IRS Instructions 1065 2020 free printable template

Show details

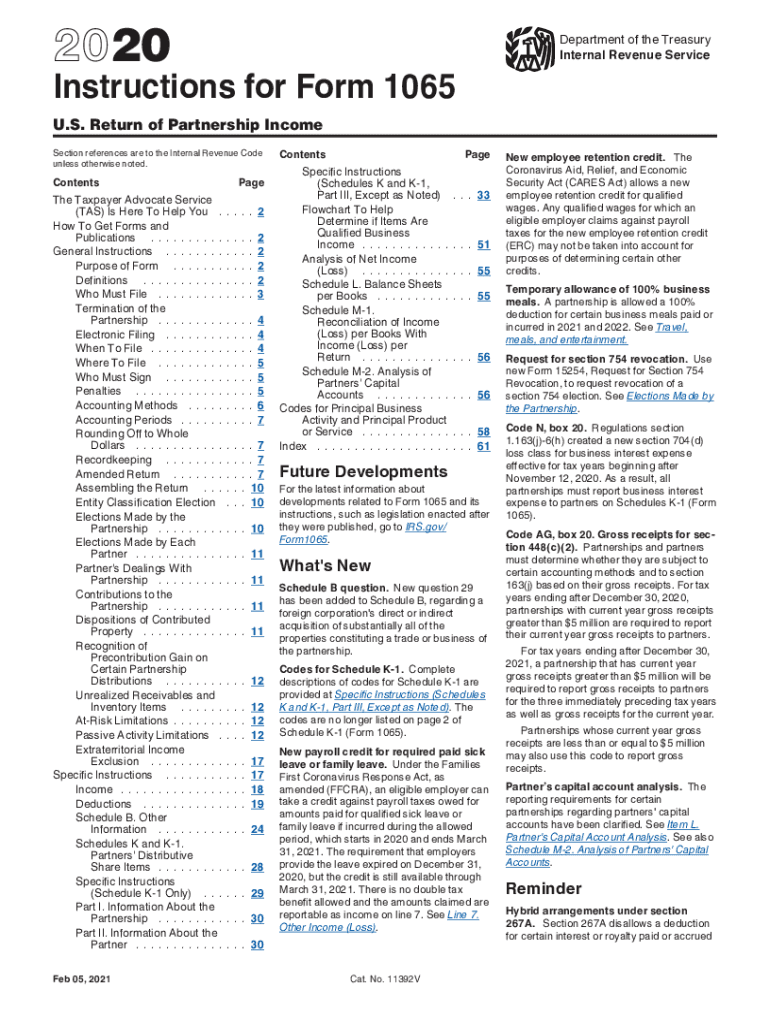

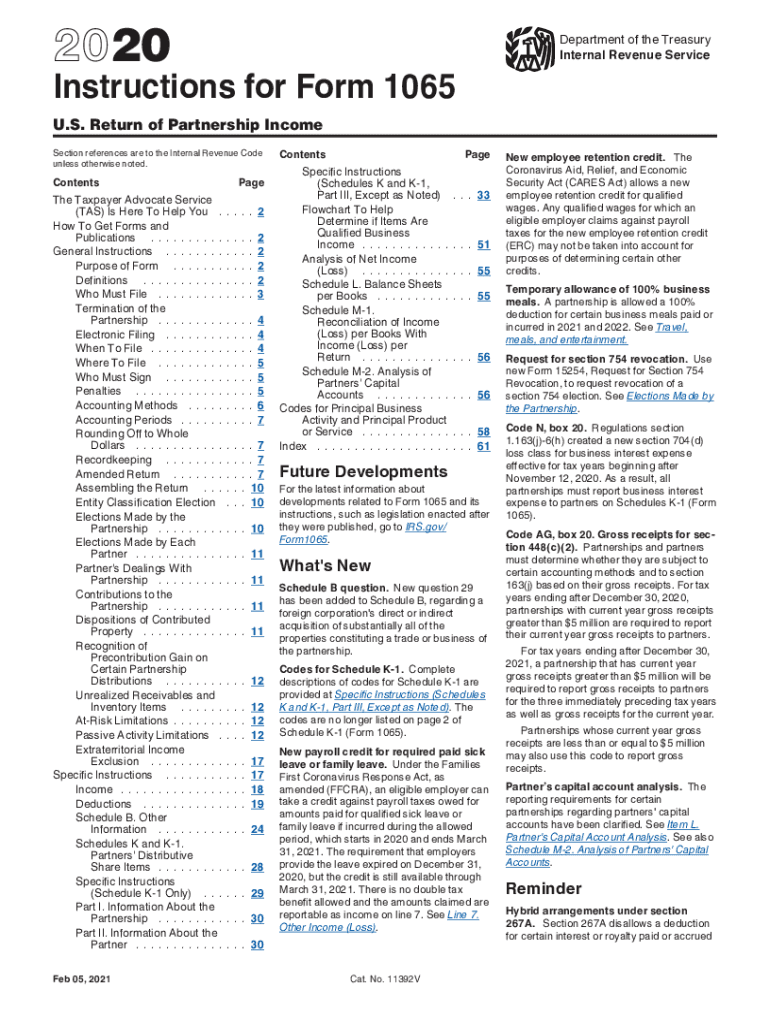

2020Department of the Treasury Internal Revenue ServiceInstructions for Form 1065 U.S. Return of Partnership Income Section references are to the Internal Revenue Code unless otherwise noted. Contents

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 1065

Edit your IRS Instructions 1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IRS Instructions 1065 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS Instructions 1065. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 1065

How to fill out IRS Instructions 1065

01

Obtain IRS Form 1065 and the accompanying instructions from the IRS website.

02

Review the eligibility criteria to ensure your partnership needs to file Form 1065.

03

Collect all necessary financial records, including income, expenses, and balance sheet information.

04

Complete the basic information section, including partnership name, address, and employer identification number (EIN).

05

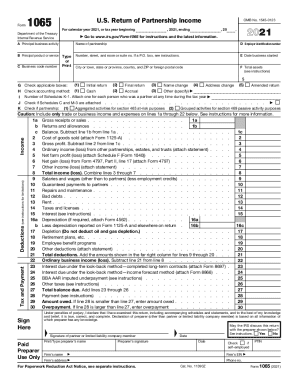

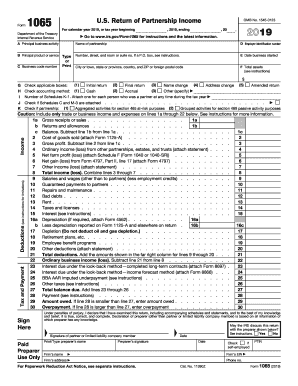

Fill out the income section, listing all sources of income for the partnership.

06

Detail the deductions, including section for ordinary business expenses.

07

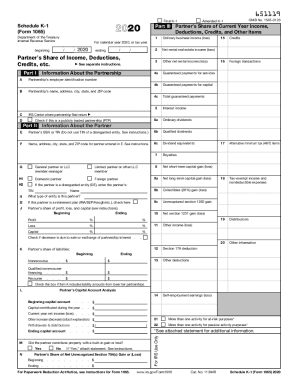

Complete the partner's information Schedule K-1 for each partner.

08

Review and double-check all entered information for accuracy.

09

Submit the completed Form 1065 and any additional schedules by the due date, either electronically or via mail.

Who needs IRS Instructions 1065?

01

Partnerships that have income, deductions, or credits to report.

02

Limited Liability Companies (LLCs) that have elected to be treated as partnerships for tax purposes.

03

Any business entities that qualify as partnerships under IRS definitions.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Schedule B 1?

It is only required when the total exceeds certain thresholds. In 2022 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

Do you have to fill out balance sheet on 1065?

To file Form 1065, you'll need all of your partnership's important year-end financial statements, including a profit and loss statement that shows net income and revenues along with all the partnership's deductible expenses, and a balance sheet for the beginning and end of the year.

Is Schedule B required for 1065?

Partnerships use Schedule B-1 (Form 1065) to provide information applicable to certain entities, individuals, and estates that own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership.

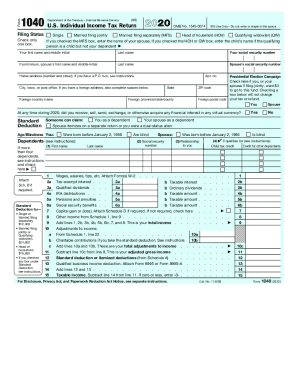

What is Schedule B used for?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What is Schedule B on Form 1065?

Partnerships use Schedule B-1 (Form 1065) to provide information applicable to certain entities, individuals, and estates that own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership.

What do I include with form 1065?

This form requires significant information about the partnership's annual financial status. This includes income information such as gross receipts or sales. Deductions and operating expenses such as rent, employee wages, bad debts, interest on business loans, and other costs are also included.

What is Schedule B 2 form 1065?

Schedule B-2 was created for the purpose of allowing certain partnerships with 100 or less partners to elect out of the centralized partnership audit regime. The election occurs on the main 1065 form on Schedule B, line 25 (if answered “Yes”).

How do I prepare a 1065 tax return?

Form 1065 instructions Gather relevant financial documents and IRS forms. Fill in IRS Form 1065 A-K. Fill in the remainder of IRS Form 1065 (page 1) Fill in IRS Form 1065 Schedule B (page 2) Complete IRS Form 1065 Schedule B (page 3) Complete IRS Form 1065 Schedule K (page 4) Complete IRS Form 1065 Schedule L (page 5)

How do I prepare Form 1065?

Fill in Boxes A Through J Principal business activity, principal product or service, and business code number. Employer Identification Number (EIN). Date your business started. Total assets as shown by your books. Type of tax return. Accounting method. The amount of Schedule K-1s you're attaching.

What does B mean in taxes?

IRS Schedule B is a tax schedule that helps American taxpayers compute income tax due on interest and dividends earned. 1 This schedule uses information from Forms 1099-INT and 1099-DIV to populate the correct figures into your 1040 tax return.

How do I file a 1065 partnership?

5 Steps to Filing Partnership Taxes Prepare Form 1065, U.S. Return of Partnership Income. Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065. Prepare Schedule K-1. File Form 1065 and Copies of the K-1 Forms. File State Tax Returns. File Personal Tax Returns.

Do partnerships have to file Schedule L?

If the partnership does NOT meet the four requirements set forth in Schedule B (Form 1065), Line 4, the partnership is required to complete Schedule L and enter the balance sheet as reflected on the partnership's books and records.

Can I do my own partnership tax return?

Partnerships with 100 or less partners (Schedules K-1) may voluntarily file their return using the MeF Platform. This page provides an overview of electronic filing and more detailed information for those partnerships that prepare and transmit their own income tax returns using MeF.

Where do I put charitable contributions on 1065?

Click the three dots at the top of the screen and select Lines 12-19. Scroll down to the Other Deductions (13) section. Locate the Charitable Contributions (8) subsection. Enter the contributions in the appropriate fields under Cash or Noncash.

What are Question 4 Requirements 1065?

What are the requirements for Question 4? The partnership's total receipts for the tax year were less than $250,000. The partnership's total assets at the end of the tax year were less than $1 million.

How much does it cost to prepare a partnership tax return?

Typical fee range is $1,500 to $1,800 for partnership and corporate tax returns depending on the quality of your accounting records. S Corp Election. We can have your entity taxed as an S corporation for $450. Online Accountant. Consultation.

Is Schedule L required for 1065?

When Schedule L is required: If the partnership does NOT meet the four requirements set forth in Schedule B (Form 1065), Line 4, the partnership is required to complete Schedule L and enter the balance sheet as reflected on the partnership's books and records.

Can I prepare my own 1065?

You can find the 1065 tax form on the IRS website. You can fill out the form using tax software or print it to complete it by hand. If your partnership has more than 100 partners, you're required to file Form 1065 online. Other partnerships may be able to file by mail.

How do I prepare a partnership tax return?

5 Steps to Filing Partnership Taxes Prepare Form 1065, U.S. Return of Partnership Income. Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065. Prepare Schedule K-1. File Form 1065 and Copies of the K-1 Forms. File State Tax Returns. File Personal Tax Returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instructions 1065 for eSignature?

To distribute your IRS Instructions 1065, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete IRS Instructions 1065 online?

pdfFiller has made it simple to fill out and eSign IRS Instructions 1065. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit IRS Instructions 1065 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign IRS Instructions 1065 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is IRS Instructions 1065?

IRS Instructions 1065 are guidelines provided by the Internal Revenue Service for partnerships to report their income, deductions, gains, losses, etc., using Form 1065.

Who is required to file IRS Instructions 1065?

Partnerships, including multi-member LLCs that are treated as partnerships for tax purposes, are required to file IRS Instructions 1065.

How to fill out IRS Instructions 1065?

To fill out IRS Instructions 1065, partnerships must gather necessary financial information and use the form to report income, expenses, and tax information. Detailed instructions can be found in the IRS guidelines.

What is the purpose of IRS Instructions 1065?

The purpose of IRS Instructions 1065 is to provide the framework for partnerships to accurately report their financial activities to the IRS and to distribute income or losses to partners.

What information must be reported on IRS Instructions 1065?

Information that must be reported on IRS Instructions 1065 includes partnership income, deductions, business expenses, partner’s shares of income or loss, and any applicable credits.

Fill out your IRS Instructions 1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.