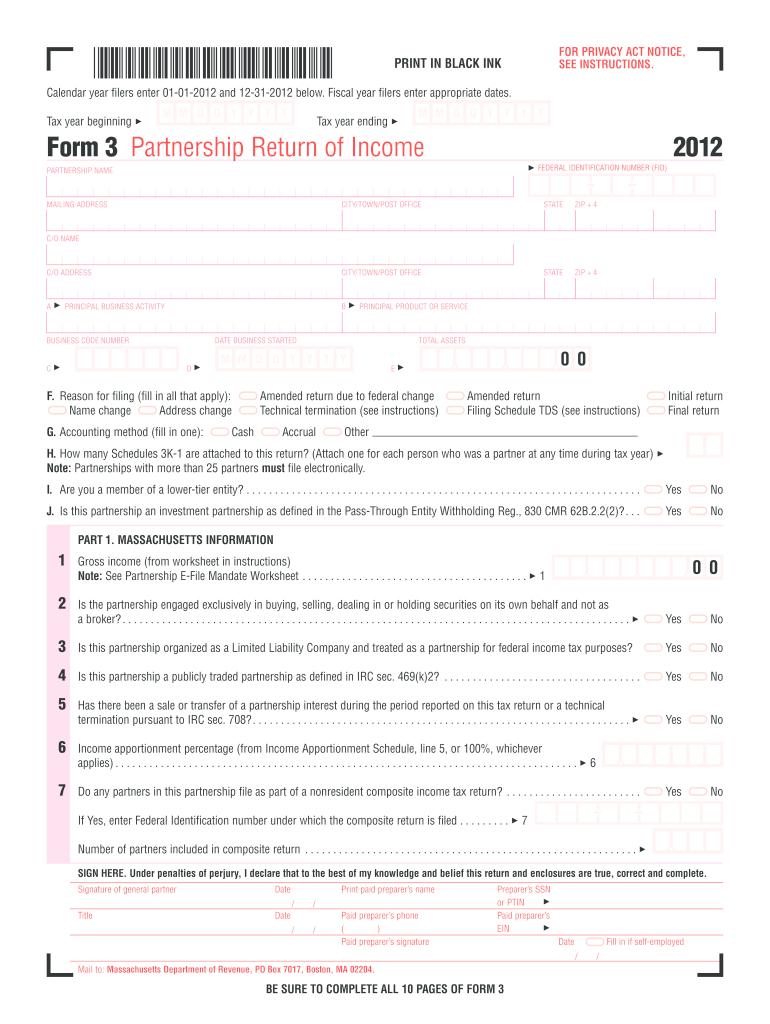

MA Form 3 2012 free printable template

Get, Create, Make and Sign MA Form 3

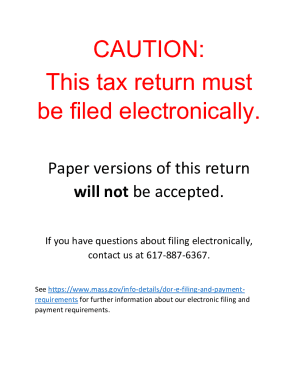

How to edit MA Form 3 online

Uncompromising security for your PDF editing and eSignature needs

MA Form 3 Form Versions

How to fill out MA Form 3

How to fill out MA Form 3

Who needs MA Form 3?

Instructions and Help about MA Form 3

Welcome to the disability television calm discussion series hosted by Florida disability attorney Walter root of not the third of the disability resolution law firm on completing important social security disability forms necessary to apply for disability benefits now as always there are no guarantees in life but the more thorough and accurate you are in completing these important forms the better your chances become of being awarded disability benefits while you can always complete all the forms yourself we a disability resolution are always available to assist you with this detailed process to ensure that all the necessary information is properly communicated to the SS an am attorney Walter are not the third of disability resolution I like to cover completing the Social Security Administration supplemental anxiety questionnaire form being the document that disability determination services uses to better understand your anxiety first consider whether you have a generalized anxiety disorder obsessive-compulsive disorder panic disorder post-traumatic stress disorder or a social anxiety such phobia we can also talk a little later about mood based disabilities okay so let's break it down but consider first how they must all be severe enough to keep you from working, and they have or will last more than 12 months or be terminal AKA they'll kill you okay let's talk about generalized anxiety constant worrying that something bad is going to happen dry mouth rinse wedding for your sweats waking up sweating palpitations rapid heart skipping beats shaking trembling quivering unlikely fears constant alertness due to fears irritability hyperactivity insomnia muscle tension tiredness and easy startle reflex apprehension difficulty focusing tossing and turning at night and suicidal ideation okay that's basically for anxiety now similarly panic attacks have additional elements but many of them are very similar for example panic attacks share basically that random sweating fear sweats waking up sweating palpitations rapid heart skipping beats but keep in mind panic attacks are usually that sharp spike okay they're shorter, and they're usually more aggressive when it comes to you see red you control you can't remember things okay they also include shaking trembling quivering shortness of breath hyperventilating difficulty with social functioning or leaving the house choking and easy startle reflex and ability to focus on tasks or daily activities' apprehension difficulty focusing suicidal ideation and severe ongoing and recurrent panic attacks that occur at least one time per week on average okay the next thing that I'm going to cover is the obsessive-compulsive disorders basically everybody knows as OCD being the continued meaning constant and or ongoing obsessive or compulsive behavior that causes significant distress that is unwanted basically it's difficult for individuals with OCD to keep jobs because they use a lot of sick days and have a tendency to have...

People Also Ask about

Does MA have state income tax form?

Who must file a Massachusetts fiduciary return?

Do I need to include a copy of my federal return with my Massachusetts state return?

Do I need to attach federal tax return to state tax return?

Who must file 1041 instructions?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MA Form 3?

How do I make changes in MA Form 3?

How do I fill out MA Form 3 using my mobile device?

What is MA Form 3?

Who is required to file MA Form 3?

How to fill out MA Form 3?

What is the purpose of MA Form 3?

What information must be reported on MA Form 3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.