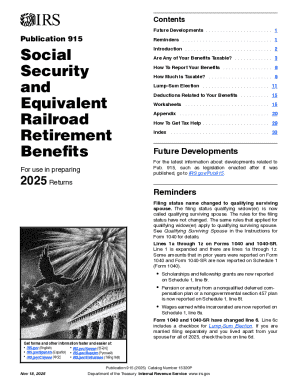

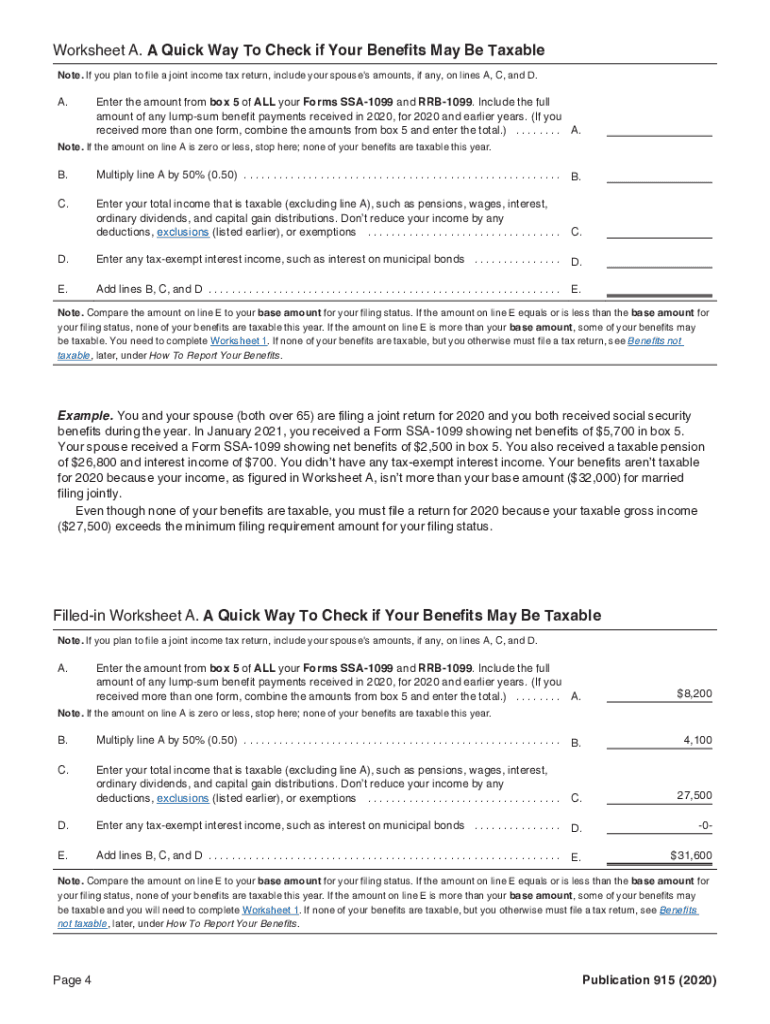

IRS Publication 915 2020 free printable template

Instructions and Help about IRS Publication 915

How to edit IRS Publication 915

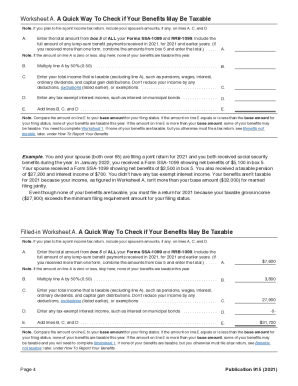

How to fill out IRS Publication 915

About IRS Publication previous version

What is IRS Publication 915?

Who needs the form?

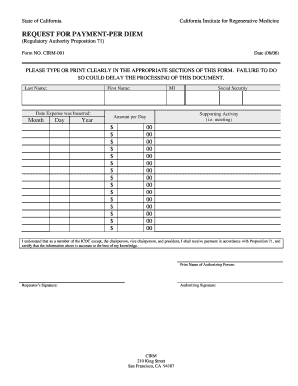

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

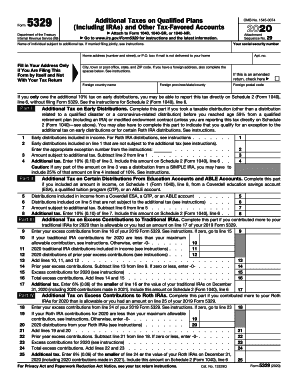

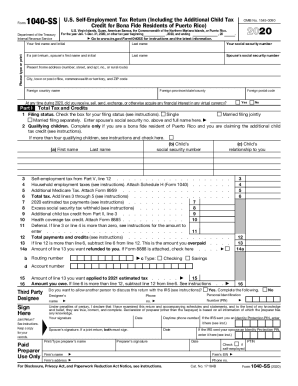

Is the form accompanied by other forms?

FAQ about IRS Publication 915

What should I do if I need to correct a mistake on my IRS Publication 915?

If you've realized there's an error on your IRS Publication 915, you can submit an amended form. Ensure that you clearly indicate the changes made, and include any necessary documentation that supports your corrections. This process will help maintain compliance and accuracy in your filings.

How can I track the status of my submitted IRS Publication 915?

To track the status of your IRS Publication 915, you can use the IRS online tools available for tracking submissions. Keep an eye out for any rejection codes if you filed electronically; these codes will guide you on the next steps to rectify any issues to ensure successful processing.

What are the privacy and data security considerations when filing IRS Publication 915?

When filing IRS Publication 915, it’s crucial to safeguard your personal information. Utilize secure methods of submission, such as e-filing via reputable software. Additionally, retain your filed documents for the recommended period to protect against data breaches and to be prepared for any future audits.

Are there common errors to avoid when completing IRS Publication 915?

Yes, common errors on IRS Publication 915 include incorrect Social Security numbers, miscalculating amounts, and failing to sign the form. Double-check your entries and consult resources or professionals if you're unsure to minimize the risk of rejection or processing delays.

See what our users say