AZ Form 140 2023 free printable template

Show details

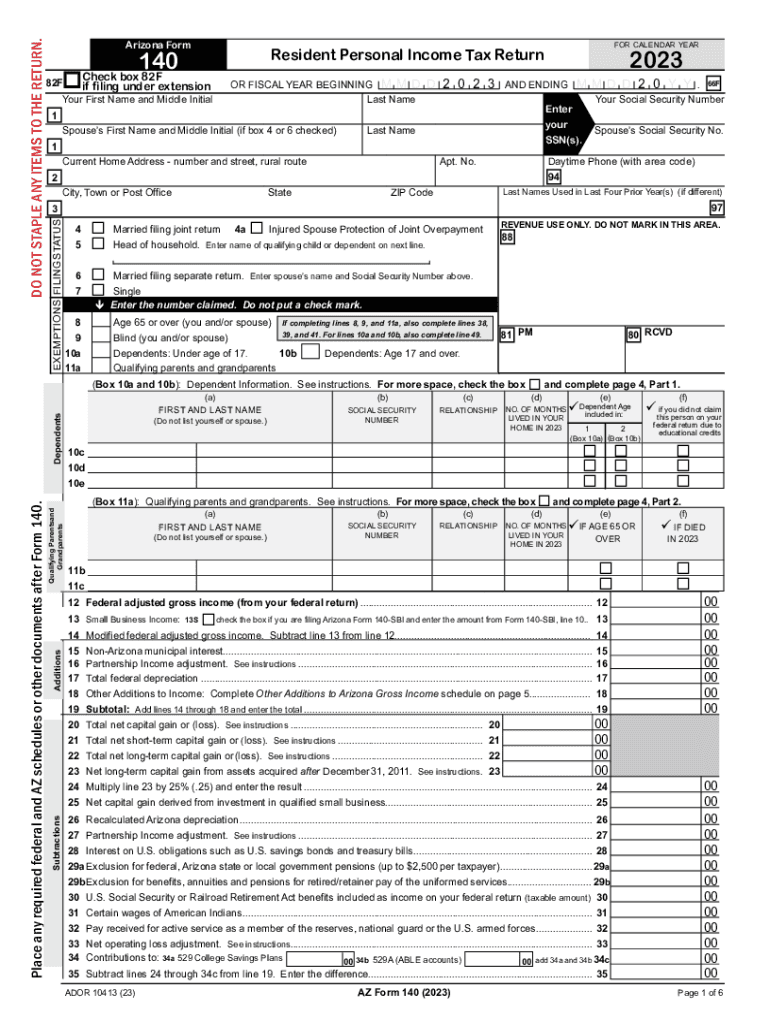

DO NOT STAPLE ANY ITEMS TO THE RETURN.Arizona Form140Check box 82F

if filing under extension82FD 2 0 2 3Spouses First Name and Middle Initial (if box 4 or 6 checked)AND ENDINGLast Name

Apt. No.State.

pdfFiller is not affiliated with any government organization

Instructions and Help about AZ Form 140

How to edit AZ Form 140

How to fill out AZ Form 140

Instructions and Help about AZ Form 140

How to edit AZ Form 140

To edit AZ Form 140, you need a digital version of the form. Use pdfFiller to upload the PDF, then utilize its editing tools to make necessary changes. Ensure all edits comply with IRS guidelines to avoid errors during submission.

How to fill out AZ Form 140

Filling out AZ Form 140 requires accurate completion of several key sections. First, gather all necessary financial documents, including your W-2 forms and other income statements. Follow these steps for a successful fill-out:

01

Obtain the latest version of AZ Form 140.

02

Enter your personal information such as name, address, and Social Security number.

03

Detail your income sources and deductions as instructed.

04

Review all entries for accuracy before submission.

About AZ Form previous version

What is AZ Form 140?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About AZ Form previous version

What is AZ Form 140?

AZ Form 140 is the individual income tax return form used by Arizona residents to report their income, file for deductions, and determine tax liability for the tax year. This form is essential for residents who earn income in Arizona and need to comply with state tax laws.

What is the purpose of this form?

The purpose of AZ Form 140 is to facilitate the reporting of income, calculate the amount of state tax owed, and claim any eligible tax credits or deductions. It is designed to ensure that residents fulfill their tax obligations accurately and fairly.

Who needs the form?

AZ Form 140 needs to be completed by any Arizona resident whose income exceeds the filing threshold established by the Arizona Department of Revenue. Additionally, individuals who wish to claim credits or deductions related to their income or expenses will also need to file this form.

When am I exempt from filling out this form?

Exemptions from filing AZ Form 140 typically apply to individuals whose gross income is below the minimum threshold set by the state. Also, certain types of income, like Social Security benefits, may not require filing if it constitutes the only source of income.

Components of the form

AZ Form 140 includes several components: personal information sections, income reporting fields, deductions, taxable income calculation, and tax credits. Each section must be completed accurately to reflect your financial situation correctly.

What are the penalties for not issuing the form?

Failing to submit AZ Form 140 can result in penalties, including fines and interest on any unpaid taxes. The Arizona Department of Revenue may also withhold future tax refunds until compliance is achieved.

What information do you need when you file the form?

When filing AZ Form 140, you will need your Social Security number, income statements (such as W-2 forms), documentation of any deductions or credits, and information about any other sources of income. Thorough preparation can reduce the likelihood of errors.

Is the form accompanied by other forms?

AZ Form 140 may need to be accompanied by additional schedules or forms, especially if you are claiming deductions or credits. Refer to the latest instructions from the Arizona Department of Revenue for specifics regarding additional documentation required based on your financial situation.

Where do I send the form?

Upon completing AZ Form 140, it should be sent to the Arizona Department of Revenue. The specific mailing address can change, so it’s advisable to check the latest guidance on their official website or consult your tax advisor for updated mailing instructions.

See what our users say