Get the free Reassessment Exclusion - Riverside County Assessor

Show details

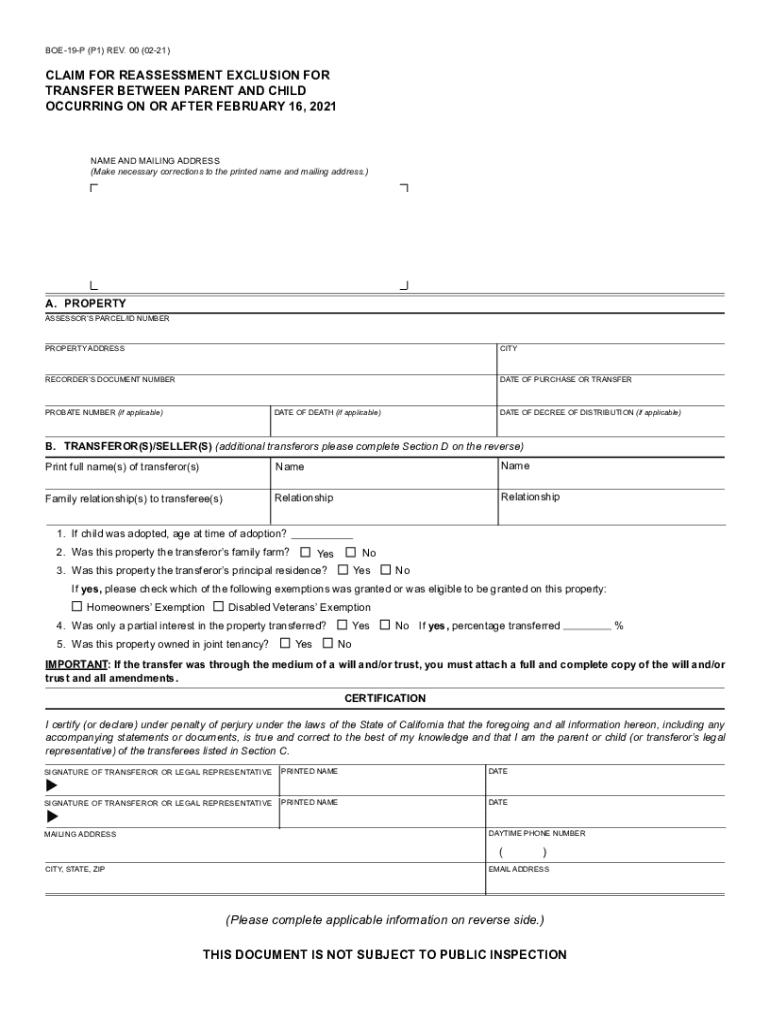

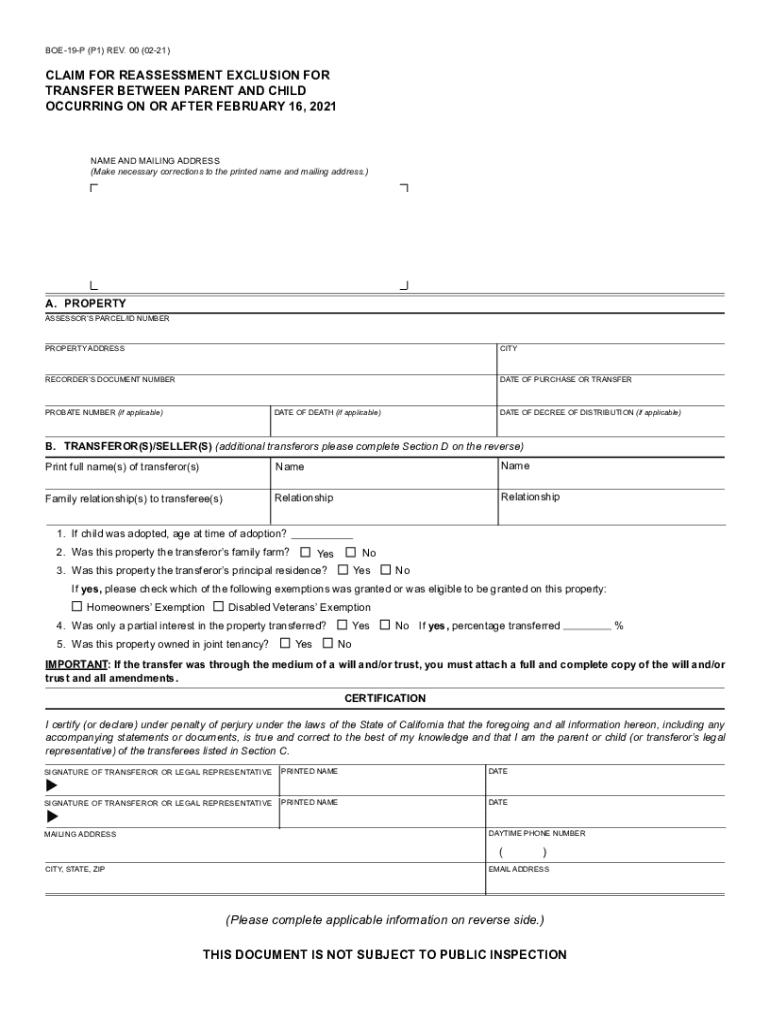

BOE19P (P1) REV. 00 (0221)CLAIM FOR REASSESSMENT EXCLUSION FOR

TRANSFER BETWEEN PARENT AND CHILD

OCCURRING ON OR AFTER FEBRUARY 16, 2021NAME AND MAILING ADDRESS

(Make necessary corrections to the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign reassessment exclusion - riverside

Edit your reassessment exclusion - riverside form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your reassessment exclusion - riverside form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit reassessment exclusion - riverside online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit reassessment exclusion - riverside. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out reassessment exclusion - riverside

How to fill out reassessment exclusion - riverside

01

To fill out reassessment exclusion in Riverside, follow these steps:

02

Obtain the reassessment exclusion form from the Riverside County Assessor's office. The form may be available for download on their official website or can be obtained in person.

03

Fill out the form accurately and completely. Provide all the necessary information, such as your name, property address, and contact details.

04

Attach any supporting documentation required by the exclusion form. This may include documents related to property ownership, recent improvements, or any other relevant information.

05

Review the completed form and supporting documents to ensure everything is filled out correctly and legibly.

06

Submit the filled-out form and supporting documents to the Riverside County Assessor's office. You can either mail it to the designated address or submit it in person.

07

Wait for confirmation from the Assessor's office regarding the reassessment exclusion. They may contact you for additional information or clarification if needed.

08

Once approved, you will receive a notification about the successful reassessment exclusion. Keep this notification for your records and future reference.

Who needs reassessment exclusion - riverside?

01

Reassessment exclusion in Riverside County is needed by property owners who meet certain criteria. The reassessment exclusion can be claimed for properties that have undergone certain changes, such as seismic retrofitting, installation of solar energy systems, or construction of disabled access features.

02

Additionally, property owners who have experienced damage due to disasters, such as fires or floods, may also be eligible for reassessment exclusion in order to avoid an increase in property taxes.

03

It is recommended to consult the Riverside County Assessor's office or a tax professional for specific eligibility requirements and further guidance regarding reassessment exclusion.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my reassessment exclusion - riverside in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign reassessment exclusion - riverside and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I execute reassessment exclusion - riverside online?

Easy online reassessment exclusion - riverside completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out reassessment exclusion - riverside on an Android device?

Use the pdfFiller mobile app and complete your reassessment exclusion - riverside and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is reassessment exclusion - riverside?

Reassessment exclusion in Riverside refers to a provision that prevents the reassessment of property value for tax purposes when certain conditions are met, allowing property owners to maintain their current tax rate.

Who is required to file reassessment exclusion - riverside?

Property owners in Riverside who meet specific eligibility criteria, such as being seniors, disabled, or victims of natural disasters, are required to file for reassessment exclusion.

How to fill out reassessment exclusion - riverside?

To fill out the reassessment exclusion in Riverside, property owners should complete the designated application form available from the Riverside County Assessor's office and provide the necessary supporting documentation regarding their eligibility.

What is the purpose of reassessment exclusion - riverside?

The purpose of the reassessment exclusion in Riverside is to provide financial relief to qualified property owners by preventing increases in property tax assessments and maintaining lower tax rates.

What information must be reported on reassessment exclusion - riverside?

Property owners must report information such as their name, property address, eligibility criteria, and any supporting documentation required to substantiate their claim for reassessment exclusion.

Fill out your reassessment exclusion - riverside online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Reassessment Exclusion - Riverside is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.