PA Form PA-40 ES (I) 2021 free printable template

Show details

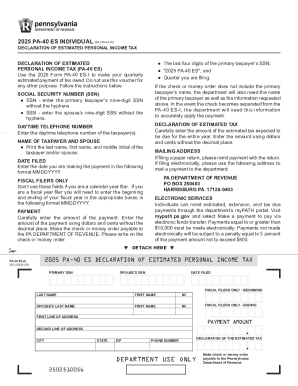

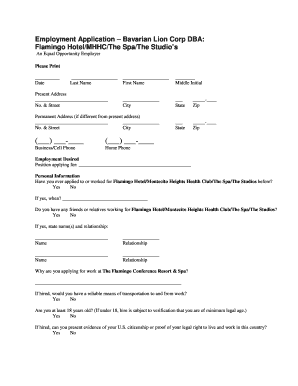

2021 PA40 ES INDIVIDUAL (EX) 1220 DECLARATION OF ESTIMATED PERSONAL INCOME DECLARATION OF ESTIMATED PERSONAL INCOME TAX (PA40 ES) Use the 2021 Form PA40 ESI to make your quarterly estimated payment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA Form PA-40 ES I

Edit your PA Form PA-40 ES I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA Form PA-40 ES I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA Form PA-40 ES I online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA Form PA-40 ES I. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA Form PA-40 ES (I) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA Form PA-40 ES I

How to fill out PA Form PA-40 ES (I)

01

Download the PA Form PA-40 ES (I) from the Pennsylvania Department of Revenue website.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Indicate the tax year for which you are making an estimated payment.

04

Calculate your estimated tax liability for the year based on your income and deductions.

05

Divide your total estimated tax by the number of estimated payments you plan to make (usually four).

06

Enter the calculated estimated payment amount in the appropriate section of the form.

07

Complete any other required fields, such as declaration of your estimated tax status.

08

Review the filled form for accuracy and completeness.

09

Sign and date the form.

10

Submit the form via mail or electronically, along with your estimated payment, by the due date.

Who needs PA Form PA-40 ES (I)?

01

Individuals who are self-employed.

02

Taxpayers expecting to owe more than $500 in taxes for the year.

03

Pennsylvania residents with additional income not subject to withholding.

04

Anyone who prefers to make estimated payments rather than pay a lump sum at tax filing.

Fill

form

: Try Risk Free

People Also Ask about

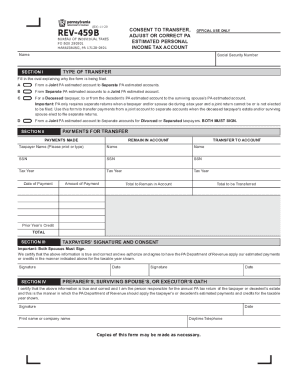

Has Pa extended tax filing deadline?

You will automatically receive a 6-month extension of time to file your return (not to pay). The extended tax return due date is October 15, 2022 October 17, 2022. Please be aware that Pennsylvania will not accept the federal extension form as an extension for your Pennsylvania tax return.

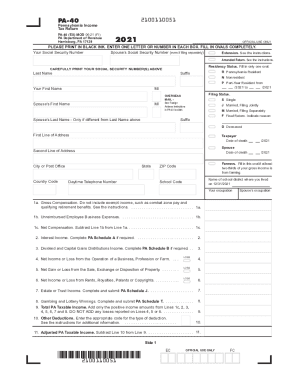

How much do you have to make to file taxes 2021 in PA?

Every resident, part-year resident or nonresident individual must file a Pennsylvania Income Tax Return (PA-40) when he or she realizes income generating $1 or more in tax, even if no tax is due (e.g., when an employee receives compensation where tax is withheld).

What is the extended tax deadline for 2022?

October 16, 2023 - Deadline to file your extended 2022 tax return. If you chose to file an extension request on your tax return, this is the due date for filing your tax return.

Do I need to file PA taxes 2021?

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2021 PA tax return if: • You received total PA gross taxable income in excess of $33 during 2021, even if no tax is due with your PA return; and/or • You incurred a loss from any transaction as an individual, sole proprietor, partner in a

Is October 15 2021 the tax extension deadline?

The new federal tax filing deadline is automatic, so you don't need to file for an extension unless you need more time to file after May 17, 2021. If you file for an extension, you'll have until October 15, 2021 to file your taxes. But, you'll still need to pay any taxes you owe by May 17.

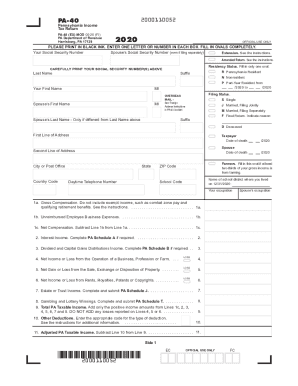

How much do you have to make to file taxes in PA?

Full-year residents, part-year residents, and nonresidents are all required to file an income tax return in Pennsylvania once they have made over $1 in taxable income, even if no tax is due.

Who must file PA local tax return?

12. When To File: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by April 18, 2022. Even if you have employer withholding or are not expecting a refund, you must still file a return.

When can I file PA State Taxes 2021?

April 18 Deadline All taxpayers who received more than $33 in total gross taxable income in calendar year 2021 must file a Pennsylvania personal income tax return by midnight, Monday, April 18, 2022.

Did Pa extend the tax deadline for 2021?

Although there is an extension for the filing of 2021 personal income tax returns, the Department of Revenue is reminding taxpayers that payments related to these 2021 returns are not eligible for an extension. These Pennsylvania income tax payments were due on April 18, 2022.

Has Pennsylvania extended the tax deadline?

The extended tax return due date is October 16, 2023. Please be aware that Pennsylvania will not accept the federal extension form as an extension for your Pennsylvania tax return. If you are making an online tax payment, a Form REV-276 is not needed.

Where do I file my PA tax return 2021?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Jan 31, 2022

Is PA tax deadline extended 2021?

Although there is an extension for the filing of 2021 personal income tax returns, the Department of Revenue is reminding taxpayers that payments related to these 2021 returns are not eligible for an extension. These Pennsylvania income tax payments were due on April 18, 2022.

Is PA tax Deadline Extended 2021?

Although there is an extension for the filing of 2021 personal income tax returns, the Department of Revenue is reminding taxpayers that payments related to these 2021 returns are not eligible for an extension. These Pennsylvania income tax payments were due on April 18, 2022.

Can I file my PA local tax online?

File Your Local Earned Income Tax Return Online Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by April 18, 2022.

Do I have to file a PA state tax return?

State law requires Pennsylvania residents with earned income, wages and net profits, to file an annual tax return along with supporting documentation, such as a W-2. You must file the tax return even if you are: subject to employer withholding.

What is the PA tax filing deadline for 2021?

All taxpayers who received more than $33 in total gross taxable income in calendar year 2021 must file a Pennsylvania personal income tax return by midnight, Monday, April 18, 2022.

What is the due date for PA state taxes?

April 18 Deadline All taxpayers who received more than $33 in total gross taxable income in calendar year 2021 must file a Pennsylvania personal income tax return by midnight, Monday, April 18, 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit PA Form PA-40 ES I in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing PA Form PA-40 ES I and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an eSignature for the PA Form PA-40 ES I in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your PA Form PA-40 ES I and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I complete PA Form PA-40 ES I on an Android device?

Use the pdfFiller mobile app and complete your PA Form PA-40 ES I and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is PA Form PA-40 ES (I)?

PA Form PA-40 ES (I) is the Pennsylvania Estimated Personal Income Tax Payment form used by taxpayers to make estimated tax payments to the state.

Who is required to file PA Form PA-40 ES (I)?

Individuals who expect to owe tax of $500 or more for the tax year and who are self-employed or have income not subject to withholding are generally required to file PA Form PA-40 ES (I).

How to fill out PA Form PA-40 ES (I)?

To fill out PA Form PA-40 ES (I), taxpayers must provide their name, address, social security number, and estimated income and tax amounts for the year, then calculate the estimated payment due.

What is the purpose of PA Form PA-40 ES (I)?

The purpose of PA Form PA-40 ES (I) is to allow taxpayers to report and remit estimated payments of their personal income tax liability to the Pennsylvania Department of Revenue.

What information must be reported on PA Form PA-40 ES (I)?

PA Form PA-40 ES (I) requires taxpayers to report their personal information, estimated income, estimated tax payment amounts, and any previous payments made for the current tax year.

Fill out your PA Form PA-40 ES I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA Form PA-40 ES I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.