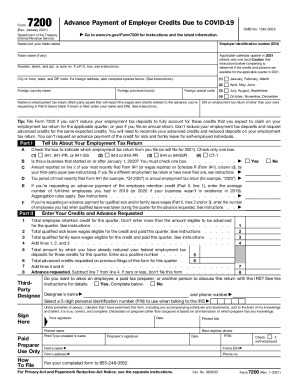

IRS Instructions 7200 2021 free printable template

Show details

Instructions for Form 7200Department of the Treasury

Internal Revenue Service(Rev. January 2021)Advance Payment of Employer Credits Due to COVID-19

Section references are to the Internal Revenue Code

unless

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 7200

Edit your IRS Instructions 7200 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 7200 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 7200 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS Instructions 7200. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 7200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 7200

How to fill out IRS Instructions 7200

01

Visit the IRS website and locate the Instructions for Form 7200.

02

Download or print the Instructions for Form 7200 PDF document.

03

Gather the necessary information, including your business name, EIN, and details of your qualified wages.

04

Fill out Part 1 of Form 7200, providing information about the employer and type of credit being requested.

05

In Part 2, calculate the amount of the employee retention credit you are claiming.

06

Review the eligibility criteria and ensure all sections are completed accurately.

07

Sign and date the form electronically or print it and sign physically.

08

Submit your completed Form 7200 to the IRS as per the instructions provided.

Who needs IRS Instructions 7200?

01

Employers who have retained employees during the COVID-19 pandemic.

02

Businesses that are eligible for the Employee Retention Credit.

03

Tax-exempt organizations seeking to claim refundable credits for qualified wages.

04

Any business concerned about cash flow due to COVID-19 related impacts and are seeking advance payments.

Fill

form

: Try Risk Free

People Also Ask about

Is it too late to file form 7200?

When can I file? You can file the form for an advance payment of the credits anticipated for a quarter at any time before the end of the month following the quarter in which you paid the qualified wages. You can file form 7200 several times during a quarter.

Is there a deadline for form 7200?

More In Forms and Instructions Taxpayers filing a Form 943, Employer's Annual Federal Tax Return for Agricultural Employees, or Form 944, Employer's ANNUAL Federal Tax Return, may submit a Form 7200 up to the earlier of February 1, 2021, or the date they file the applicable employment tax return for 2020.

Can I still apply for the employee retention credit in 2022?

Businesses can no longer pay wages to claim the Employee Retention Tax Credit, but they have until 2024, and in some instances 2025, to do a look back on their payroll during the pandemic and retroactively claim the credit by filing an amended tax return.

Is there a deadline to claim employee retention credit?

Employee Retention Tax Credit Deadline The deadline for qualified firms to claim the ERTC is July 31, October 31, and December 31, 2021, with their Employee per quarter Form 941 tax filings.

Can you still file form 7200 in 2022?

Please note the Form 7200 fax line will be shut down after January 31, 2022 and IRS will no longer be accepting Form 7200 submissions.

Can I still file form 7200 in 2022?

Please note the Form 7200 fax line will be shut down after January 31, 2022 and IRS will no longer be accepting Form 7200 submissions.

How do I calculate the employee retention credit?

The ERC calculation is based on total qualified wages, including health plan expenses paid by the employer to the employee. The ERC equals 50 percent of the qualified wages for 2020 and 70% for 2021. The maximum credit amount is for 2021, with a cap of $10,000 in a quarter.

How do I fill out a 7200 form?

How to Complete Your IRS Form 7200: Instructions Enter Your Business Information. Complete Your Employee Tax Returns. Enter Your Credits and Advance Requested. Indicate Your Third-Party Designee (If any) Sign the Document for Authorization.

When should I file form 7200?

When to File Form 7200? Form 7200 can be filed at any time before the end of the month following the quarter in which qualified wages were paid and you can file Form 7200 several times during each quarter if needed. Don't file Form 7200: After you file Form 941 for the quarter or file Form 943, 944, or CT-1.

How long does it take to get 7200 advance?

For more details, see the IRS page About Form 7200. The IRS is estimating a 2-week processing time, and you will receive the tax credit refund directly from the IRS, not Patriot.

What is the deadline to file form 7200 2022?

More In Forms and Instructions The last day to file Form 7200, Advance Payment of Employer Credits Due to COVID-19, was January 31, 2022.

When Should form 7200 be completed?

When can I file? You can file the form for an advance payment of the credits anticipated for a quarter at any time before the end of the month following the quarter in which you paid the qualified wages. You can file form 7200 several times during a quarter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS Instructions 7200 from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like IRS Instructions 7200, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for the IRS Instructions 7200 in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your IRS Instructions 7200 in minutes.

How can I edit IRS Instructions 7200 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing IRS Instructions 7200, you need to install and log in to the app.

What is IRS Instructions 7200?

IRS Instructions 7200 provides guidance for businesses to claim the Employee Retention Credit (ERC) or request an advance of the credit under the CARES Act.

Who is required to file IRS Instructions 7200?

Employers that have qualified wages and wish to claim the Employee Retention Credit or seek an advance payment of the credit need to file IRS Form 7200.

How to fill out IRS Instructions 7200?

To complete Form 7200, employers should follow the instructions provided for the form, ensuring to correctly report eligible wages, the number of employees, and any advance payments needing to be requested.

What is the purpose of IRS Instructions 7200?

The purpose of IRS Instructions 7200 is to assist employers in understanding how to claim the Employee Retention Credit and request advance payments, helping them to retain employees during the economic impact of the COVID-19 pandemic.

What information must be reported on IRS Instructions 7200?

Employers must report information including the number of qualified employees, total qualified wages paid, the amount of ERC claimed, and any advance payment requested.

Fill out your IRS Instructions 7200 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 7200 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.