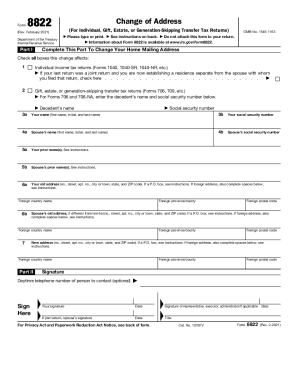

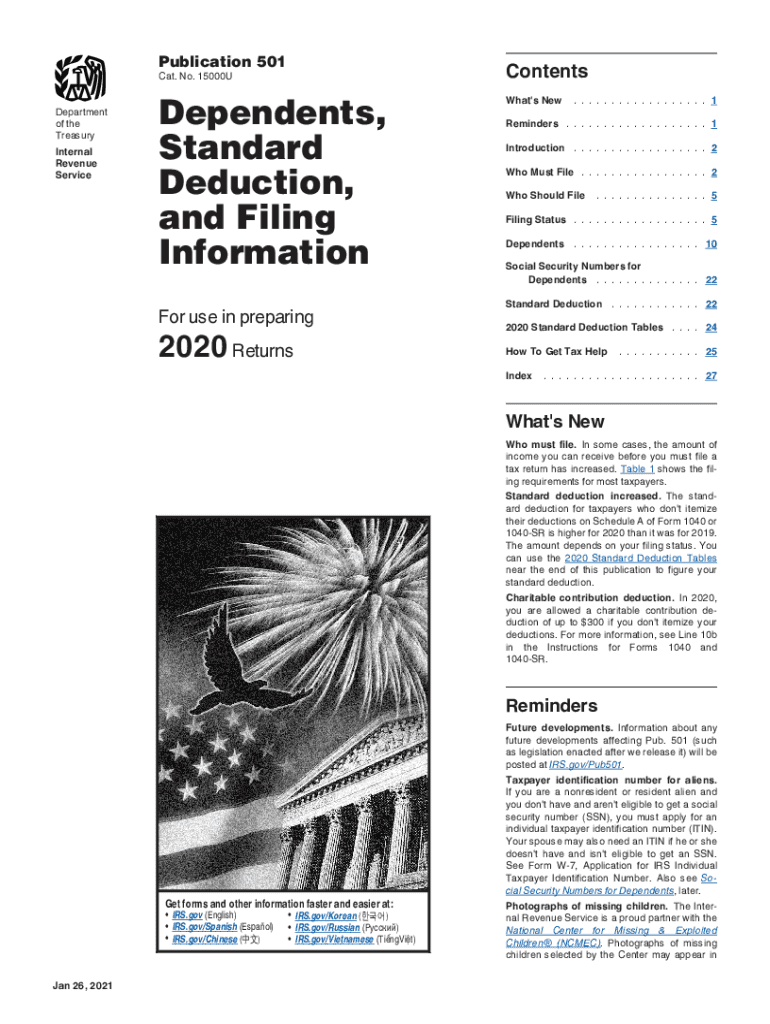

IRS Publication 501 2020 free printable template

Instructions and Help about IRS Publication 501

How to edit IRS Publication 501

How to fill out IRS Publication 501

About IRS Publication previous version

What is IRS Publication 501?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

What information do you need when you file the form?

FAQ about IRS Publication 501

What should I do if I notice an error on my IRS Publication 501 after submission?

If you find an error on your IRS Publication 501 after submission, you must amend the form. This typically involves completing a corrected version and following the IRS guidelines for amendments, which may require additional documentation to clarify the changes made.

How can I track the status of my submitted IRS Publication 501?

You can track the status of your IRS Publication 501 by using the IRS 'Where's My Refund?' tool, available on their website. This tool is useful for verifying that your form was received and is being processed, and it will provide you with updates on any potential issues, including common e-file rejection codes.

What are some common mistakes that filers make with IRS Publication 501?

Common mistakes with IRS Publication 501 include misreporting the number of exemptions and failing to provide accurate taxpayer information. To avoid errors, double-check all entries for completeness and accuracy, and ensure that any supporting documents are in order.

What should I do if I receive an audit notice related to my IRS Publication 501?

If you receive an audit notice regarding your IRS Publication 501, it's important to respond promptly. Gather all relevant documents and evidence to support your filings, and consider consulting a tax professional to ensure you are adequately prepared for the audit process.

See what our users say