AZ DoR 140 Instructions 2020 free printable template

Show details

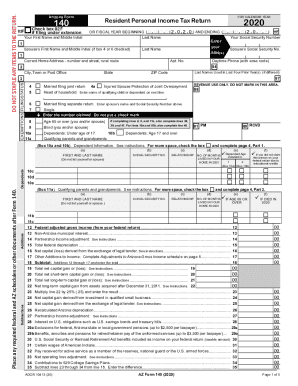

Arizona Form

1402020 Resident Personal Income Tax Return

For information or help, call one of the numbers listed:

Phoenix

(602) 2553381

From area codes 520 and 928, toll-free

(800) 3524090

Tax forms,

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ DoR 140 Instructions

How to edit AZ DoR 140 Instructions

How to fill out AZ DoR 140 Instructions

Instructions and Help about AZ DoR 140 Instructions

How to edit AZ DoR 140 Instructions

To edit the AZ DoR 140 Instructions, obtain the form from the Arizona Department of Revenue’s official website or other reliable sources. Use a document editing tool that allows PDF annotations to make necessary changes. Ensure your edits align with the guidelines provided by the Arizona Department of Revenue.

How to fill out AZ DoR 140 Instructions

Filling out the AZ DoR 140 Instructions requires accurate and complete information. Follow these steps:

01

Review the purpose of the form to understand what information is required.

02

Gather necessary documents such as income statements and identification numbers before starting.

03

Carefully read each section of the form and fill out the required fields with precise details.

04

Double-check for any errors or omissions before submission.

About AZ DoR 140 Instructions 2020 previous version

What is AZ DoR 140 Instructions?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ DoR 140 Instructions 2020 previous version

What is AZ DoR 140 Instructions?

AZ DoR 140 Instructions is a tax form issued by the Arizona Department of Revenue, providing guidance for taxpayers on how to complete their tax returns accurately. This form outlines the procedures and requirements necessary for proper compliance with state tax filing obligations.

What is the purpose of this form?

The purpose of the AZ DoR 140 Instructions is to assist taxpayers in understanding how to correctly fill out their tax returns, including details on allowable deductions and credits. It serves as a critical resource to ensure adherence to Arizona tax laws, aiming to reduce errors that could lead to delays or penalties.

Who needs the form?

Taxpayers who have income sourced within Arizona are required to complete the AZ DoR 140 Instructions. This includes individuals, married couples filing jointly, and dependents who are filing their own tax returns. Any entity with taxable income in Arizona must refer to this form for accurate filing guidance.

When am I exempt from filling out this form?

Exemptions from filling out the AZ DoR 140 Instructions typically apply to certain taxpayers with low income who qualify for the Arizona standard deduction. Additionally, those who have no taxable income or who are not required to file federal taxes may also be exempt. Review the Arizona Department of Revenue guidelines for specific circumstances that qualify for exemption.

Components of the form

The AZ DoR 140 Instructions include several essential components: personal identification information, income sources, deductions and credits, and signature fields. Each component is designed to capture detailed information about the taxpayer’s financial situation, enabling precise tax calculations.

What are the penalties for not issuing the form?

Failure to submit the AZ DoR 140 Instructions can result in penalties imposed by the Arizona Department of Revenue. These penalties may include fines and interest on unpaid taxes. Additionally, incomplete or inaccurate submissions could lead to audits and further complications regarding tax compliance.

What information do you need when you file the form?

When filing the AZ DoR 140 Instructions, you will need personal identification details, income statements from all sources, and documentation supporting any claimed deductions. This includes forms W-2, 1099, and any receipts for deductible expenses. Having these documents organized simplifies the filing process and ensures accuracy.

Is the form accompanied by other forms?

The AZ DoR 140 Instructions may need to be accompanied by additional forms depending on the taxpayer's situation. This can include supporting schedules for itemized deductions or other tax credits claimed. Always verify with the Arizona Department of Revenue for specific requirements related to your filing circumstances.

Where do I send the form?

The completed AZ DoR 140 Instructions should be mailed to the appropriate address provided on the form or the Arizona Department of Revenue’s official website. Ensure that you are sending your form to the correct location, as misdirected forms can lead to processing delays.

See what our users say