AZ Form 140 2021 free printable template

Show details

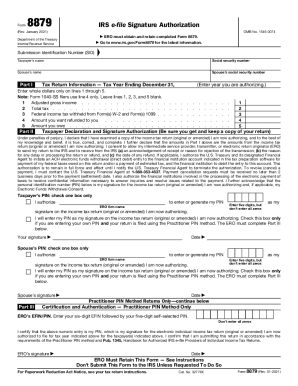

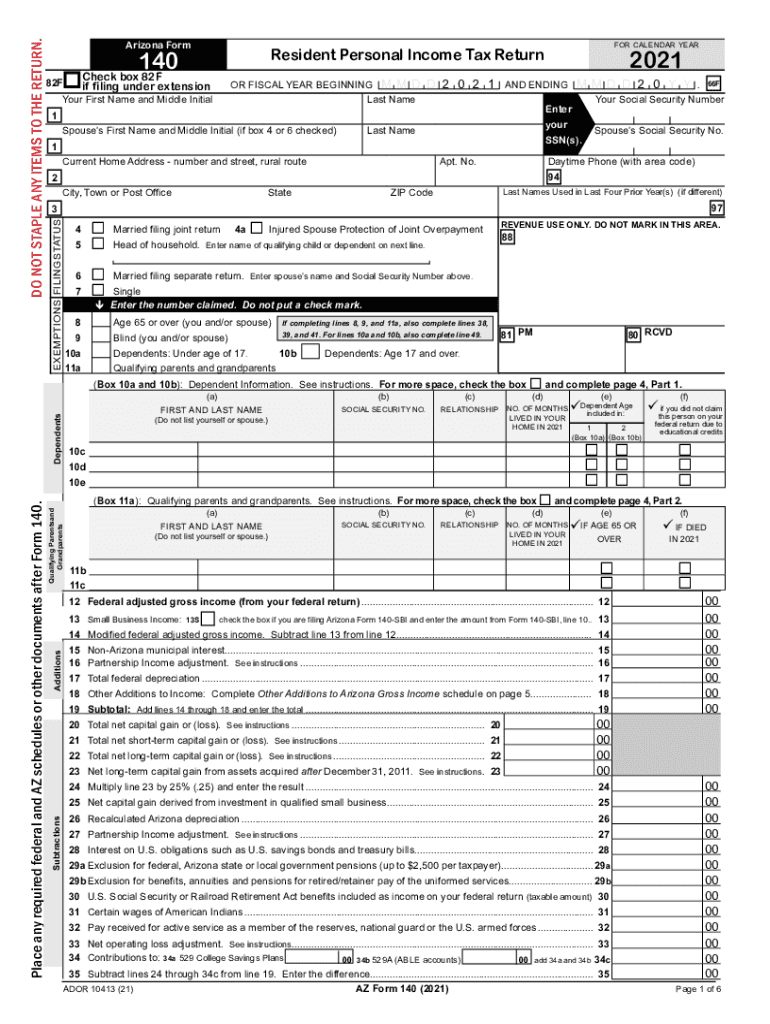

DO NOT STAPLE ANY ITEMS TO THE RETURN. Arizona Form140Check box 82F if filing under extension82FSpouses First Name and Middle Initial (if box 4 or 6 checked)AND Ending. No. State. 66F Your Social

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ Form 140

How to edit AZ Form 140

How to fill out AZ Form 140

Instructions and Help about AZ Form 140

How to edit AZ Form 140

Edit AZ Form 140 by downloading the form and using a suitable PDF editor. Ensure that all changes are made in compliance with IRS guidelines. You can also utilize pdfFiller to fill out the form online, which allows for easy edits and adjustments before submitting.

How to fill out AZ Form 140

To fill out AZ Form 140, first gather the necessary personal and financial information. This includes your Social Security number, income details, and any deductions you intend to claim. Follow these steps:

01

Download the form from the official Arizona Department of Revenue website.

02

Provide your name, address, and filing status on the first page.

03

Report your total income from various sources in the income section.

04

Complete the deduction section based on your eligibility.

05

Sign and date the form before submission.

About AZ Form previous version

What is AZ Form 140?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ Form previous version

What is AZ Form 140?

AZ Form 140 is the individual income tax return form used by residents of Arizona to report their income. This form is filed annually with the Arizona Department of Revenue and is essential for calculating state tax liabilities.

What is the purpose of this form?

The purpose of AZ Form 140 is to provide the state of Arizona with information about an individual's income and deductions for the tax year. This information is used to determine the correct amount of state taxes owed or refundable.

Who needs the form?

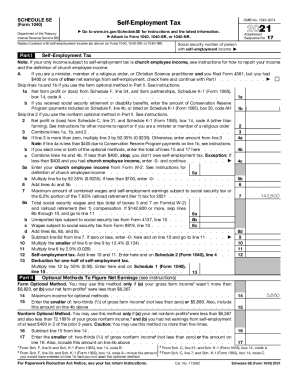

Individuals who are residents of Arizona and have income that exceeds the filing threshold need to complete and submit AZ Form 140. This applies to taxpayers with wages, self-employment income, or other sources of taxable income.

When am I exempt from filling out this form?

You may be exempt from filing AZ Form 140 if your income is below the minimum threshold set by the state of Arizona for the tax year. Additionally, certain individuals, such as dependents or those only receiving Social Security benefits, may not need to file.

Components of the form

AZ Form 140 consists of several components including personal information sections, income reporting lines, deduction schedules, and a section for state tax calculations. Each section must be filled out accurately to ensure correct tax processing.

What are the penalties for not issuing the form?

Failure to file AZ Form 140 when required can result in penalties including fines and interest on unpaid taxes. The Arizona Department of Revenue may also assess additional fees for late submissions.

What information do you need when you file the form?

When filing AZ Form 140, you will need to provide personal identification information such as your Social Security number, total income from all sources, and details regarding any deductions you wish to claim. Ensure that all figures are accurate to avoid issues with your tax return.

Is the form accompanied by other forms?

AZ Form 140 may require additional forms for specific deductions or credits. Taxpayers should consult the instructions provided with the form to identify relevant schedules or supplementary documents that may need to be submitted alongside it.

Where do I send the form?

You can send AZ Form 140 to the Arizona Department of Revenue at the address specified in the form instructions. Ensure that you mail it to the correct address, as submissions can vary depending on your filing status and the form's submission type (e.g., paper or electronic).

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

mkm

ease of use

Great program

I DONT HAVE TIME AT PRESENT

excellent

Still apprehensive about and unsure of what a few of the icons in the menus are capable of doing without trial and error occurrences.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.