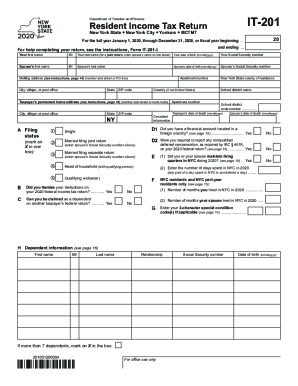

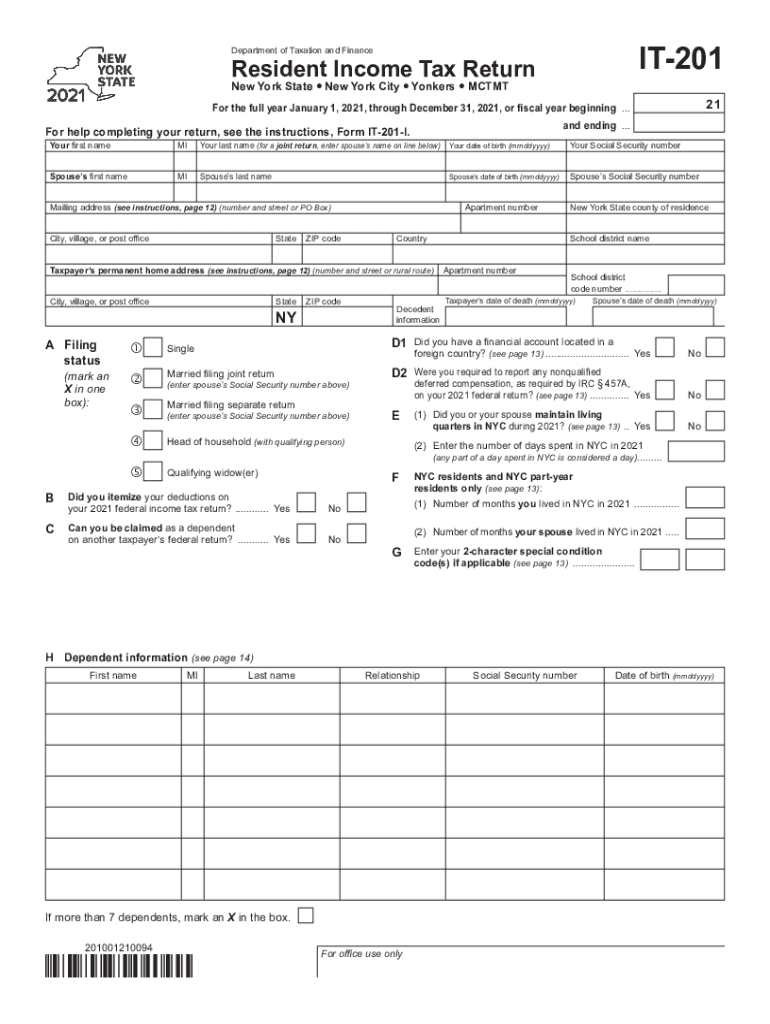

NY DTF IT-201 2021 free printable template

Instructions and Help about NY DTF IT-201

How to edit NY DTF IT-201

How to fill out NY DTF IT-201

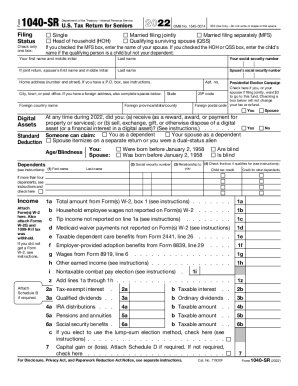

About NY DTF IT previous version

What is NY DTF IT-201?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about NY DTF IT-201

What should I do if I realize I made a mistake after filing the NY DTF IT-201?

If you discover an error post-filing, you can submit an amended NY DTF IT-201. This involves preparing a new form that corrects the inaccuracies found in your original submission. Ensure to include a clear explanation of the changes made and keep copies for your records.

How can I verify the status of my NY DTF IT-201 submission?

To track the status of your NY DTF IT-201, you can use the online services provided by the New York Department of Taxation and Finance. You'll need to provide certain identifying information, like your Social Security number or the Employer Identification Number (EIN), to check whether your form has been received and processed.

What steps should I take if my NY DTF IT-201 was rejected during e-filing?

In the case of a rejected NY DTF IT-201 submission, you will receive an error code indicating the reason for rejection. Review the code, correct the issues highlighted, and then attempt to re-submit the form. Some common reasons may include incorrect personal information or formatting errors.

Are electronic signatures accepted for the NY DTF IT-201, and what about record retention?

Yes, electronic signatures are accepted for the NY DTF IT-201, making it easier for individuals to file online. For record retention, it is advised to keep copies of your submitted forms and any correspondence with the Department of Taxation and Finance for at least three years, as it may be needed for audits or inquiries.

How can authorized representatives file a NY DTF IT-201 on someone else's behalf?

An authorized representative can file a NY DTF IT-201 on behalf of another individual by ensuring they have the proper Power of Attorney (POA) documentation. This documentation should be submitted along with the form to validate their authority to act on the taxpayer's behalf, ensuring compliance with state regulations.

See what our users say