Get the free MINI LOAN

Show details

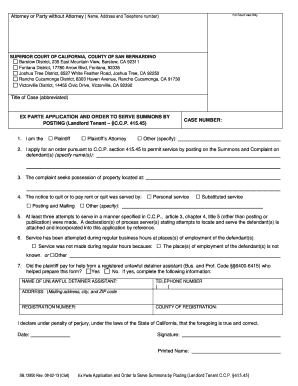

LOAN APPLICATION FORM

PLAF2017AMINI NONINFLATIONARY LOANEMERGENCY LOANCALAMITY NONEDUCATIONAL LOANWORDS ADVANCE LOANREGULAR INVARIABLE LOANREFERENCE NUMERATE

MOTHERS (please specify)RELEASE THRUDDATMYYYYCHECKI

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mini loan

Edit your mini loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mini loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mini loan online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mini loan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mini loan

How to fill out mini loan

01

To fill out a mini loan, follow these steps:

02

Research different lenders to compare interest rates and loan terms.

03

Gather all the necessary documents such as identification, proof of income, and bank statements.

04

Visit the lender's website or physical branch to start the application process.

05

Complete the loan application form, providing accurate information about your personal and financial details.

06

Review the terms and conditions of the loan carefully before submitting the application.

07

Submit the application along with the required documents.

08

Wait for the lender's approval, which may take a few hours to a few days.

09

If approved, carefully read and understand the loan agreement before signing it.

10

Receive the funds in your bank account once the loan is approved and processed.

11

Make timely repayments according to the agreed-upon schedule to avoid any penalties or additional charges.

Who needs mini loan?

01

Mini loans are typically suitable for individuals who:

02

- Need a small amount of money for a short period of time.

03

- Have an urgent financial need and cannot wait for traditional loan processing.

04

- Have a good credit score or have a limited credit history.

05

- Do not qualify for a regular bank loan due to their income or employment status.

06

- Can afford to repay the loan within the specified repayment period.

07

- Understand the terms and conditions of the loan and are willing to abide by them.

08

- Are aware of the potential high interest rates associated with mini loans and can manage the cost.

09

- Have exhausted other options and have determined that a mini loan is the most feasible solution for their current financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mini loan in Gmail?

mini loan and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make edits in mini loan without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your mini loan, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete mini loan on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your mini loan by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is mini loan?

A mini loan is a type of short-term loan that typically involves a small amount of money, aimed at meeting immediate financial needs.

Who is required to file mini loan?

Individuals or entities that take out mini loans from financial institutions may be required to file documentation or reports concerning these loans.

How to fill out mini loan?

To fill out a mini loan application, gather necessary personal and financial information, complete the application form provided by the lender, and submit it along with any required documentation.

What is the purpose of mini loan?

The purpose of a mini loan is to provide quick access to funds for urgent financial needs, such as unexpected expenses or emergencies.

What information must be reported on mini loan?

Information that must be reported typically includes the loan amount, interest rate, repayment terms, and borrower’s personal information.

Fill out your mini loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mini Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.