CT DRS Schedule CT-SI 2020 free printable template

Show details

Department of Revenue Services

State of Connecticut

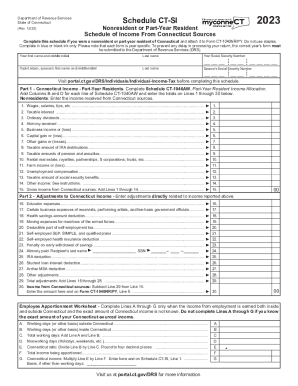

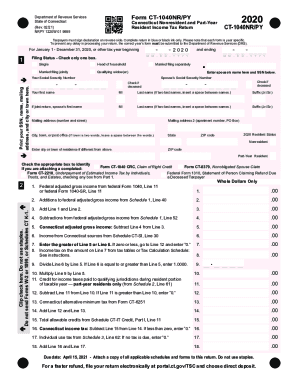

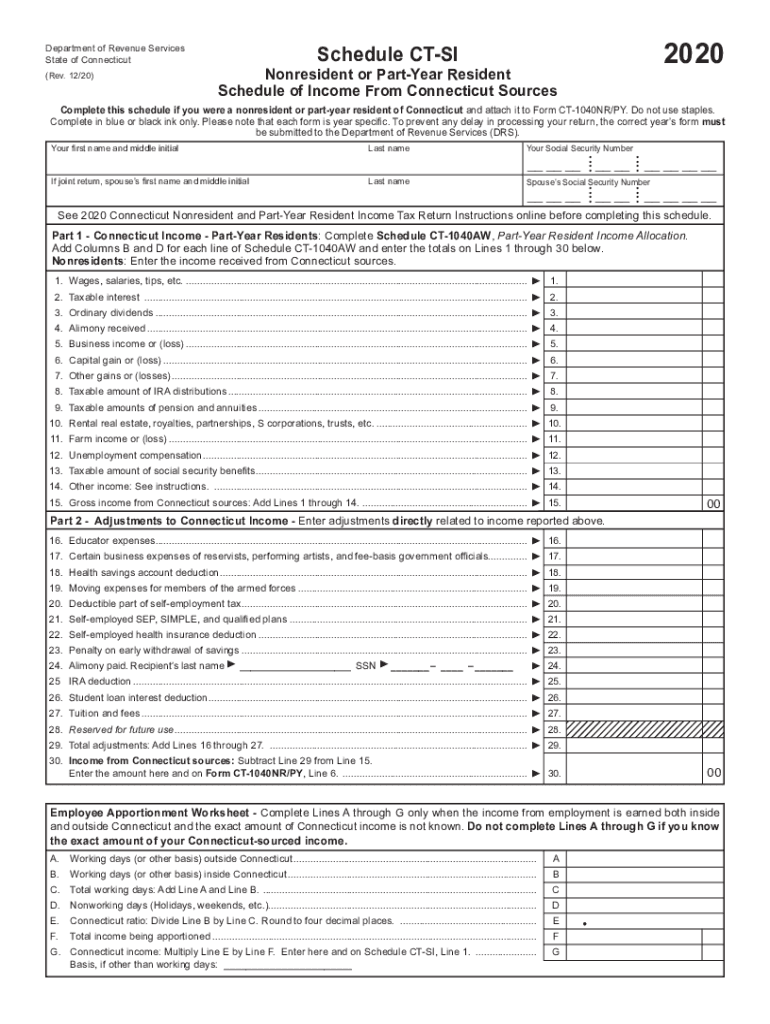

(Rev. 12/20)2020Schedule CTSINonresident or Part Year Resident

Schedule of Income From Connecticut SourcesComplete this schedule if you were a nonresident

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS Schedule CT-SI

How to edit CT DRS Schedule CT-SI

How to fill out CT DRS Schedule CT-SI

Instructions and Help about CT DRS Schedule CT-SI

How to edit CT DRS Schedule CT-SI

To edit the CT DRS Schedule CT-SI, you need to access the form digitally. You can utilize pdfFiller tools that allow you to fill in or modify fields as needed. Ensure all changes are correct before saving the document to avoid submission errors.

How to fill out CT DRS Schedule CT-SI

Filling out the CT DRS Schedule CT-SI involves several key steps. First, gather all necessary financial information relevant to the specific tax period. Next, complete each section of the form accurately, ensuring that all income and expenses are reported. Finally, review all entries for accuracy before submission.

About CT DRS Schedule CT-SI 2020 previous version

What is CT DRS Schedule CT-SI?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS Schedule CT-SI 2020 previous version

What is CT DRS Schedule CT-SI?

CT DRS Schedule CT-SI is a form used by certain taxpayers in Connecticut to report various types of income and expenses. This schedule is specifically designed for individuals involved in certain occupations or businesses who need to document their taxable activities for the Connecticut Department of Revenue Services (DRS).

What is the purpose of this form?

The primary purpose of the CT DRS Schedule CT-SI is to provide a detailed accounting of income generated from specific activities and to ensure proper tax compliance. By filing this form, taxpayers help the state assess the correct amount of tax owed based on their reported income and deductions.

Who needs the form?

The CT DRS Schedule CT-SI must be filed by taxpayers who receive income from activities such as self-employment, business ventures, or investments within Connecticut. If your income falls within the criteria set forth by the Connecticut DRS guidelines, you are required to submit this form along with your income tax return.

When am I exempt from filling out this form?

You are exempt from filling out the CT DRS Schedule CT-SI if you do not have taxable income from the activities specified for reporting. Additionally, filers who earn below a certain threshold may not be required to submit this schedule. Always verify against the latest Connecticut DRS guidelines to confirm your eligibility for exemption.

Components of the form

The form consists of several sections, including income and expense reporting, tax calculations, and personal information. Each section must be filled out with relevant figures to ensure accurate processing. Additionally, any relevant attachments or supplementary forms must be included when submitting the CT DRS Schedule CT-SI.

What are the penalties for not issuing the form?

Failing to file the CT DRS Schedule CT-SI or submitting it inaccurately can lead to penalties imposed by the Connecticut DRS. These penalties may include fines or additional interest charged on taxes owed. Timely and accurate filing is crucial to avoid these financial repercussions.

What information do you need when you file the form?

When filing the CT DRS Schedule CT-SI, you will need personal identification details, including your Social Security number, business information if applicable, and a detailed account of your income and expenses. Ensure that all numerical entries are correct and correspond to your financial records.

Is the form accompanied by other forms?

The CT DRS Schedule CT-SI often needs to be filed in conjunction with other tax forms, such as the main Connecticut income tax return. Depending on your specific situation, additional schedules or documents may also need to be submitted to ensure comprehensive reporting of your financial status.

Where do I send the form?

The completed CT DRS Schedule CT-SI should be sent to the Connecticut Department of Revenue Services. The mailing address can typically be found in the form's instructions or on the Connecticut DRS website. Make sure to check for any specific requirements regarding where to send the form based on your filing method.

See what our users say