Get the free arizona form 140

Show details

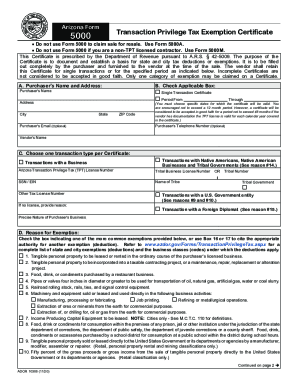

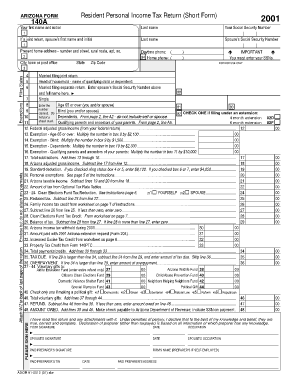

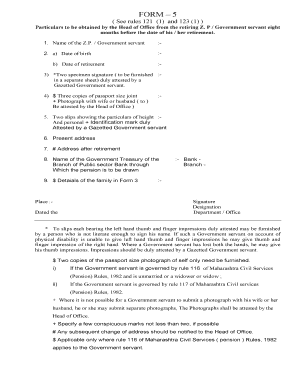

DO NOT STAPLE ANY ITEMS TO THE RETURN. Arizona Form140Check box 82F if filing under extension82FOR FISCAL YEAR BEGINNING M D Last Named 2 0 2 0Spouses First Name and Middle Initial (if box 4 or 6

We are not affiliated with any brand or entity on this form

Instructions and Help about AZ Form 140

How to edit AZ Form 140

How to fill out AZ Form 140

Instructions and Help about AZ Form 140

How to edit AZ Form 140

To edit AZ Form 140, you can use pdfFiller to upload the PDF document. Once uploaded, you can easily add text, check boxes, or annotations. Make sure to save changes regularly and verify that all edits reflect accurate information before submission.

How to fill out AZ Form 140

Filling out AZ Form 140 requires specific details about your income, deductions, and credits. Follow these steps:

01

Download the AZ Form 140 from the Arizona Department of Revenue website or enter pdfFiller to fill it out online.

02

Provide your personal information, including your name, social security number, and address.

03

Report your income and any applicable deductions in the designated fields.

04

Calculate your tax liability based on the provided instructions within the form.

05

Sign and date the form before submission.

About AZ Form previous version

What is AZ Form 140?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ Form previous version

What is AZ Form 140?

AZ Form 140, or the Arizona Resident Income Tax Return, is the primary tax form used by Arizona residents to report their income and calculate state tax liability. This form is essential for ensuring compliance with state tax regulations.

What is the purpose of this form?

The purpose of AZ Form 140 is to facilitate the reporting of earnings, deductions, and tax credits for state income tax purposes. By completing this form, residents provide the necessary information to compute their tax responsibilities accurately.

Who needs the form?

Arizona residents who earn income are required to file AZ Form 140. This includes individuals with wages, salaries, or self-employment income. Even those with limited income may need to file to claim potential tax credits or refunds.

When am I exempt from filling out this form?

You might be exempt from filling out AZ Form 140 if your income is below a certain threshold set by the Arizona Department of Revenue. Additionally, if you have no Arizona-source income or are claiming only certain credits, you may not need to file.

Components of the form

AZ Form 140 includes various components, such as basic personal information, income reporting sections, tax credits, and calculations for tax owed or refunds due. Understanding each section is crucial for accurate completion.

Due date

AZ Form 140 is typically due on April 15, aligning with federal income tax deadlines. However, extensions may be available, and it's essential to confirm current deadlines in case of changes.

What payments and purchases are reported?

AZ Form 140 requires reporting all forms of income, including wages, salaries, rental income, and investment income. Specific deductions and credits related to personal expenses, such as medical expenses or child tax credits, can also be included.

How many copies of the form should I complete?

Generally, you need to complete one original copy of AZ Form 140 for submission. However, it is wise to make a copy for your records before sending it to the Arizona Department of Revenue.

What are the penalties for not issuing the form?

Failure to file AZ Form 140 may result in penalties, such as fines or interest on any taxes owed. Additionally, consistently not filing can lead to more severe repercussions, including potential legal action.

What information do you need when you file the form?

When filing AZ Form 140, you need your personal identification information, details of all income sources, any applicable deductions, and documentation supporting tax credits. This information ensures accurate reporting and compliance with state tax laws.

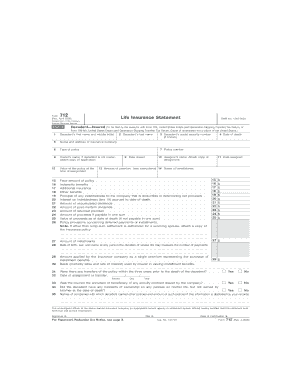

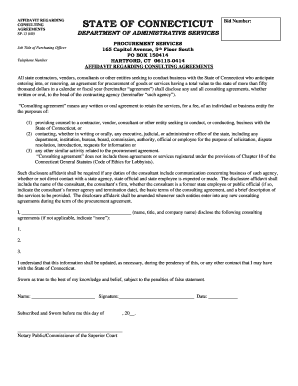

Is the form accompanied by other forms?

AZ Form 140 may require additional forms depending on your financial situation. For example, you might need to include schedules for certain deductions or credits, which provide further detail on your tax situation.

Where do I send the form?

Completed AZ Form 140 should be mailed to the Arizona Department of Revenue. Ensure you verify the correct mailing address based on your location and whether you are submitting a refund request or owe taxes.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.