IL PTAX-324 2009 free printable template

Show details

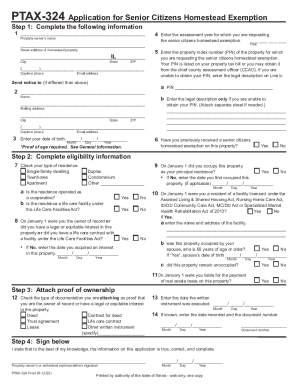

PTAX-324 Application for Senior Citizens Homestead Exemption Step 1: Complete the following information Property owner'name 1 Streetaddressofhomesteadproperty 4 Writetheassessmentyearforwhichyouarerequesting

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL PTAX-324

Edit your IL PTAX-324 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL PTAX-324 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL PTAX-324 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IL PTAX-324. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL PTAX-324 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL PTAX-324

How to fill out IL PTAX-324

01

Obtain the IL PTAX-324 form from the official Illinois Department of Revenue website or your local assessor's office.

02

Read the instructions carefully to understand the requirements for completing the form.

03

Fill out the property owner's information at the top of the form, including name, mailing address, and phone number.

04

Provide details of the property in question, including the property address and parcel number.

05

Indicate the reason for the request by checking the appropriate box.

06

If applicable, attach any necessary documentation that supports your claim or request.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the form to the appropriate local authority or assessor’s office, either by mail or in person.

Who needs IL PTAX-324?

01

Property owners in Illinois who are seeking a property tax exemption or who need to appeal their property assessment.

02

Individuals who are filing for certain benefits related to property assessments as outlined by the Illinois Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What is the disabled person exemption in Cook County?

A Person with Disabilities Exemption is for persons with disabilities and provides an annual $2,000 reduction in the equalized assessed value (EAV) of the property.

How do I apply for disabled veterans property tax exemption in Illinois?

Illinois veterans or their spouses should contact their local Veteran Service Officer for information to apply for the specially-adapted housing property tax and mobile home tax exemption benefits.

How much is the senior tax exemption in Illinois?

Senior Citizens Homestead Exemption The maximum amount of the reduction in equalized assessed value is $8,000 in Cook County and counties contiguous to Cook County or $5,000 in all other counties.

What is the Illinois senior freeze exemption?

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2021 calendar year. A "Senior Freeze" Exemption provides property tax savings by freezing the equalized assessed value (EAV) of an eligible property.

At what age do you get a property tax break in Illinois?

Most senior homeowners are eligible for this exemption if they are 65 years of age or older (born in 1957 or prior) and own and occupy their property as their principal place of residence. Once this exemption is applied, the Assessor's Office automatically renews it for you each year.

How do I get senior discount on property taxes in Illinois?

This program allows persons 65 years of age and older, who have a total household income for the year of no greater than $65,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments (up to a maximum of $7,500) on their principal residences.

Who qualifies for homeowners exemption in Illinois?

Taxpayers whose primary residence is a single-family home, townhouse, condominium, co-op or apartment building (up to six units) are eligible. First-time applicants must have been the occupants of the property as of January 1 of the tax year in question.

What is the disability exemption for property taxes in Illinois?

A Person with Disabilities Exemption is for persons with disabilities and provides an annual $2,000 reduction in the equalized assessed value (EAV) of the property.

How much is the senior tax exemption in Illinois?

The Senior Exemption reduces the Equalized Assessed Value (EAV) of a property by $8,000.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit IL PTAX-324 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit IL PTAX-324.

How do I fill out the IL PTAX-324 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign IL PTAX-324 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit IL PTAX-324 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign IL PTAX-324 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is IL PTAX-324?

IL PTAX-324 is a form used in Illinois for reporting the exempt status of certain properties from property taxes.

Who is required to file IL PTAX-324?

Individuals or organizations that own property in Illinois and are claiming a property tax exemption are required to file IL PTAX-324.

How to fill out IL PTAX-324?

To fill out IL PTAX-324, provide the required information regarding the property's exempt status, ownership details, and the reason for the exemption in the designated sections of the form.

What is the purpose of IL PTAX-324?

The purpose of IL PTAX-324 is to establish and verify the exempt status of properties to ensure they are not improperly assessed for property taxes.

What information must be reported on IL PTAX-324?

Information that must be reported on IL PTAX-324 includes the property's location, owner details, type of exemption being claimed, and any supporting documentation as required.

Fill out your IL PTAX-324 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL PTAX-324 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.