FL Bad Check Crime Report - Miami-Dade County 2008 free printable template

Get, Create, Make and Sign FL Bad Check Crime Report

Editing FL Bad Check Crime Report online

Uncompromising security for your PDF editing and eSignature needs

FL Bad Check Crime Report - Miami-Dade County Form Versions

How to fill out FL Bad Check Crime Report

How to fill out FL Bad Check Crime Report - Miami-Dade

Who needs FL Bad Check Crime Report - Miami-Dade?

Instructions and Help about FL Bad Check Crime Report

We all know that if you write a bad check on one hand it's a civil matter which means that the other party could sue you in small claims court or Superior Court to try to recover the money but in California law under Penal Code section 476 a's also a crime, and it's something for which you could go to jail now in order to prove the crime of writing bad checks the prosecution has to show three things first of all that you wrote or passed a bad check secondly that you knew there were insufficient funds in your account to cover it and thirdly that you intended to commit a fraud which basically means that you intended to trick the other party into believing that the check would be honored, and usually we see these cases come up in a situation where you're buying some goods or service, and you write a check knowing that the account is closed or knowing that the account is overdrawn or will be when the person goes to deposit the check now if the amount of the check or checks is 450 dollars or fewer than usually it's only a misdemeanor, and it's punishable by up to one year in County Jail on the other hand if the amount of the checker checks is more than four hundred and fifty dollars then the prosecutor has discretion to file it as a felony and as a felony you could face up to three years in state prison but perhaps worst of all a conviction would give you a criminal record that that's liable to show up anytime someone does a background check and particularly for prospective employers a conviction for writing bad checks is a real red flag because an employer will look and think you know is this person deceptive are they dishonest now as serious as these consequences are the fact is that writing bad checks can be a difficult crime for the prosecution to prove and a lot of innocent people do get wrongly accused of example a lot of times we find that it's really an honest mistake so for example maybe you thought that there were going to be sufficient funds to cover the check, but you simply did a bad job of balancing your bank book, or perhaps you told the other party that there were not sufficient funds at the time and therefore to hold the check for a while, and they went and deposited it too soon, or perhaps it was a banking error maybe your bank closed your account or failed to make funds available when they were supposed to due to some sort of clerical error the good news is that here at House Law Group we've had a great record of success over the years and defending clients who were prosecuted for writing or passing bad checks

People Also Ask about

Can you go to jail for writing a bad check in Ohio?

How much does a bad check have to be a felony in California?

What is a bad check penalty?

Does the recipient get charged for a bounced check?

Why do I get charged if someone writes me a bad check?

Is writing a bad check a felony in California?

Do you get charged for depositing a bad check?

What is the penalty for a bounced check in California?

What happens if someone writes me a check and it bounces?

What is the penalty for writing a bad check in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my FL Bad Check Crime Report in Gmail?

How can I send FL Bad Check Crime Report for eSignature?

Where do I find FL Bad Check Crime Report?

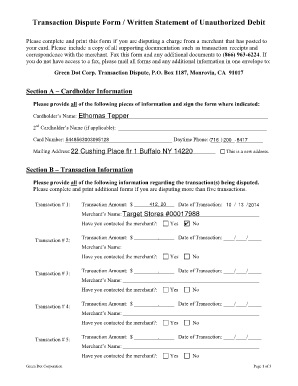

What is FL Bad Check Crime Report - Miami-Dade?

Who is required to file FL Bad Check Crime Report - Miami-Dade?

How to fill out FL Bad Check Crime Report - Miami-Dade?

What is the purpose of FL Bad Check Crime Report - Miami-Dade?

What information must be reported on FL Bad Check Crime Report - Miami-Dade?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.