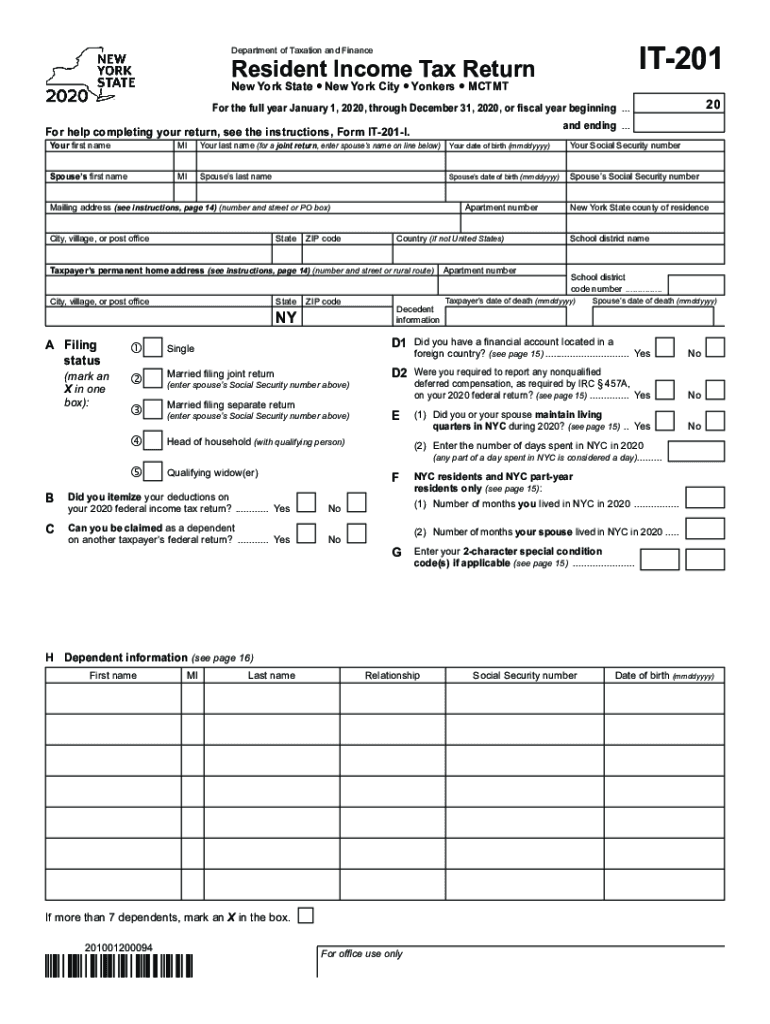

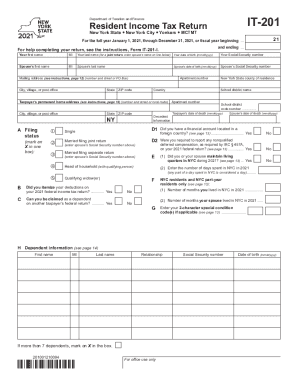

Who needs a Form NYS IT-201?

There are several conditions which a person should meet in order to complete this IT-201.

- - A person should file a federal return;

- A person’s federal adjusted gross income was more than $4,000;

- A person wants to claim a refund of any New York State, New York City, or Yonkers income taxes withheld from their pay;

- A person wants to claim any of the refundable or carryover credits in the credit chart on pages 7 through 11.

What is Form NYS IT-201 for?

The information in this tax return is used to determine the amount of taxes that have been paid by the submitter of this tax return.

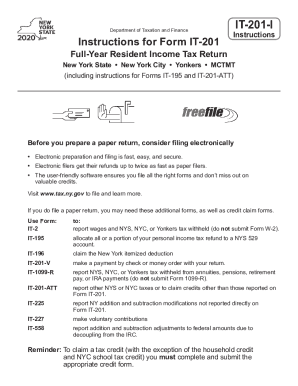

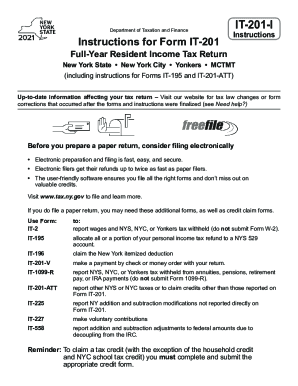

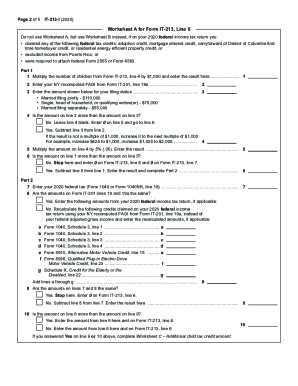

Is Form NYS IT-201 accompanied by other forms?

If you file a paper return, you should accompany it with the following completed forms:

- - IT-2 — report wages and NYS, NYC, or Yonkers tax withheld;

- IT-201-V — make a payment by check or money order with your return;

- IT-201-D — claim the New York itemized deduction;

- IT-1099-R — report NYS, NYC, or Yonkers tax withheld from annuities, pensions, retirement pay, or IRA payments;

- IT-201-ATT — report other NYS or NYC taxes or to claim credits other than those reported on Form IT-201;

- IT-225 — report NY addition and subtraction modifications not reported directly on Form IT-201.

When is Form NYS IT-201 due?

You should file this form before or on April 18, 2016. Or, you should file the form not later than on June 15, 2016, in case you are a U.S. citizen or resident alien and live outside the U.S. or you are in the military service outside the U.S.

How do I fill out Form NYS IT-201?

Like any tax return that includes the following items to be filled out:

- - Personal information and family status of the submitter;

- Information on Federal Income and Adjustments;

- Standard deduction or itemized deduction;

- Tax computation, credits, and other taxes;

- Voluntary contributions;

- Payments and refundable credits;

- Submitter’s refund, owed amount, and account information.

Where do I send Form NYS IT-201?

If enclosing a payment, mail your return to: STATE PROCESSING CENTER, PO BOX 15555, ALBANY NY, 12212-5555;

If not enclosing a payment, mail your return to: STATE PROCESSING CENTER, PO BOX 61000, ALBANY NY, 12261-0001.