AZ Form 140 2022 free printable template

Show details

DO NOT STAPLE ANY ITEMS TO THE RETURN. Arizona Form140Check box 82F if filing under extension82FSpouses First Name and Middle Initial (if box 4 or 6 checked)AND Ending. No. State. 66F Your Social

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ Form 140

How to edit AZ Form 140

How to fill out AZ Form 140

Instructions and Help about AZ Form 140

How to edit AZ Form 140

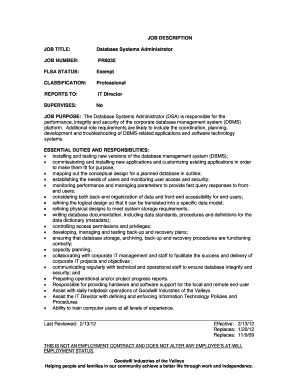

To edit AZ Form 140, first obtain the document in a digital format. You can utilize pdfFiller’s tools to make corrections or updates directly on the form. Input the necessary changes to fields such as personal information, income details, or deductions. After editing, save the revised form for your records or subsequent filing.

How to fill out AZ Form 140

Filling out AZ Form 140 requires careful attention to detail. Start by entering your personal information, including your name and address. Proceed to report your income, deductions, and any tax credits applicable to your situation. Ensure that all figures are accurate, as discrepancies can lead to delays or penalties. Once completed, review the form to double-check for errors before submission.

About AZ Form previous version

What is AZ Form 140?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ Form previous version

What is AZ Form 140?

AZ Form 140 is the individual income tax return form used by residents of Arizona to report their income and calculate state tax liabilities. This form allows taxpayers to disclose earnings, claim deductions, and receive credits under Arizona state tax laws.

What is the purpose of this form?

The primary purpose of AZ Form 140 is to facilitate the accurate reporting of income earned by individuals within the state of Arizona for tax purposes. This includes determining the total tax owed, accounting for any payments made or credits earned, and ensuring compliance with state tax regulations.

Who needs the form?

Individuals who are residents of Arizona and have taxable income must complete AZ Form 140. This includes those who are self-employed, employed, or receiving any form of taxable income. Non-residents with income sourced from Arizona may also need to file this form, depending on their specific circumstances.

When am I exempt from filling out this form?

You may be exempt from filing AZ Form 140 if your gross income falls below the state filing thresholds. Additionally, if you qualify for certain exemptions, such as being a dependent or being solely entitled to non-taxable income, you may not need to submit this form.

Components of the form

AZ Form 140 consists of various sections, including personal information, income details, deductions, and tax credits. Key components include lines for reporting wages, interest income, and business income, as well as sections for claiming various deductions like property tax or medical expenses. Accurately completing each section is critical for proper tax processing.

What are the penalties for not issuing the form?

Failing to file AZ Form 140 can result in penalties imposed by the Arizona Department of Revenue. These penalties may include late filing fees and interest on unpaid taxes. In some cases, additional fines can accrue for submitting inaccurate information, leading to further complications in your tax obligations.

What information do you need when you file the form?

When filing AZ Form 140, gather key information such as your Social Security number, income statements (W-2s,1099s), and financial documents that support deductions and credits claimed. Ensure you have details on any other income sources and previous tax returns, as they may impact the current year's filing.

Is the form accompanied by other forms?

AZ Form 140 may need to be accompanied by additional forms, depending on your financial situation. For instance, if you are claiming certain deductions or credits, you might need to complete related schedules or forms. Ensure you check the latest instructions for any additional requirements that relate to your filing circumstances.

Where do I send the form?

AZ Form 140 should be sent to the Arizona Department of Revenue. The mailing address will depend on whether you are enclose a payment or filing without payment. Consult the current guidelines or the form's instructions for the correct mailing address.

See what our users say