LA LTC LAT05 2021 free printable template

Show details

LAT 5 INVENTORY MERCHANDISE ETC. 20 PERSONAL PROPERTY TAX FORM NAME/ADDRESS INDICATE ANY CHANGES RETURN TO CONFIDENTIAL RS 47 2327. FIRMS HAVING 10 YEAR EXEMPTIONS SHALL COMPLETE FORM LAT 5A AND ATTACH TO THIS FORM. BANKS ONLY ATTACH TO THIS REPORT A LIST OF SHAREHOLDERS AND A COPY OF YOUR CONSOLIDATED REPORT OF CONDITION AND CONSOLIDATED REPORT OF INCOME AS FURNISHED TO THE OFFICE OF FINANACE INSTITUTIONS ST OR TO THE COMPTROLLER OF CURRENCY AS OF DECEMBER 31. Only the Assessor the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA LTC LAT05

Edit your LA LTC LAT05 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA LTC LAT05 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit LA LTC LAT05 online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit LA LTC LAT05. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

LA LTC LAT05 Form Versions

Version

Form Popularity

Fillable & printabley

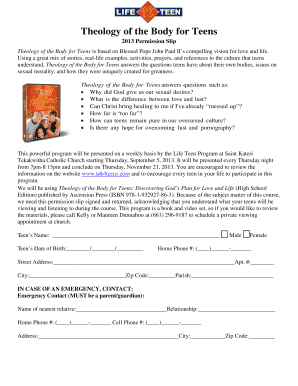

How to fill out LA LTC LAT05

How to fill out LA LTC LAT05

01

Obtain the LA LTC LAT05 form from the relevant authority or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including name, address, and contact details.

04

Provide the necessary identification documents as specified in the guidelines.

05

Complete any sections related to the purpose of the form, ensuring accuracy.

06

Review your entries for any errors or missing information.

07

Sign and date the form as required.

08

Submit the form according to the specified submission methods (mail, online, etc.).

Who needs LA LTC LAT05?

01

Individuals applying for a license to carry firearms in Los Angeles.

02

Residents of Los Angeles seeking permits for personal protection.

03

Those requiring documentation for professional or occupational reasons related to firearm use.

Instructions and Help about LA LTC LAT05

Fill

form

: Try Risk Free

People Also Ask about

Does Louisiana have a state tax form?

Resident taxpayers who are required to file a federal individual income tax return are required to file a Louisiana income tax return, IT-540, reporting all of their income. If a Louisiana resident earns income in another state, that income is also taxable by Louisiana.

Do I have to file homestead exemption every year in Louisiana?

In the first quarter of each year, the assessor will mail a renewal card to all taxpayers with a homestead exemption. This card must be signed and returned yearly in order for the homestead exemption to continue to be applied to your property.

Who is exempt from paying property taxes in Louisiana?

One of the owners must be 65 years of age or older as of January 1 of the qualifying year. Owner or owners must have a total combined adjusted gross income which cannot exceed $100,000. Applicants must own, occupy, and receive a homestead exemption on the property.

How many years do you have to pay property taxes before legally owning in Louisiana?

§ 47:2153). After three years, the purchaser can file a lawsuit to quiet the title, which provides the purchaser with clear title and full ownership of the property.

How do I find out how much I owe in Louisiana state taxes?

To verify your tax liability for individual income tax, call LDR at (225) 219-0102. To verify your tax liability for business taxes, you can review your liabilities online using the Louisiana Taxpayer Access Point (LaTAP) system.

Where to get Louisiana state tax forms?

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form. Please note that if you choose to download and print a form at the State Library or at your library, you may be charged for the cost of printing.

Where can I pick up IRS forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

How do I pay Louisiana state taxes online?

Individual income tax liabilities may be paid electronically by an electronic bank account debit using the Louisiana File Online application or by credit card using Official Payments. Credit card payments may also be initiated by telephone at 1-888-272-9829. Credit card payments incur a 2.49 percent convenience fee.

Can I pay a tax bill online?

You can pay online. There's a fee if you pay by corporate credit card or corporate debit card.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

How do you calculate property tax in Louisiana?

Louisiana Property Tax Rates The property tax rates that appear on bills are denominated in millage rate. A mill is equal to $1 of tax for every $1,000 of net assessed taxable value. If your net assessed taxable value is $10,000 and your total millage rate is 50, your taxes owed will be $500.

How do I find out my property taxes in Louisiana?

There are currently no state property taxes in Louisiana. For the current property millage rates, or questions about the assessed value of a particular parcel, contact the Caddo Parish Tax Assessor at 318-227-6701.

Can I pay my property taxes online in Louisiana?

Welcome to Online Filing and Payments You have arrived at Louisiana File and Pay Online, your gateway to filing and paying your state taxes electronically. Louisiana File Online is a fast, easy to use, absolutely free public service from the Louisiana Department of Revenue.

At what age are you exempt from property taxes in Louisiana?

a) Owned and occupied by a person who is 65 years of age or older. b) Owned and occupied by a person who has a 50% or greater military service-related disability.

How do I find my local property tax?

Your area's property tax levy can be found on your local tax assessor or municipality website, and it's typically represented as a percentage—like 4%. To estimate your real estate taxes, you merely multiply your home's assessed value by the levy.

Where can I get federal tax forms and booklets?

Visit the Forms, Instructions & Publications page to download products or call 800-829-3676 to place your order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my LA LTC LAT05 in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your LA LTC LAT05 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send LA LTC LAT05 for eSignature?

Once your LA LTC LAT05 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I create an eSignature for the LA LTC LAT05 in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your LA LTC LAT05 right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is LA LTC LAT05?

LA LTC LAT05 is a tax form used in Louisiana for reporting information related to certain tax liabilities and credits associated with the Louisiana Long-Term Care Insurance program.

Who is required to file LA LTC LAT05?

Entities or individuals who operate or manage long-term care facilities in Louisiana are typically required to file LA LTC LAT05.

How to fill out LA LTC LAT05?

To fill out LA LTC LAT05, you need to provide accurate information regarding the facility, the operations conducted, and relevant financial data as specified on the form. Make sure to follow the instructions provided with the form carefully.

What is the purpose of LA LTC LAT05?

The purpose of LA LTC LAT05 is to collect information necessary for the state to evaluate the compliance and financial operations of long-term care facilities, ensuring proper oversight and regulation within the state.

What information must be reported on LA LTC LAT05?

The information that must be reported on LA LTC LAT05 includes the facility's name, address, tax identification number, total assets and liabilities, revenue generated, and details on services provided.

Fill out your LA LTC LAT05 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA LTC lat05 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.